This week has seen a lot of unusual activity along different asset classes and has continued to add to the environment of uncertainty that was prevailing earlier (and I’m only talking about economic environment here).

Wednesday saw the NCD of India Infoline list at a big discount of 8%, which hasn’t happened before, and gold fell quite a bit in the US markets that day as well. On Thursday, gold fell about 5% in a day in India, which is very unusual for it, and to the best of my knowledge has never happened in India.

The same day saw a fall of 1.7% in the German index DAX, and other stock markets globally aren’t exactly having a peachy time either.

In this context, Kartavi Dave wrote a very interesting comment and I thought I’d write a full post detailing a response to it.

First, the comment.

Manshu, we are awaiting your new post.

Please also keep in mind following points:

In India, What General (Middle Class) ppl should do ?

• Interest rates on Bank Deposits are around 10% .

• Gold Prices are rising like any thing. one article says that it will rise for 2 to 3 years and thereafter the GOLD BUBBLE may burst and may show bottom. So, long term investor should avoid GOLD.

• Some News Paper articles said that this year share market (and hence Mutual Funds) will not give better return than Prevailing Fixed Deposits ( around 10% )

A small investor cry out … Aare bhai…. Kare to Kya kare ? !!

1. Should one ( in India) Sell out all our M.Funds / Share holdings and invest in Bank Fixed deposits.

2. Should one go for a SIP for Gold ETF (purchasing fixed units every month) for 10 Years for a good purpose (say child marriage or mere investment).

3. Should one buy a house (for investment) ?

My humble request to address all above points in your next post.

With regards.

Kartavi.

In terms of the big picture, I don’t feel that anything has happened that should change the fundamental approach of an investor towards savings and investments. In the past decade we have seen several very bad crashes due to the great recession, real estate bubble, 9/11 and dot com bubble, and all these events tanked the market, but at least the Indian markets have continued to grow in that period. I feel that even if we hit a global double dip recession – India will come out of it better than other countries.

In terms of the specific items listed in Kartavi’s comment – I think it’s a really bad idea to sell all stocks or mutual funds and move into fixed deposits only.

You should have a balance of both, and if you have SIPs with good mutual funds then you should continue those regardless of the market uncertainty. Volatility is in the nature of the markets, and I wouldn’t let these wild mood swings change my approach to investing.

No one knows what the bottom of the market is so you can’t wait for the fall to play out as that’s like catching falling knives. This is essentially the same thing I wrote in October 2008 (of course there weren’t many people reading then), and if you remember the uncertainty surrounding the economy at that time – it was way higher than today.

Stick to your SIPs and equity investments, and don’t let the market movement scare you out of them and sell at a deep loss.

But all your money shouldn’t be there either. You should have fixed income instruments, and I think it makes sense to look at NCDs in addition to fixed deposits also.

A lot of them have launched and some are even trading in the market for a discount. Today I saw that Religare Invest has also filed its papers with SEBI for the launch of a NCD so that’s another one that’s coming up. I think it makes sense to buy a few of these from the stock market when they are trading at a discount in addition to fixed deposits.

A point about both these things is that a lot of you will invest in 80C investments during the tax season – you can think about those now itself and see if you want to buy some ELSS mutual funds, or do tax saving fixed deposits etc.

On the point of gold, regular readers know my aversion to gold, and I have been writing about this since at least March 2009. Gold has risen by about 100% in the time, but if anything, my aversion has become stronger in the last few days looking at all the activity in it.

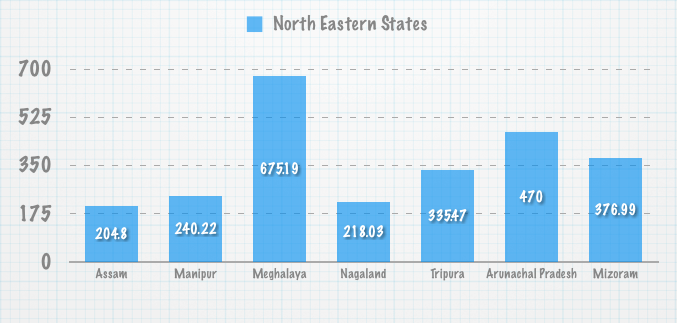

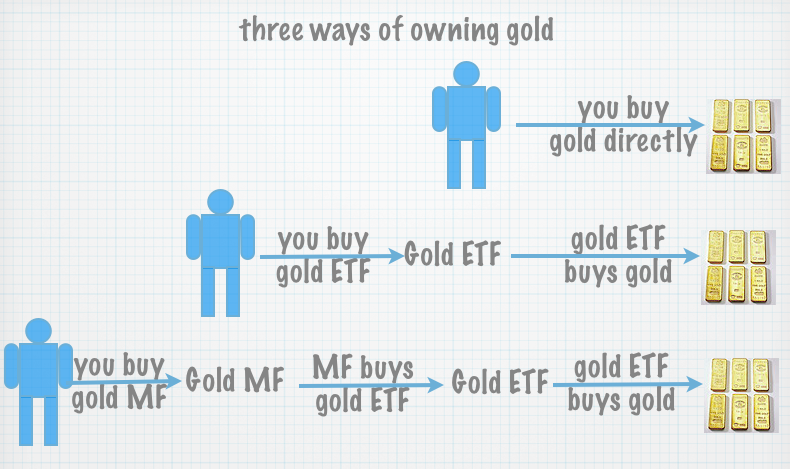

For a brief period this week the world’s biggest gold ETF – SPDR Gold Shares became the world’s biggest ETF as well, and it owns more than 1.1 million kilos of gold! In contrast the GoldBeES – India’s prominent gold ETF must own about 8,500 kilos of gold. This should show you where the trading market of gold really is, and also drive home the fact that gold prices will move in tandem globally.

I’m going to sit at the sidelines as far as gold is concerned, but if you do want to buy it then buy it systematically, and don’t let it become more than 5 or 10% of your portfolio. I see a lot of folks saying very proudly how gold is the biggest component of their portfolio so even though the market has crashed they have made money, but the question is what if they are wrong about the future of gold?

What if they are wrong like the people who owned real estate stocks were wrong, and the people who owned IT stocks before them were wrong?

If you truly own so much gold, and find that prices go back to where they were two years ago – that will destroy your portfolio.

Do you really want to take that chance?

The last point in Kartavi’s comment is about a house, and that’s the thing that is more emotional than financial for a lot of people, and is a very personal decision. I would personally never take a loan that puts me so deep under debt that it takes me 20 years to repay that and it leaves nothing else to do, and I wouldn’t advise anyone else to do that either. Unfortunately, at today’s prices a lot of deals do exactly that. I understand that a house means more than money to a lot of people so it’s for you to decide, but I myself wouldn’t stretch to buy property at today’s prices.

This is how I view the current situation, the way I would behave myself regarding my finances. By now, it should be clear to most regular readers that this is driven by a very long term outlook on the markets, and hasn’t changed at all since I first started writing. This is what I would do, and I’ll be happy to hear what you make of the current situation and if that has changed your outlook in any way.