This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

India Infoline Finance Limited (formerly known as India Infoline Investment Services Ltd.) will be launching its second issue of non-convertible debentures (NCDs) from September 5, 2012. To keep things absolutely clear right from the beginning, I’ll use IIFFL as the short name for this company as I want to distinguish this company from its well known listed parent company, India Infoline Limited (IIFL), and advise the readers not to confuse this issue as the issue launched by the parent company IIFL.

About India Infoline Finance Limited

India Infoline Finance Limited is a credit and finance arm of the IIFL group and provides loans against property, housing loans, gold loans, loans against securities/margin financing and medical equipment financing to the corporates, high networth individuals (HNIs) and retail clients. One of its subsidiaries, India Infoline Distribution Company Limited, is also engaged in the business of distribution of financial products like mutual funds, insurance products, company fixed deposits, NCDs, National Pension System (NPS), IPOs etc.

The company was originally incorporated on July 7, 2004 as a private limited company which leaves this company with a very short operating history and unproven business track record.

Financials of the company

During the year ended March 31, 2012, the loan book of the company stood at Rs. 6,746 crore as against Rs. 3,288 crore, an increase of approximately 105%. This jump has been achieved mainly on account of mortgage loans and gold loans which constitute approximately 45% and 41% of the total loan book respectively. The mortgage loan book is contributed by loan against property (LAP) at 89% and home loans at 11%. These figures suggest that the company is primarily focusing on gold loans as the new business segment and LAP in the housing loan segment.

IIFFL reported revenues of Rs. 953 crore in FY12 as against Rs. 520 crore in FY11, a jump of almost 83%. It also reported 76% increase in its net interest income (NII) to Rs. 412 crore in FY12 from Rs. 234 crore in FY11 mainly on account of a 105% increase in its lending book. Gross NPAs and Net NPAs of the company stood at 0.61% and 0.44% respectively as on March 31, 2012 as against 0.37% and 0.30% respectively as on March 31, 2011.

The company has made a significant branch expansion in the gold loan business last year which resulted in 79% increase in its operating costs to Rs. 297 crore in FY12 as compared to Rs. 166 crore in FY11. This resulted in a very tepid improvement of 14% in company’s net profit after taxes (PAT) which stood at Rs. 105 crore in FY12 as compared to Rs. 92 crore in FY11.

Here is the link to check the latest audited financial results of the company ending March 31, 2012.

About the NCD Issue

The size of this NCD issue is Rs. 500 crore including a green-shoe option of Rs. 250 crore. The company plans to use the proceeds for various financing activities including lending and investments, to repay existing loans, for capital expenditures and other working capital requirements.

The bonds offer a coupon rate of 12.75% per annum in three different options – payable monthly, payable annually and cumulative annually payable on maturity. Unlike Shriram Transport Finance NCD, this issue will not offer any additional incentive to the retail investors and the same rate of interest will be offered to all the categories of investors. This uniform rate of interest should make it attractive for the Category I – institutional investors and Category II – non-institutional investors. Under the cumulative interest option, the investors will get Rs. 2054.50 at the time of maturity. The maturity period in all the three options will remain 72 months only.

| Option | I | II | III |

| Rate of Interest | 12.75% | 12.75% | 12.75% |

| Interest Payment | Monthly | Annual | Cumulative |

| Effective Yield | 13.52% | 12.75% | 12.75% |

| Tenure | 72M | 72M | 72M |

| Redemption Amount | Rs. 1000 | Rs. 1000 | Rs. 2054.50 |

The interest earned will be taxable as per the tax slab of the investor but the company will not deduct any TDS on it as is the case with all of the listed NCDs taken in a demat form. The company has decided to keep the minimum investment requirement of Rs. 5,000 (or 5 bonds of face value Rs. 1,000) which has made it easily investable from the small retail investors’ point of view.

Like most of the NCDs, these bonds are going to list on both the stock exchanges – NSE and BSE. Investors will have the option to apply these bonds in physical form also.

25% of the issue is reserved for the “Reserved Individual Portion†i.e. for the individual investors investing up to Rs. 5 lakhs and another 25% of the issue is reserved for the “Unreserved Individual Portion†i.e. for the individual investors investing above Rs. 5 lakhs. 40% of the issue is reserved for the institutional investors and the remaining 10% is for the non-institutional investors. NRIs and foreign nationals among others are not eligible to invest in this issue. The allotment will be made on a “first-come-first-served†basis.

IIFFL is a relatively new company with a limited operational track record. The issue has been rated ‘AA-/Stable’ by CRISIL and ‘AA- (Stable)’ by ICRA. One notable point I want to emphasise here is that unlike last year and unlike all NCD issues of the past, these NCDs qualify as “Unsecured Redeemable Subordinated Debt†in nature or in other words, in the event of default, no charge upon the assets of the company would be created in connection with these NCDs.

I’ve picked this text from the DRHP

“The NCDs will be in the nature of subordinated debt and hence the claims of the holders thereof will be subordinated to the claims of other secured and other unsecured creditors of our Company. Further, since no charge upon the assets of our Company would be created in connection with the NCDs, in the event of default in connection therewith, the holders of NCDs may not be able to recover their principal amount and/or the interest accrued therein in a timely manner, for the entire value of the NCDs held by them or at all. Accordingly, in such a case the holders of NCDs may lose all or a part of their investment therein. Further, the payment of interest and the repayment of the principal amount in connection with the NCDs would be subject to the requirements of RBI, which may also require our Company to obtain a prior approval from the RBI in certain circumstances.â€

Though this feature should not make this issue an untouchable one to invest in but the investors should exercise extreme caution while investing in such issues as extreme adverse business conditions related to gold loan business or housing loan business might put IIFFL’s fortunes in trouble and it would become difficult for the investors to recover their hard earned money in the form of investment.

The issue closes on September 18, 2012.

Performance of the bonds issued last year

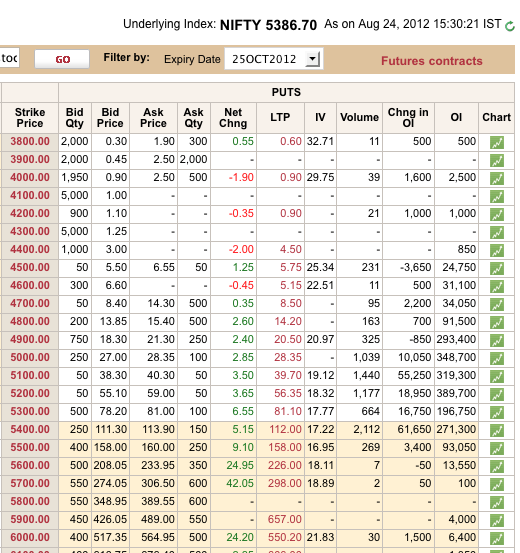

As I mentioned in the Shriram Transport Finance NCD post also, as many as ten such NCD issues had hit the markets last year issued by companies like Shriram Transport Finance, Shriram City Union Finance, Muthoot Finance, Manappuram Finance, Religare Finvest and India Infoline Investment Services Ltd. All the issues, except Shriram Transport Finance NCDs, listed at a discount and that too at a very deep discount of 5-8% in some cases. Many of them have still not been able to recover from those losses. They are yielding higher than 13% even now.

NCDs issued last year by IIFFL offering 11.90% coupon were secured in nature and are currently yielding 13.75% under the 60 months reserved individual option with the price quoting at Rs. 1001.10. It is the most traded option among all the options offered last year.

Next 20-30 days will witness three more such NCD issues seeking your investment offered by Shriram City Union Finance, Muthoot Finance and Religare Finvest. These companies have already filed their respective draft red herring prospectus (DRHP) with SEBI and almost all the regulatory formalities have been completed. Let us see how these NCDs perform once they get listed and if they are able to give any kind of much needed relief from the sinking stock prices or escalate our pain by listing at a discount again.