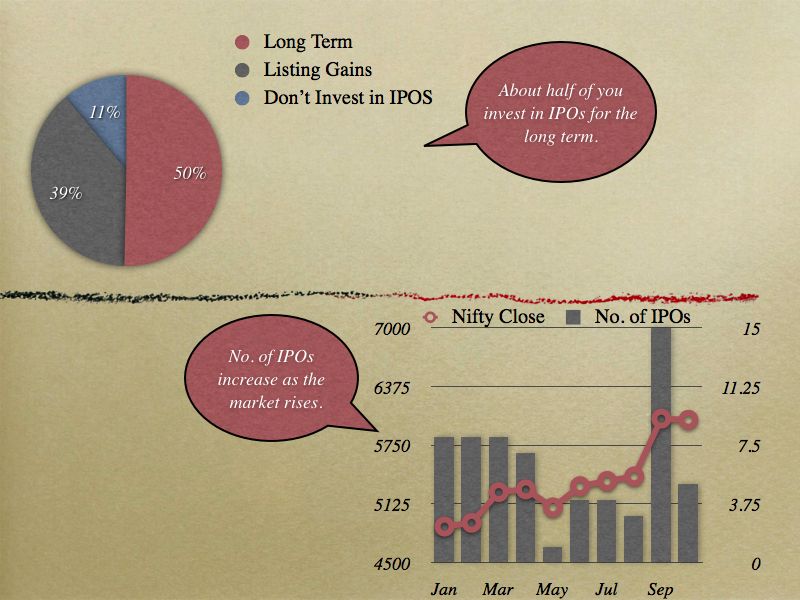

In the last poll I had asked you the objective of your IPO investment, and you had three options:

- To get a good stock for the long term.

- To sell on listing and make a quick buck.

- I don’t invest in IPOs

Here is the results of that poll, and I will make a couple of points about long term investing in IPOs and short term listing gains as well.

IPOs as a Long Term Investment Vehicle

If you look at the picture above (you might need to click it) – the graph at the lower half shows you the number of IPOs in a particular month in 2010 on one axis (the bars), and the Nifty close at the end of the month on another axis (the red line).

You can see that in the last couple of months or so the number of IPOs have increased quite a bit, and Nifty has rose to highs as well.

Since the promoters are trying to maximize the money they can raise from the market it is only natural that there are more issues in the market when the sentiment is positive, and there is general euphoria in the markets.

If you had a company would you take it public when there is blood on the streets, or when everyone is gung – ho about stocks?

This is an important thing to keep in mind for long term investors. If you are looking at a time horizon of several years, and you feel that the promoters of the company have not left much on the table for investors then it is probably better to wait for the markets to settle down, and initiate a position when the markets are not close to their all time peaks.

At the same time if you like a company because of its fundamentals and feel that the issue has been priced attractively – by all means – go for it.

This is just meant as a piece of caution because you will hear and read a lot about IPOs at about the time the markets are high, so that’s one thing to keep in mind while investing in them for the long term.

IPOs for Listing Gains

In August I took all the IPOs that had came out in 2010 (till that point), and plotted their returns to see how they fared. The results were quite mixed. Here is how that looked.

Even though the data has not been updated, the point still remains that you have to do a bit of a guess-work in determining which one of your IPOs will get you a good listing, and which ones will be just dud issues. If it’s too apparent that pricing is attractive then the over-subscription will be high and you won’t be left with much money.

Personally, making a quick buck at listing gains doesn’t attract me in the slightest, but that’s just my view, and no reason why it should turn you away. I’d just say that take stock of the IPOs you have invested over the years, the money you have made, and the money you have blocked in them. How would that compare to simply investing in a mutual fund or even a fixed deposit? A little bit of introspection might change your mind.

Lastly, thanks to all of you for voting, and I’d love to hear what your experience with IPO investing has been, and also like to hear any poll topics that you might want to see here.