Ritesh Shah had a very interesting question about how many new shares will be issued in the course of the Power Grid FPO, and I thought I’d elaborate the response into a post because there are going to be a slew of disinvestments shortly, and it’ll be good to be familiar with this aspect for future reference.

Let’s take Power Grid’s capital structure for example and see how it works. Before this FPO – these are the number of shares that the government and others held in PowerGrid.

| Shareholder |

Number of Shares |

Percentage of total |

| Government |

3,634,908,335 |

86.36% |

| Others |

573,932,895 |

13.64% |

| Total |

4,208,841,230 |

100% |

For the issue, it was decided that the government will sell shares equal to 10% of the existing capital, and issue an additional 10% also.

In this case 10% of 4,208,841,230 is 420,884,123 – which is equal to the number of shares the government is going to sell, and also equal to the number of freshly issued shares.

Number of shares sold by the government: 420,884,123

Newly Issued shares: Â 420,884,123

This means that post the FPO – the total Power Grid shares will be a sum of the earlier total plus the newly issued shares.

Earlier total: 4,208,841,230

+ Newly Issued Shares: 420,884,123

Total Post FPO: Â 4,629,725,353

The government will hold shares equivalent to their earlier total minus the shares sold by them viz. 3,634,908,335 – 420,884,12 = 3,214,024,212

Others will hold shares equal to the Earlier total held by others + Number of shares sold by the government + The newly issued shares viz.

573,932,895 + 420,884,123 + 420,884,123 = 1,415,701,141

So, the new structure will look like this:

| Shareholder |

Number of Shares |

Percentage of total |

| Government |

3,214,024,212 |

69.42% |

| Others |

1,415,701,141 |

30.58% |

| Total |

4,629,725,353 |

100% |

When they say the total FPO is 20% it means that the total number of shares offered for sale (existing plus new issue) is equal to 20% of the existing capital or pre FPO capital.

The implication of this is that when you issue more shares then your Earnings Per Share (EPS) reduces because now your earnings are spread over a larger number of shares.

When an EPS is reported or a P/E multiple is quoted it is most of the time pre – issue EPS, so that doesn’t take into account the equity dilution due to the new issue of shares. Normally, when an analyst takes equity dilution into account they mention it, so if someone is quoting an EPS or P/E multiple without actually saying that they are taking into account the fresh issue – it is very likely that they are not considering it.

All data from the red herring prospectus

Power Grid FPO Subscription Numbers

The number of shares that are offered during a FPO are reserved for various categories like Qualified Institutional Bidders, Non Institutional Investors, Retail Investors and Employees.

When an issue is oversubscribed the number of shares you get depends on the demand in your own category. For example – the Coal IPO saw very low employee subscription, and an over subscription in all other categories, which means that even though the issue was over-subscribed overall – employees should have gotten the number of shares they bid for, while others got a lesser percentage.

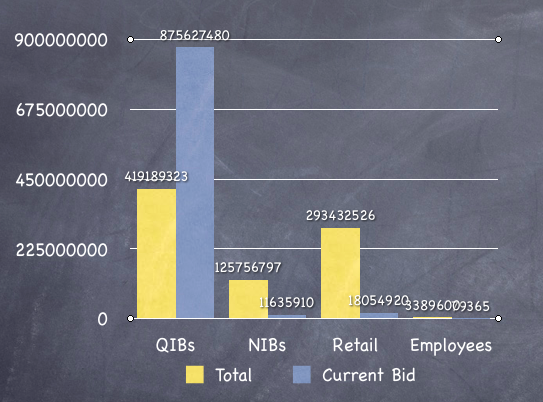

At the end of day 1, here is the demand data for the various categories for Power Grid from the NSE website.

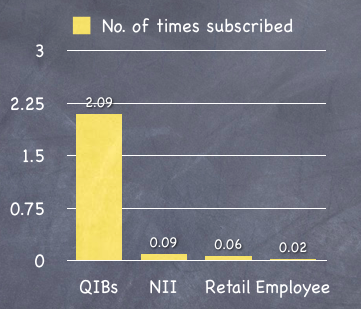

The subscription ratio is not very clear from the above chart, so here is a chart with just the subscription ratio from the same data.

The data above confirms the commonly known fact that retail investors wait till the end, and you can see that it’s the institutional investors who have already subscribed twice their quota. As the days go by you will see the retail numbers shoot up, and I’ll update this post regularly to see how that pans out.

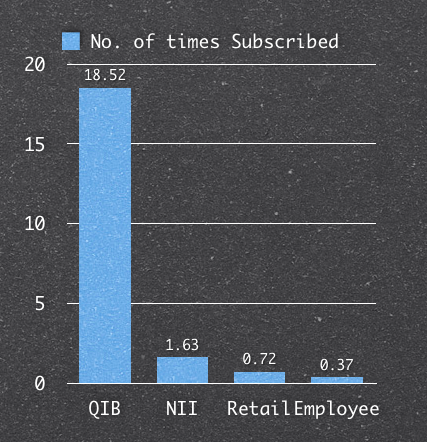

Update: At the end of November 11th 2010 – the numbers have increased for the QIB part quite dramatically, and have inched up for other categories also but not by so much. Here is how they look like. Data from NSE.

Any comments or feedback?

I have applied for 1105 shares as retailer in Power grid FPO. Now allocation is very near. Can you please tell me how many shares I ll get in the allocation process?

I’ve read 1/3rd ratio of allocation could be expected, but let’s see, it’s only a few days so you will know shortly Dev. I will update this post or leave a comment once the link to find the allotment is out.

The allotment status is out, and you can check it out at this link:

http://mis.karvycomputershare.com/ipo/

Do let me know how many shares you applied for and how many you got Dev. Want to see how the final ratio turned out.

Nice information.

I want to understand the impact of equity dilution on F&O segment.

Considering that company is issuing 10% fresh shares (which is equivalent to rights issue), would that mean that strike prices for options would be lowered by 10% ?

If not, buying PUTs just a day before listing of new shares would be wonderful to make money… wat say ?

I really don’t know about that Ash. Maybe some one else who understands options better can answer that.

I don’t have demat account, can i apply for IPO, as retailer. Please provide the details.

You need a demat account, so I guess if you really are interested in buying stocks or even debt instruments you should look at getting a demat account. There are several options and the annual fee is in the region of Rs. 500 or so.

A careful analysis of the figures reveal that the Retail Category is still very much undersubscribed. Is it expected to remain the same or huge applications are expected on the last day of the Issue ???

It will change with retail numbers increasing as they always do on the last day, but it’ll be surprising if there are any major fireworks

I want to know the future prospectives of power grid.

Is it worth investing in powergrid fpo at this point of time.

What about the premium the new investors would be bringing in which would also get added to the reserves of the company. Considering the premium the new investors would be bringing will actually increase the networth of the company by about 15% in this case. It may have an effect of increasing the market price of the stock.

Rgds,

Narayan

They have some 13 projects identified for which they’re going to use part of the proceeds, so that’s always a good thing when the company uses funds for expansion.

nice information, pls.update regularly.

Just updated with data from NSE for Nov 11 2010 Dipak. Will update this tomorrow also as I’m also quite interested to see how much the retail part increases at the end.

One doubt….

1. lets say QIB is subscribed 5 times

2. reail investor portion only .5 times and employees .5 times and NII also .5 times

how the allocation would be? will retail get full shares they applied for?

Yes, Retail will get full allocation, and the under utilized quota from Retail, NII and Employees will be allocated to QIB.

Your posting is tooo good ..

Thanks

Thanks for your comment Nilesh!

Pls contact me i want to now more about this

RAJAN

09868379286

Rajan, I guess you’re interested in buying the IPO, but I don’t provide that service…sorry. Is that what you’re looking for?