This post is written by CA Karan Batra, who is the Founder and CEO of Chartered Club. He can be reached at mrkaranbatra@gmail.com

The Gains from trading in Future and Options (F&O) are not considered as Capital Gains but are considered as Business Income. These gains are considered as non-speculative business gains and therefore income tax on these gains is levied as per the income tax slab rates.

To levy income tax – the first thing which is required to be done is computation of income. Once the income is computed, the tax would be levied on the income so computed. The lower the income, the lower is the tax payable and the higher the income, the higher is the tax payable.

There are 2 ways to compute the Income from F&O Trading:-

- Normal system of computation i.e. Income = Sales – Purchase – Other Expenses – Depreciation

- Presumptive system of computation i.e. Income = Assumed percentage of Sales

These 2 systems have been explained below in detail.

Normal System of Taxation

Under the normal system of taxation, the income is computed as per the following formula:

Income = Sales – Purchase – Other Expenses – Depreciation

This can be explained with the help of an example.

Example: During the complete year 2017-18, Mr. A traded in Nifty several times. His total purchases were worth Rs. 70 lakhs and Sales were 80 lakhs. Apart from these, he also incurred several expenses related to his business which are:-

- Subscription plan for receiving stock market tips: Rs. 3,000

- Telephone and internet expenses: Rs. 20,000

- Salary paid to employee(s): Rs. 2,00,000

- Fee paid to CA for tax return filing: Rs. 10,000

- Other business expenses: Rs. 15,000

Therefore, his total other expenses are Rs. 2,48,000 (Rs. 2,00,000 + Rs. 20,000 + Rs. 3,000 + Rs. 10,000 + Rs. 15,000)

In addition, the depreciation on assets during the year was Rs. 1,25,000

In this case, the Income of Mr. A would be as follows:-

Income = Rs. 80,00,000 – Rs. 70,00,000 – Rs. 2,48,000 – Rs. 1,25,000

= Rs. 6,27,000

Under this system, the income is computed on actual basis and the taxpayer is required to maintain a record and invoice for each and every expense which he has made. Moreover, he is also required to maintain all the books of accounts, Profit & Loss A/c. as well as the Balance Sheet.

It gets very difficult for a small business owner to maintain so many records and to keep a copy of all the invoices.

Therefore, for small traders – there is another option wherein no records are required to be maintained and the tax is to be paid on an assumed basis. This scheme is called Presumptive Tax and is explained below.

Presumptive Scheme of Taxation – Section 44AD

Under the Presumptive scheme of taxation, the law gives the small traders an option to declare his income as a percentage of total turnover.

The law says that the small trader can disclose his income at any level above 6% of Turnover. The small trader would be required to disclose his total turnover and the income which he would like to disclose (Min 6%). Earlier the minimum required to be disclosed was 8% but this was reduced to 6% from Financial Year 2016-17 onwards. As the payment is always received in bank in case of F&O Transactions, they can disclose the income as 6% of Turnover.

In case the small trader feels that his income is less than 6%, he would be required to shift to the Normal Scheme of Taxation and prepare all books of accounts and keep copies of all invoices.

The presumptive scheme of tax is only applicable to traders whose annual turnover is less than Rs. 2 Crores.

However, in case of F&O Trading, as the value of contracts traded is huge – the manner of computation is a bit different and the same has been explained below.

Computation of Turnover in case of F&O Transactions

In case of F&O transactions, the total of all contracts sold would not be considered as the total turnover.

In case of F&O transactions – the turnover would be computed by taking into account the total of all favourable and unfavourable trades. This can be explained with the help of the following example:-

Mr. B enters into the following 2 transactions during the year:-

- Purchased 1 Lot of Nifty for Rs. 8,00,000 and sells the same for Rs. 8,50,000, thereby earning a profit of Rs. 50,000.

- Purchased 1 Lot of Reliance Industries for Rs. 9,50,000 and sold for Rs. 9,40,000, thereby incurring a loss of Rs. 10,000.

In the above case, the total turnover would be considered as Rs. 60,000.

Which of the above 2 systems is better?

The normal scheme of taxation may turn out to be better in some cases whereas Presumptive Scheme of taxation may turn out to be better in other cases.

Therefore, it is very difficult to state which option is better. The trader should himself assess as to which system is better for him.

In case you have any query regarding the tax treatment of F&O trading, or you have any special case of F&O trading gain/loss, please share it share. It might help other investors or tax-payers to get their issues resolved.

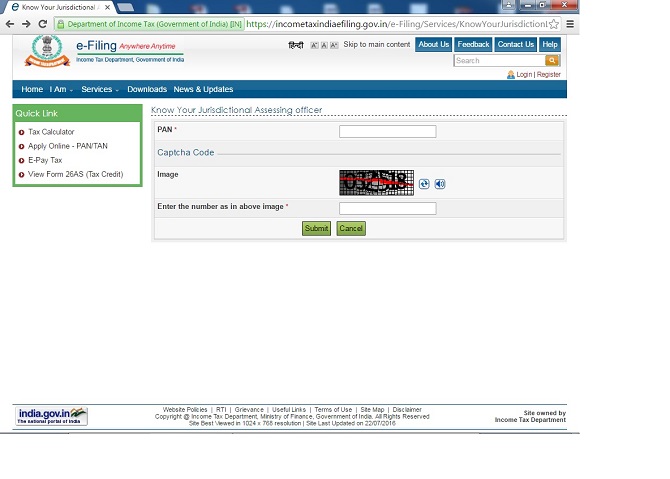

Assessing Officer of this ward/circle will take care of your ITR and he/she has the authority to scrutinize your tax return in detail, issue notice(s) if any further info regarding your ITR is required and issue refund/demand notice wherever applicable.

Assessing Officer of this ward/circle will take care of your ITR and he/she has the authority to scrutinize your tax return in detail, issue notice(s) if any further info regarding your ITR is required and issue refund/demand notice wherever applicable.