Reliance Industries today announced the tariffs of its 4G services during its Annual General Meeting (AGM) in Mumbai. The services, which are to be carried out in the name of Reliance Jio, would be commercially launched on September 5th. Whatever got announced today during this AGM with respect to Reliance Jio, its tariffs and the company’s plans to carry out its operations was extremely exciting for the Indian consumers.

But, it was a very bad day as far as the stock prices of Airtel, Idea, Reliance Communications and even Reliance Industries itself are concerned. Idea stock suffered the most of the brunt and closed down 10.49% at Rs. 83.65. Anil Ambani’s Reliance Communications was next in line with a fall of 8.99% at Rs. 49.10. While Bharti Airtel, the largest telecom service provider in India, suffered 6.27% fall in its share price to Rs. 310.85, Reliance itself got hammered by 2.91% to close the day at Rs. 1029.20.

So, what made these big companies fall so much in a single day of trading? The answer is – all Reliance Jio services, including voice calling, 4G data usage, SMS services etc. will be absolutely free for all its subscribers for almost four months before they get paid w.e.f. January 1, 2017. Even when these services become paid from January 1, voice calling would remain free across all its plans and there would be disruptive 4G tariffs, which are termed by Mukesh Ambani as the World’s cheapest data tariffs at Rs. 50 per GB of data.

Reliance Jio’s tariffs are termed as disruptive and on the face of it they are truly intimidating for the incumbent telecom players. So, what are the Reliance Jio 4G plan tariffs which have made the existing players to rework their future strategies? Here you have the tariffs the consumers will have to pay to avail Reliance Jio services:

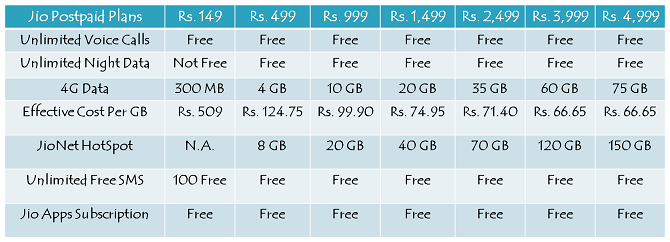

Postpaid Tariff Plans

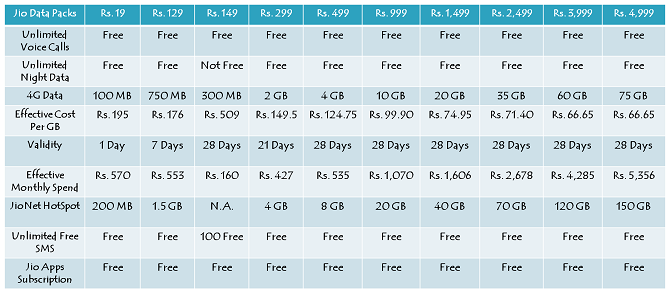

Prepaid Tariff Plans

Base plan of Rs. 149

A consumer will get:

1) 300 MB 4G data

2) Free Unlimited local/ISD voice calls

3) Free Jio app subscription worth Rs. 1,250

4) Free 100 local/STD SMS

Effective cost per GB of data – Rs. 508

Rs. 499 Pack

A consumer will get:

1) 4 GB 4G data + Unlimited 4G data during night

2) Free Unlimited local/ISD voice calls

3) Free Jio app subscription worth Rs. 1,250

4) Free unlimited local/STD SMS

5) 8 GB JioNet WiFi Hotspot access

Effective cost per GB of data – Rs. 124.75

Rs. 999 Pack

A consumer will get:

1) 10 GB 4G data + Unlimited 4G data during night

2) Free Unlimited local/ISD voice calls

3) Free Jio app subscription worth Rs. 1,250

4) Free unlimited local/STD SMS

5) 20 GB JioNet WiFi Hotspot access

Effective cost per GB of data – Rs. 99.9

Rs. 1,499 Pack

A consumer will get:

1) 20 GB 4G data + Unlimited 4G data during night

2) Free Unlimited local/ISD voice calls

3) Free Jio app subscription worth Rs. 1,250

4) Free unlimited local/STD SMS

5) 40 GB JioNet WiFi Hotspot access

Effective cost per GB of data – Rs. 75

Rs. 2,499 Pack

A consumer will get:

1) 35 GB 4G data + Unlimited 4G data during night

2) Free Unlimited local/ISD voice calls

3) Free Jio app subscription worth Rs. 1,250

4) Free unlimited local/STD SMS

5) 70 GB JioNet WiFi Hotspot access

Effective cost per GB of data – Rs. 71.4

Rs. 3,999 Pack

A consumer will get:

1) 60 GB 4G data + Unlimited 4G data during night

2) Free Unlimited local/ISD voice calls

3) Free Jio app subscription worth Rs. 1,250

4) Free unlimited local/STD SMS

5) 120 GB JioNet WiFi Hotspot access

Effective cost per GB of data – Rs. 66.65

Rs. 4,999 Pack

A consumer will get:

1) 75 GB 4G data + Unlimited 4G data during night

2) Free Unlimited local/ISD voice calls

3) Free Jio app subscription worth Rs. 1,250

4) Free unlimited local/STD SMS

5) 150 GB JioNet WiFi Hotspot access

Effective cost per GB of data – Rs. 66.65

Is it really disruptive and will it affect you?

I think an average Indian telecom consumer does not want to spend more than Rs. 300 for its monthly voice calling and data usage. Airtel reported its average revenue per user (ARPU) to be Rs. 196 during its first quarter results in July 2016. As against Rs. 50/GB of data as announced by Jio, the cheapest Rs. 149 data pack would effectively cost you Rs. 508 per GB of data, but also provides you free unlimited voice calling.

As you can check from the plans above, even a Rs. 4,999 plan does not bring down cost per GB of data to Rs. 50. So, tariffs here are presented in a manner which sound music to your ears, but eventually they could end up higher. Incumbent players Airtel, Idea, Vodafone and RCom have sufficient time to act or react to these tariffs. Whether these tariffs would add to the overall growth of the telecom sector or to the woes of its existing players, that is something only time will tell. But, one thing is certain, the consumers here in India are going to enjoy some highly competitive data tariffs in the months to come.

There are a few things I do in a high market, but all of them stem from believing that the market runs in cycles and the length of those cycles can be quite unpredictable.

Roger Nusbaum put this very well in a recent post:

So, given all this, here is what I do.

Sell the stocks that are high

When I buy a stock, I have a file that lists down its qualities and a fair price. If the company goes a lot higher than the price I have in my file, and this usually happens during up-markets, – I sell the stock. In the past year I have sold 3D Systems that went up quite a bit more than the fair value I assigned to it but unfortunately for me, it continued rising further even after I sold it.

Reduce purchases

I don’t stop purchases altogether because there is no way to know if I am right about the cycle or not, and how long it will last. I’m also not patient or brave enough to wait for crashes and only buy when there is panic. A recent example of a buy is Zynga which I think will do well in the years to come and I didn’t want to wait for a crash to buy it.

However, the money I put in the markets is a lot less than what I put in during panics.

Build on savings

I am sure a lot of us personal finance types have Excel files, Google Docs or online portfolio tools that help us keep a close track of our net-worth. In my case, I have a Google Spreadsheet that has my liquid net-worth and I find it motivating to see small up-ticks in it every month. By saving money and adding to it I find motivation, and energy that I’m heading in the right direction. So even if I’m not putting money in the market, it is getting put in my brokerage account and adding to that number, also, it is ready to use whenever I need.

Pay down debt

It is also very useful to pay down whatever debt you have in the form of car loans or home loans during these periods. The interest rate on these is high, and it is usually a good idea to pay them down so you can reduce the total number of EMIs. So far, I’ve been lucky enough to pre-pay every loan that I have taken, and periods of high markets are the best for this.

Build on your list of stocks

I find it interesting to look at companies, and the whole investment process thrills me, so I continue to build on my list of stocks that I could potentially invest in – screening companies that I come across in my daily life.

An interesting phenomenon that I have noted is that screening companies in high markets makes it a lot easier to invest in them in low markets. What happens is that valuation is very subjective, and when the market has assigned a price to a stock, your own valuation is biased by that and you tend to assign a number close to it.

When the market falls, and the stock halves (happens more frequently than you’d like) – it is a lot easier to now invest in this stock.

Conclusion

So these are some of my own ideas around the process of investing when the markets seem high. I hope you find them useful to your own process, and I’ll be happy to answer any questions you may have.