This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

In the absence of any fresh supply of tax-free bonds, investors are lapping up non-convertible debentures (NCDs) like never before. In its last issue in the first week of August, DHFL (Dewan Housing Finance Limited) received applications worth Rs. 18,651 crore as against Rs. 4,000 crore worth of NCDs on offer. Nobody, including the management of DHFL, expected such a huge demand which poured in from all categories of investors.

To capitalise on such a big appetite for debt instruments and an abundant liquidity in the system, DHFL is bringing one more issue of its NCDs from the coming Monday i.e. 29th August. The investors will be offered a slightly lower rate of interest between 9.10% to 9.25% for a period of 3 years, 5 years and 7 years.

Issue Closing Date – September 12 is the official date of this issue getting closed. But, if you want to invest in these NCDs, you should not wait for this date as the issue is not likely to remain open for that long. Going by the response DHFL NCDs got in its first issue, I don’t think it should remain open for more than 5 working days.

Issue Size – After getting a bumper response to its previous issue of Rs. 4,000 crore, DHFL is overwhelmed and does not want to miss the opportunity to cash in on this craze for its NCDs. So, the company has decided to launch an even bigger issue of Rs. 10,000 crore this time around. Base size of the issue is Rs. 2,000 crore and there is a green shoe option to retain Rs. 8,000 crore more.

Coupon Rate & Tenor of the Issue – The issue will carry coupon rate of 9.10% p.a. for an investment period of 3 years (36 months), 9.20% p.a. for 5 years (60 months) and 9.25% p.a. for 7 years (84 months). Interest will be paid compulsorily on an annual basis every year. Monthly interest and cumulative interest options are not there this time around.

Credit Rating & Nature of NCDs – CARE and Brickwork Ratings have rated this issue as ‘AAA’ with a ‘Stable’ outlook. ‘AAA’ rated debt instruments are considered to be the safest from credit default point of view. Moreover, these NCDs are ‘Secured’ in nature and investors with such secured NCDs have the right on certain assets of the issuer in case of any financial trouble for the company.

Objective of the Issue – DHFL plans to use the issue proceeds for its lending and financing activities, to repay interest and principal of its existing borrowings and other general corporate purposes.

Categories of Investors & Allocation Ratio – The investors have been classified in the following four categories and each category will be allocated NCDs as per the percentages fixed for them:

Category I – Qualified Institutional Bidders (QIBs) – 30% of the issue i.e. Rs. 3,000 crore

Category II – Non-Institutional Investors (NIIs) – 10% of the issue i.e. Rs. 1,000 crore

Category III – High Net Worth Individuals (HNIs) including HUFs – 30% of the issue is reserved i.e. Rs. 3,000 crore

Category IV – Resident Indian Individuals including HUFs – 30% of the issue is reserved i.e. Rs. 3,000 crore

Allotment on First-Come-First-Served (FCFS) Basis – Subject to the allocation ratio, allotment will be made on a first-come-first-served basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

NRIs Not Eligible – Like its previous issue, non-resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Listing, Premature Withdrawal & Put/Call Option – These NCDs will get listed on both the stock exchanges i.e. Bombay Stock Exchange (BSE) as well as National Stock Exchange (NSE). The listing will take place within 12 working days after the issue gets closed. Moreover, the issue does not carry ‘Call’ option for DHFL or ‘Put’ option for the investors. However, as these NCDs get listed on the stock exchanges, the investors will have the option to sell them on the exchanges anytime they want.

Demat or Physical Option – Demat account is not mandatory to invest in these NCDs as the investors have the option to apply for these NCDs in physical or certificate form as well.

TDS – Though the interest earned is taxable with these NCDs, DHFL will not deduct any TDS on the NCDs held in a demat form. The investor will have to pay tax on the interest income while filing his/her income tax return.

Should you invest in this issue?

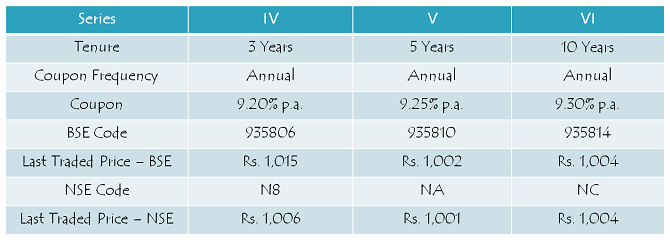

Investors investing just for listing gains were left disappointed when these NCDs from its previous issue got listed at a discount to their face value of Rs. 1,000. Going by such a listing, investors should not expect listing gains from these NCDs too. Interest rates for this issue have been fixed at 9.10% for 3 years as against 9.20%, 9.15% for 5 years as against 9.25% and 9.25% for 7 years as against 9.30% for 10 years. These lower rates will make sure that these NCDs will not list at a significantly higher price as compared to their issue price of Rs. 1,000.

DHFL NCDs trading on the BSE and NSE

As I mentioned earlier as well, periods of making easy money in the bond markets seems to be over now. Bond yields have fallen sharply in the last 6-9 months, but they are showing signs of stabilisation. It seems debt investments would yield lower returns for the next 2-3 years. In the absence of any significant adverse event, I think 10-year G-Sec yield should remain in the range of 6.90% to 7.40% for the remainder of this calendar year. If that happens, it would be termed as a very passive period for bond trading. In such a scenario, you should not expect any significant price movement in your bond holdings too.

These NCDs are for those investors who want to have higher returns as compared to bank fixed deposits (FDs) or fall in the lower tax brackets of 10% or do not pay tax at all. Investors in the higher tax bracket of 20% or above should avoid these taxable NCDs and explore tax-free bonds or other tax-efficient investments.

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in DHFL NCDs, you can reach us at +919811797407

Dear Sir,

Investor details:

Name: Anahita M Mistry

Appln No: 49014379

PAN No: ACAPM8734H

Cheque No: 272318

Amount: 1,80,000/-

Bank: PNB

With reference to the above details customer made investmen in AUGUST 2016. But till date cusomer has not received the Bond certificate Therefore kindly send the allotment amount and folio of the investor

Hi Shiv,

I just checked and found out that the option 1 ncd (i.e. 3 years, annual interest payment) were trading on NSE at Rs.993. I was thinking of investing in them. Before investing though I wanted to clarify some points with you,

(1) The interest payment will be on 09/09/2017, so will I get all the interest or will I get it on pro rata basis (i.e. only for the period I am holding the ncd for).

(2) I don’t have much idea of the yield concept but shouldn’t the ideal trading price be around Rs.1004.50 considering interest payable of Rs 4.50 from 09/09/2016 to 26/09/2016 to the earlier holder of ncd.

(3)The redemption value per ncd at the time of maturity will be Rs.1000 right?

Thanks in advance.

Hi Rohan,

1. You’ll get the interest amount for complete one year.

2. These NCDs are currently trading at a discount and whatever price they are trading at is the ideal trading price in the current scenario as per the market forces. Moreover, no interest will be paid to the earlier holder(s) of these NCDs.

3. Yes, the redemption value will remain the face value of these NCDs i.e. Rs. 1,000 per NCD.

Indiabulls Housing Finance Limited (IHFL) 9.15% NCDs Issue – http://www.onemint.com/2016/09/12/indiabulls-housing-finance-limited-ihfl-9-15-non-convertible-debentures-ncds-september-2016-issue/

Dhfl ncd allotment is available now on karvy. I got the allotment message on 9th septembe. These ncds will list on wednesday 14th september.

indiabulls ncd details available on akcapindia.com

when will be the allotment out for DHFL

An idea ?

Hi JD,

DHFL tranche II allotment will happen next week, probably on Tuesday.

Thank you Shiv for the updates

BWR (plus) and CARE plus ratings this time am I correct shiv to srei infra ncd 2016

Only Brickworks has rated the SREI NCDs issue.

this time srei infra ncd are AA by BWR and CARE so any coupan rate near about 10% is a very good bet isn’t it shiv

It is rated AA+ by Brickworks. I don’t think 10% is very attractive for the investors.

Informative post. Now, secondary market for debt bonds look more attractive for savvy traders? Any view on the sovereign gold bonds? Wrote a quick review on my site.