The American markets crashed badly today, and the past few days have seen stock markets fall globally. The talks of another recession are gaining currency, and I think this atmosphere of uncertainty gives a good context to revisit some things that I have written here earlier, and will be easier to relate to now than they were when I originally wrote them.

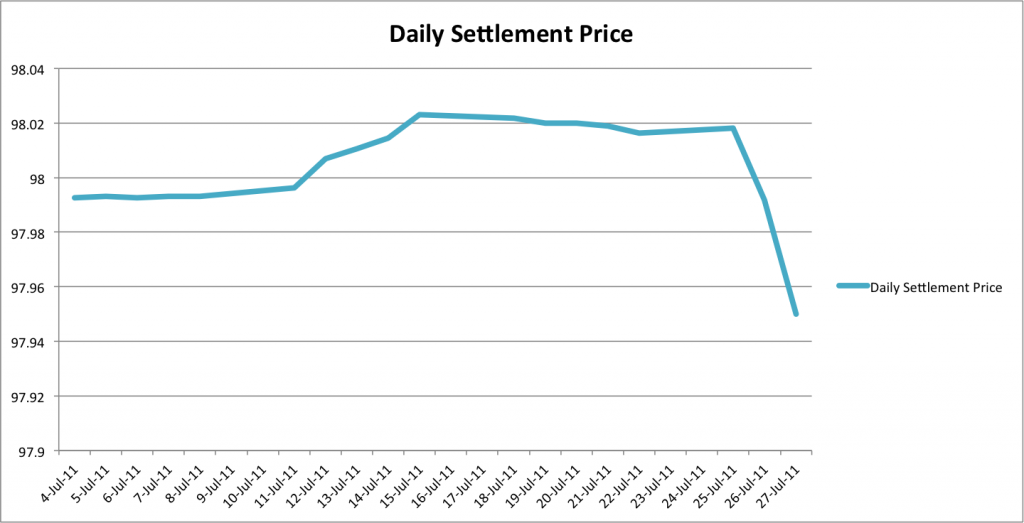

In July last year – I wrote if you remember the crash of 2008.

People were talking about when a new high will be made, and not if a new high will be made. The constant up move had lulled people into thinking that markets move in only one direction, and they were ignoring the volatility and ups and downs that are inherent in the market.

This is what I wrote then:

Now, the market is doing well, and people are getting back in the game. There is nothing wrong with investing in equities, but you need to be aware of the fact that the market can be really volatile in the short run, and can give you extreme heart-ache with very little warning.

A lot of retail investors who trade talk about getting out when the tide turns, but that’s seldom possible because the market changes direction very fast and without warning. I’ve seen an unbearably large number of people lament the downturn of the past few days. The truth is — it was a known – unknown, and if you thought it was an unknown – unknown, then just learn your lesson and get on with it.

Then in September last year on the day when the market rose by 400 points, I wrote how are you preparing for the crash?

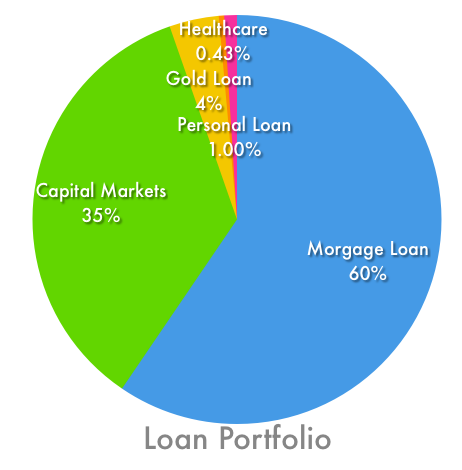

That post was prompted by a lot of people getting interested in penny stocks, IPO listing gains, buying recommendations to sell in month or so etc. Essentially, everything that goes against the principles of long term investing and diversification.

This is what I wrote then:

During the peak of the recession, and much afterwards there was a lot of talk about protecting your portfolio from a crash, looking out for the next bubble, the Greek crisis, and generally stuffing your money in your pillows, but all that is slowly receding now.

As the tide turns people are looking to get more adventurous, looking for that penny stock that will rise 10 times, the IPO that will scorch on listing, and the gold bar that’ll surely triple in three months.

The market moves in cycles, so don’t let its positive momentum numb your senses and make you throw caution out of the window.

What goes up eventually comes down. Of course, I don’t know when the crash will come, but I do know that a lot of people will be blinded by it when it eventually does.

I think the events of the past few days have shown how fast and ferocious market turns can be, and the only way to protect yourself from these downturns is to prepare in advance because when they happen they don’t give you any opportunity at all.

How can you be prepared in advance?

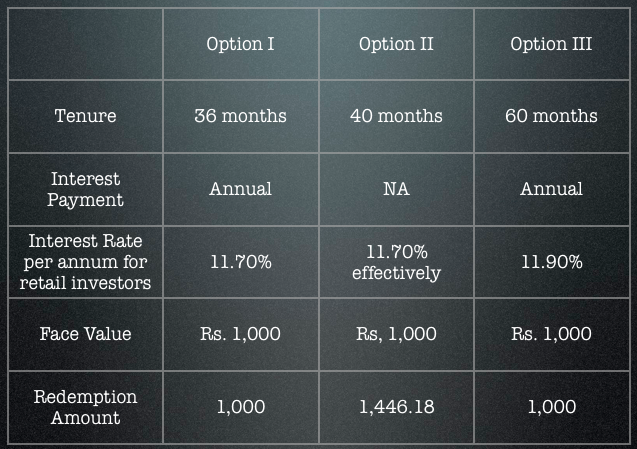

Diversification is an excellent way to do it, and investing in the share market systematically and staying invested for the long term is another. There is nothing new or complicated about this, and if short term trading, betting on penny stocks, and going after hot IPOs have not worked for you – you might want to give it a shot.