This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at shiv[email protected]

IIFL Finance will be launching its public issue of non-convertible debentures (NCDs) from January 6, 2023. The company wants to raise Rs. 1,000 crore from this issue, with base issue size of Rs. 100 crore and an additional green-shoe option of Rs. 900 crore. The issue is scheduled to close on February 18.

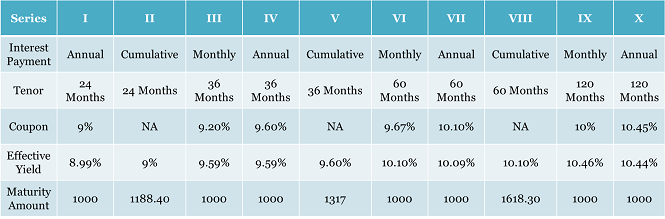

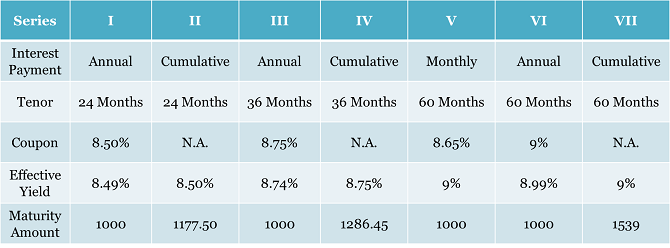

The company is offering interest rate in the range of 8.50% for 24 months and 9% for 60 months. The issue is rated “CRISIL AA/Stable” by CRISIL Limited and “[ICRA] AA (stable)” by ICRA Limited.

Here are some of the salient features of the issue:

Size & Objective of the Issue – Base size of the issue is Rs. 100 crore, with an option to retain oversubscription of an additional Rs. 900 crore, making the total issue size to be Rs. 1,000 crore. The company plans to use the issue proceeds for the purpose of onward lending, financing, refinancing the existing indebtedness and other general corporate purposes.

Interest Rate on Offer, Effective Yield & Tenor of the Issue – The issue will carry coupon rate of 9% p.a. for a period of 60 months, 8.75% p.a. for 36 months and 8.50% p.a. for 24 months. These rates would be applicable for annual and cumulative interest payment options only. Monthly interest payment option is available only for 60 months period and coupon rates for the same would be 8.65% p.a., interest payable on a monthly basis.

Demat & ASBA Mandatory – Investors will not have the option to apply for these NCDs in physical or certificate form as demat account is mandatory to invest in these NCDs. Like equity IPOs, SEBI made ASBA mandatory to apply for these debt issues also effective October 1, 2018. In case of physical applications, you need to sign on the application form as per your bank records for ASBA.

Credit Rating & Nature of NCDs – CRISIL and ICRA have been appointed as the credit rating agencies for this issue. Both CRISIL and ICRA have rated the issue as ‘AA’ with a ‘Stable’ outlook. Moreover, these NCDs would be ‘Secured’ in nature.

Categories of Investors – The company has decided to categorise investors in the following four categories:

Category I – Institutional Investors – 10% of the issue is reserved i.e. Rs. 100 crore

Category II – Non-Institutional Investors (NIIs) – 10% of the issue is reserved i.e. Rs. 100 crore

Category III – High Net Worth Individual Investors (HNIs) including HUFs – 40% of the issue is reserved i.e. Rs. 400 crore

Category IV – Resident Individual Investors (RIIs) including HUFs – 40% of the issue is reserved i.e. Rs. 400 crore

NRIs Not Allowed – Non-Resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Allotment on First-Come First-Served Basis – Subject to the allocation ratio, allotment will be made on a first-come first-served basis, as well as on a date priority basis, i.e. on the date of oversubscription, the allotment will be made on a proportionate basis to all the applicants of that day on which it gets oversubscribed.

Minimum Investment – An investor needs to invest a minimum of Rs. 10,000 in this issue i.e. 10 NCDs worth Rs. 1,000 each.

Listing, Premature Withdrawal – These NCDs are proposed to be listed on both the stock exchanges, Bombay Stock Exchange (BSE) as well as National Stock Exchange (NSE). The listing will take place within 6 working days after the issue gets closed. Though there is no option of a premature redemption, the investors can always sell these NCDs on either of the stock exchanges.

No TDS – As it is mandatory to have a demat account to apply and get these NCDs allotted, no tax would get deducted at source on the interest payments. However, as the interest income is taxable, you are supposed to disclose it while filing your ITR.

But, in case you decide to close your demat account, you can get these NCDs rematerialised. So, if rematerialised and held in physical form after the allotment, and if the annual interest income is more than Rs. 5,000, TDS @ 10% will be deducted.

Application Form of India Infoline Finance Limited NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in IIFL Finance NCDs, you can contact us at +91-9811797407