This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

In the absence of any fresh supply of tax-free bonds, investors are lapping up non-convertible debentures (NCDs) like never before. In its last issue in the first week of August, DHFL (Dewan Housing Finance Limited) received applications worth Rs. 18,651 crore as against Rs. 4,000 crore worth of NCDs on offer. Nobody, including the management of DHFL, expected such a huge demand which poured in from all categories of investors.

To capitalise on such a big appetite for debt instruments and an abundant liquidity in the system, DHFL is bringing one more issue of its NCDs from the coming Monday i.e. 29th August. The investors will be offered a slightly lower rate of interest between 9.10% to 9.25% for a period of 3 years, 5 years and 7 years.

Issue Closing Date – September 12 is the official date of this issue getting closed. But, if you want to invest in these NCDs, you should not wait for this date as the issue is not likely to remain open for that long. Going by the response DHFL NCDs got in its first issue, I don’t think it should remain open for more than 5 working days.

Issue Size – After getting a bumper response to its previous issue of Rs. 4,000 crore, DHFL is overwhelmed and does not want to miss the opportunity to cash in on this craze for its NCDs. So, the company has decided to launch an even bigger issue of Rs. 10,000 crore this time around. Base size of the issue is Rs. 2,000 crore and there is a green shoe option to retain Rs. 8,000 crore more.

Coupon Rate & Tenor of the Issue – The issue will carry coupon rate of 9.10% p.a. for an investment period of 3 years (36 months), 9.20% p.a. for 5 years (60 months) and 9.25% p.a. for 7 years (84 months). Interest will be paid compulsorily on an annual basis every year. Monthly interest and cumulative interest options are not there this time around.

Credit Rating & Nature of NCDs – CARE and Brickwork Ratings have rated this issue as ‘AAA’ with a ‘Stable’ outlook. ‘AAA’ rated debt instruments are considered to be the safest from credit default point of view. Moreover, these NCDs are ‘Secured’ in nature and investors with such secured NCDs have the right on certain assets of the issuer in case of any financial trouble for the company.

Objective of the Issue – DHFL plans to use the issue proceeds for its lending and financing activities, to repay interest and principal of its existing borrowings and other general corporate purposes.

Categories of Investors & Allocation Ratio – The investors have been classified in the following four categories and each category will be allocated NCDs as per the percentages fixed for them:

Category I – Qualified Institutional Bidders (QIBs) – 30% of the issue i.e. Rs. 3,000 crore

Category II – Non-Institutional Investors (NIIs) – 10% of the issue i.e. Rs. 1,000 crore

Category III – High Net Worth Individuals (HNIs) including HUFs – 30% of the issue is reserved i.e. Rs. 3,000 crore

Category IV – Resident Indian Individuals including HUFs – 30% of the issue is reserved i.e. Rs. 3,000 crore

Allotment on First-Come-First-Served (FCFS) Basis – Subject to the allocation ratio, allotment will be made on a first-come-first-served basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

NRIs Not Eligible – Like its previous issue, non-resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Listing, Premature Withdrawal & Put/Call Option – These NCDs will get listed on both the stock exchanges i.e. Bombay Stock Exchange (BSE) as well as National Stock Exchange (NSE). The listing will take place within 12 working days after the issue gets closed. Moreover, the issue does not carry ‘Call’ option for DHFL or ‘Put’ option for the investors. However, as these NCDs get listed on the stock exchanges, the investors will have the option to sell them on the exchanges anytime they want.

Demat or Physical Option – Demat account is not mandatory to invest in these NCDs as the investors have the option to apply for these NCDs in physical or certificate form as well.

TDS – Though the interest earned is taxable with these NCDs, DHFL will not deduct any TDS on the NCDs held in a demat form. The investor will have to pay tax on the interest income while filing his/her income tax return.

Should you invest in this issue?

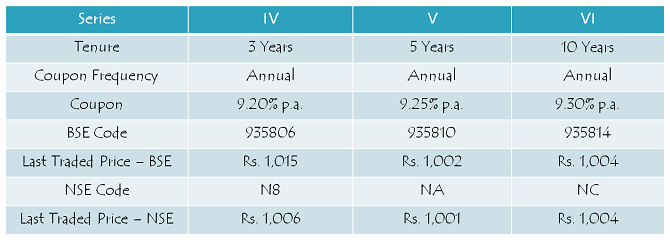

Investors investing just for listing gains were left disappointed when these NCDs from its previous issue got listed at a discount to their face value of Rs. 1,000. Going by such a listing, investors should not expect listing gains from these NCDs too. Interest rates for this issue have been fixed at 9.10% for 3 years as against 9.20%, 9.15% for 5 years as against 9.25% and 9.25% for 7 years as against 9.30% for 10 years. These lower rates will make sure that these NCDs will not list at a significantly higher price as compared to their issue price of Rs. 1,000.

DHFL NCDs trading on the BSE and NSE

As I mentioned earlier as well, periods of making easy money in the bond markets seems to be over now. Bond yields have fallen sharply in the last 6-9 months, but they are showing signs of stabilisation. It seems debt investments would yield lower returns for the next 2-3 years. In the absence of any significant adverse event, I think 10-year G-Sec yield should remain in the range of 6.90% to 7.40% for the remainder of this calendar year. If that happens, it would be termed as a very passive period for bond trading. In such a scenario, you should not expect any significant price movement in your bond holdings too.

These NCDs are for those investors who want to have higher returns as compared to bank fixed deposits (FDs) or fall in the lower tax brackets of 10% or do not pay tax at all. Investors in the higher tax bracket of 20% or above should avoid these taxable NCDs and explore tax-free bonds or other tax-efficient investments.

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in DHFL NCDs, you can reach us at +919811797407

what were the final amounts alloted in each series categorwise?

Hi Mamata,

Allotment is yet to happen in DHFL Tranche II.

srei infra AA

ncd opening on 7th September 400 days 9% cumulative 9.75% (monthly, yearly & cumulative) for

3 years and 10% for 5year (monthly, annually and clumlative ) so please post details on this ncd as soon as possible dear shiv

Hi Shiv,

I wanted to understand if they had been paying Semi-annual interest what would have been the effective yield. (would it be higher than 9.1% for 3 years bond or higher)

Thanks in advance.

Hi Krunal,

9.10% p.a. coupon paid semi-annually would have resulted in an effective yield of 9.307%.

This issue stands closed now.

Day 2 (August 30) Subscription Figures:

Category I – Rs. 6,246.69 crore as against Rs. 3,000 crore reserved – 2.08 times

Category II – Rs. 999.43 crore as against Rs. 1,000 crore reserved – 1 time

Category III – Rs. 3,404.14 crore as against Rs. 3,000 crore reserved – 1.13 times

Category IV – Rs. 2,082.30 crore as against Rs. 3,000 crore reserved – 0.694 times

Total Subscription – Rs. 12,732.55 crore as against total issue size of Rs. 10,000 crore – 1.27 times

today’s subscription figures please and whether indiabulls finance company ncd are

triple rated or not and whether a better company than dhfl or not dear shiv

Please advice can we buy this issue or not?

so we can apply tomorrow for full allotment dear shiv

Yes Nitesh, you’ll get full allotment if applied today.

so retail invester have a chance to get full allotment if applied

tomorrow isn’t it shiv

DHFL NCDs issue closes tomorrow, August 30th.

Day 1 (August 29) Subscription Figures:

Category I – Rs. 6,246.69 crore as against Rs. 3,000 crore reserved – 2.08 times

Category II – Rs. 1,194.12 crore as against Rs. 1,000 crore reserved – 1.19 times

Category III – Rs. 3,325.79 crore as against Rs. 3,000 crore reserved – 1.11 times

Category IV – Rs. 1,879.02 crore as against Rs. 3,000 crore reserved – 0.63 times

Total Subscription – Rs. 12,645.62 crore as against total issue size of Rs. 10,000 crore – 1.26 times

today’s subscription figures please shiv

today’s supscription figures please

i have ignored this issue and instead investors can buy from NSE or BSE DHFL N6 8.93% at 992..below its face value.

so if we apply tomorrow is there any chance of allotment shiv and how much

If applied tomorrow (on the last day), you should get 100% allotment.

latest subscription figures please shiv and please clear my above

doubt

Please check the subscription nos. from these links:

http://www.bseindia.com/markets/publicIssues/DisplayIPO.aspx?id=1167&type=DPI&idtype=1&status=L&IPONo=1240&startdt=8/29/2016

https://www.nseindia.com/products/content/equities/ipos/debt_ipo_current_dhflncd2.htm

dear shiv simpleinterest.in says that additional 0.25% coupon rate will get to existing bond and share holder and also senior citizens then if I apply for 7 years then will I get 9.50% coupon rate or 9.25% please clear my doubt

Hi Nitesh,

I did not get any such info of additional 0.25% for senior citizens, shareholders and/or bondholders. You should double check it with simpleinterest.in before taking any investment decision.

Dear sir,

Is multiple applications allowed ?

Yes Pradeep, multiple applications are allowed in NCD/Bond offerings.

Dear Shiv,

How about FDs of Tamilandu Power Finance Development Corporation. This fully owned Govt. Organisation. Offers 10.20 and 9.65% for sr. citizens and others respectively for 5 years with provision of interest payment monthly/quarterly and Annually. I believe this is better and safer investment than many. Please give your expert comments on parking money with this Orgnsation

May like ot visit http://www.tnpowerfinance.com/depositschemes.aspx

Thanks and Regards

Anand

Hi Anand,

I agree, it is offering attractive deposit rates to the investors, especially senior citizens. Conservative investors can consider investing in it.

Hi Shiv,

It would really help if you can do an independent review of FD scheme offered by TN Power finance.

Interest rates are very attractive esp. considering that it is backed by state govt.

It is unbelievable to find why this FD schemen is not so popular at pan india level?

Thanks!

Jalpesh Patel

Hi Jalpesh,

I’ll try to cover it soon.

please explain.

when the recent 9.3% 10yr NCD’s available almost at par or say at discount considering accrued interest, that too trading with heavy volume, why the small retail investor should invest in 9.25% new 7yr NCD?

You will have to pay brokerage to buy existing 9.3% NCDs. So its better to get 9.25% NCDs in IPO without brokerage (unless existing 9.3% NCDs trade at a discount, which is not likely)

Thanks Chaitanya!

thanks

Hi Manoj,

If Market Price + Brokerage Charges + Taxes etc. – Accrued Interest < Rs. 1,000, then you should buy these NCDs from the markets.

thanks