The first question is of course about the interest rate, and how much will a bank be willing to give out to investors.

As far as retail investors are concerned I feel it is really hard to get excitement going about the gold monetization scheme at anything less than 3 or 4 percent. I have a feeling it might be feasible to get to a rate like this or even slightly higher than this since banks are allowed the gold reserves as part of their CRR / SLR reserves, and there may be a market for them to lend this gold and make a profit.

The second question, and one that has not been discussed as much is the paper-work that will be required when you take your gold to get it melted. Do you need any paper work at all to show that was bought in white or can you take any gold at all? This is obviously important because of the realities of our economy.

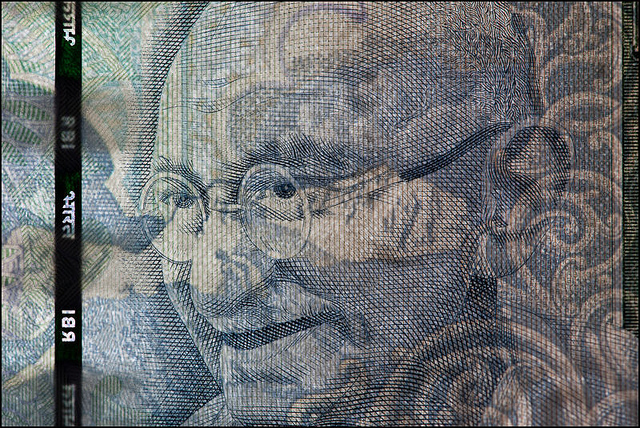

A lot of gold is bought in cash, and through money on which tax hasn’t been paid. When you talk about black money you tend to think of crores of rupees locked up in Swiss accounts but any retailer or professional who has under-reported his income and not paid tax on all of it has black money and they are not necessarily cheats or corrupt officials, they have just found ways around our tax system which isn’t good at enforcement when it comes to anyone outside of salaried employees.

Most commonly such money finds its way to gold and real estate, and if the government is introducing a scheme which looks at channeling gold into the economy and all above board, it is important to take cognizance of this reality and not be insistent on asking for paperwork when someone wants their gold melted as part of this scheme.