The big news today is the massive Rs. 7.50 petrol price hike and with this, petrol prices have crossed Rs. 73.00 per liter in all the metros with Bangalore being the worst at over Rs. 81.00.

Theoretically, oil market companies have hiked the prices and not the government since petrol prices are “deregulated” but no one even pretends this is true.

In a press release issued today, IOC says that the industry has lost Rs. 4,651 crores since the last price change in December because domestic conditions (read state elections) didn’t allow any price hikes after that.

Currently, the under – recovery on petrol is Rs. 6.28 / liter which is down from Rs. 7.17 / liter in the May 12 fortnight, and 8.04/liter in April 12 2nd fortnight.

The press release also says that the current hike is not enough and there needs to be another hike of Rs. 1.50 for the rest of the year to make up for the losses that have already taken place.

The under recovery on diesel, kerosene and LPG is expected to be Rs. 1,86,000 crores in this year, and the last time the price on these was increased in July 2o11. The under recovery on diesel is Rs. 13.64 per litre and the diesel subsidy was Rs. 81,192 crores last year.

It’s hard to see why diesel prices weren’t increased first, and perhaps that’s only because they will be increased in the days to come.

There will also be a lot of political drama in the next few days where other parties will ask the government to roll back prices and will try to extract as much mileage from this unpopular decision as possible, but it is highly unlikely that anyone will touch upon the subject of how the heck do you pay for all this?

Goa’s CM recently brought out the state budget and reduced petrol prices there but he did increase taxes on a host of things to pay for it, and that’s the reality that everyone needs to acknowledge.

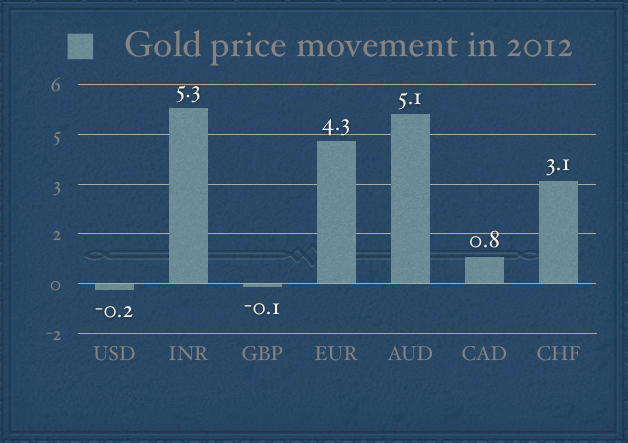

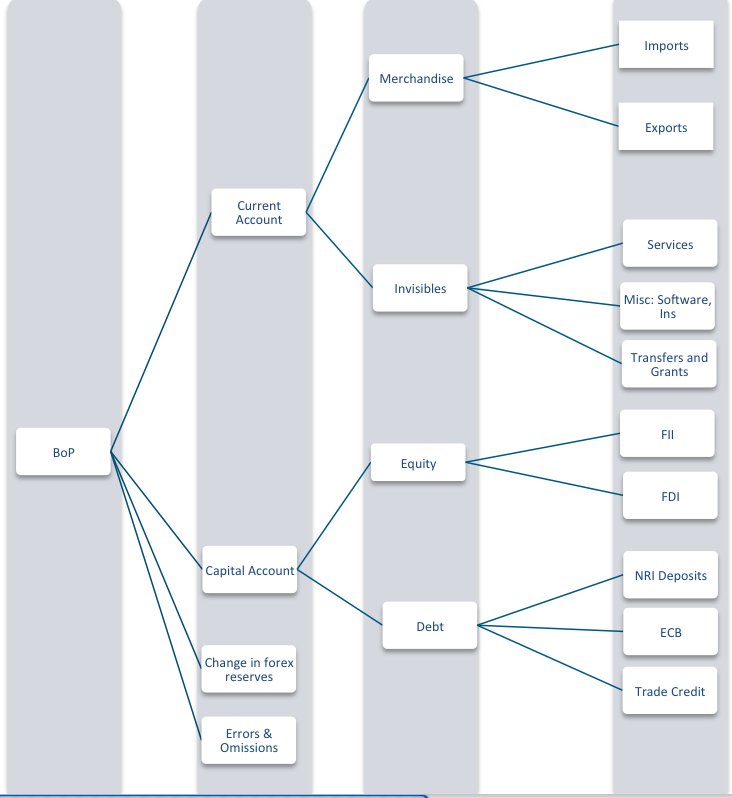

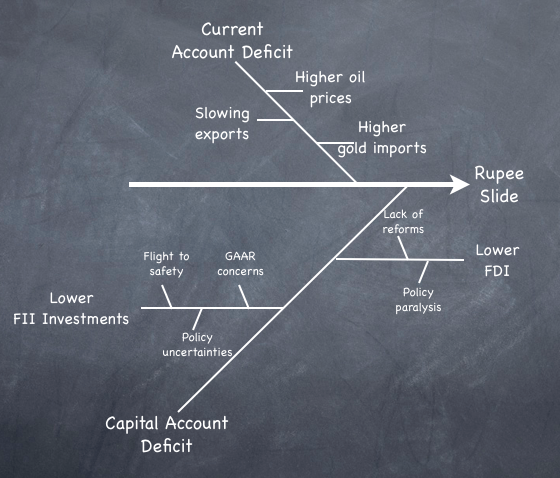

Unfortunately, today we’re having discussions about issues in isolation where we talk about the INR depreciating, or fiscal deficit increasing, inflation increasing or petrol price hikes but not talking enough about the inter linkages between these things. Petrol price doesn’t exist in isolation and nor does the Rupee exchange rate, these things need to be looked at holistically.

For example, the government will badly miss the deficit target for last year and one of the reasons for that is they couldn’t raise enough money through PSU disinvestments last year.

They rushed through ONGC FPO and when that had a luke warm response, LIC picked up a stake in it on which it is sitting at a loss right now.

Then recently Moody’s downgraded LIC because they said the credit worthiness of LIC is highly correlated with the government’s credit strength and this downgrade reflects badly on both of these entities.

The downgrade affects how much money flows in India by way of FII investments and that’s bound to worsen by this which in turns affects the Rupee exchange rate and contributes to its depreciation.

This in turn makes oil pricier and the hole in oil marketing companies’ pockets become larger who then have to pass over the price to the customer which causes inflation and so on and so forth.

It’s as if India’s economy has fallen into a vicious cycle and the feedback loop worsens the whole situation.

The silver lining, if there is any at all, is that the feedback loop works the other way round too, and India has been through much worse in the past and been able to get through it.

The government (this or the next) can still turn things around and focus on real issues instead of wasting time looking at issues in isolation and trying to “fix” one problem that only ends up making another worse.