National Highway Authority of India (NHAI) is usually known for issuing Section 54EC bonds, but for the first time they are issuing tax free bonds as well.

Now, a lot of people confuse tax savings or no TDS with tax free, but these are truly tax free bonds, which means that the interest from these bonds is tax exempt – you don’t have to pay any tax on the interest regardless of your income tax bracket.

The bonds will list on the BSE and NSE, and if you sell them on the exchange and make capital gains on them, then that will be taxable. Listing of the bonds doesn’t however mean that the bonds will be issued in dematerialized form only and you will compulsorily need a demat account.

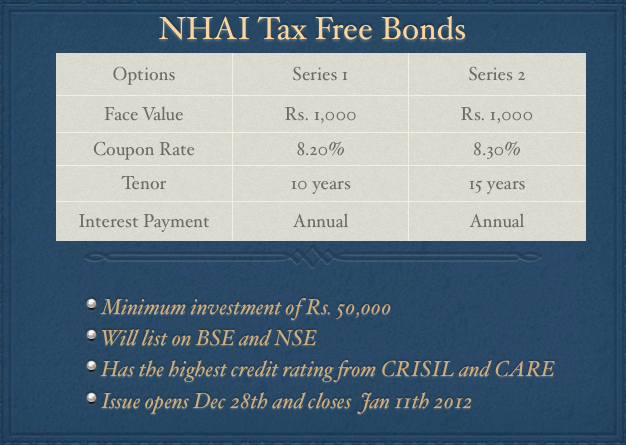

NHAI bonds will be issued in both physical and demat form, so people who don’t have demat accounts can also buy these bonds. There are two series of bonds – one with a ten year maturity, and the other with a 15 year maturity. The first series has an interest rate of 8.20% and the second series has an interest rate of 8.30%, both the series will pay interest annually.

Since some of the best bank interest rates are at 10% right now – you can see that for people in the 30% or 20% tax bracket – this issue has got great yield.

NHAI tax free bonds have been rated CRISIL AAA/Stable, CARE AAA, and Fitch AAA by CRISIL, CARE and Fitch respectively. These are very high ratings, and although NHAI has made losses in the last three years – it’s easy to see how these credit agencies assigned these bonds the highest rating.

This is a secured issue from a company that comes under the Government of India, and as such it’s hard to see how NHAI could default on its debt obligation.

I think this is a good issue especially for people in the 30% tax bracket, and won’t be surprised if it gets over subscribed in the first few days itself. This is especially so because interest rates can’t remain this high forever and this issue allows you to lock on to these high rates for 10 or 15 years, which is quite a good return for a safe debt instrument. And even NRIs can invest in these bonds, so to the extent they can manage the application process, this will be an attractive offer for them as well.

SBI Capital Markets, AK Capital Services, MCS Limited, ICICI Securities and Kotak Mahindra Capital are the lead managers to the issue so you should find the application forms in their offices. Other investment firms like Karvy should also have the application forms, and I think some of these companies will also enable it so that you can apply for the NHAI tax free bonds online, but I don’t have a definite list yet.

I’m sure as more information comes in – you will leave comments and I’ll update the post with where exactly you can find the application forms etc. at the time.

Meanwhile, many thanks to Rakesh Jain who let me know about this issue much in advance, and let’s hear any other questions or observations you have about the NHAI issue in the comments.

Application Form of NHAI Tax Free Bonds

Update: Deleted the part about allotment being on a first come first serve basis per Shiv’s comment below.

Hi Manshu.. The issue has already got subscribed two times, on the first day itself.

http://business-standard.com/india/news/nhai-tax-free-bond-issue-subscribed-two-times/460108/

Category I investors, Financial Institutions, Mutual Funds, Insurance Cos., FIIs, Trusts, Corporates are too hungry for an issue like this. Category I subscription figure is 3 times, Rs. 12,000 crore as against Rs. 4,000 crore reserved. Category II investors (HNIs, NRIs etc.) have made subscriptions of Rs. 6,000 crore vs. Rs. 3,000 crore. Retails category is still undersubscribed with Rs. 1,000 crore as against Rs. 3,000 crore reserved for them.

My earlier observation “I’m 100% sure that the Institutional Category & HNIs Categoty will get over-subscribed on the 1st day itself and probably the Retail Categoty as well” was not well off the mark. Probably Retail Investors were too busy with work yesterday, next two days will see some action in this category and the issue will get closed on friday. Thankfully, for retail investors, the allotment will be on a proportionate basis.

Huge appetite for issues like these !! PFC Tax-Free Bonds issue is opening tomorrow & it will be interesting to see how it goes.

Amazed to see such high level of interest!

Will the NHAI bond be compounded annually or it is plain 8.3%. What will be the return after 15 years for Rs.1,00,000. I tried several online calculators and each of them gives me a different number? Could you please help out???

I know this could be oversubscribed, by the time I make a decision. But I wanted to know where to look for this information in the prospectus or What is the general rule for these kind of bonds, because as a matter of fact we know FD compounds annually or quarterly etc.,

Hi Mr. Prem.. there is no compounding option available in these bonds. The interest of 8.30% p.a. is payable annually on October 1 each year. After 15 years, you’ll get back Rs. 1 lakh along with the interest for a period between October 1, 2026 and say January 20, 2027 (assuming January 20, 2012 as the deemed date of allotment).

Thanks a lot, Shiv

You are Most Welcome Mr. Prem!! 🙂

Hey , I find the discussion knowledgable, just wanted to ask what will be return on maturity if one invests Rs 1Lakh? Will it be Rs 1,82,000 ? for 10 years?

There are certain benefits of investing in NHAI tax free bonds:

1. It is generating slightly higher returns then a 10 year FD e.g SBI. But yearly compounding will increase the gap.

2. The bonds might trade at premium due to the falling interest rate scenario in future which can generate good profits

3. The flexibility to invest the interest amount anywhere is there which is not present in other instruments like FD

Due to above reasons it becomes a good option for investing especially people in highest tax bracket.

These bonds are tax free in nature there is no doubt.But the return variation from already available instruments like high rate FDs is very minimal.For NRIs it can be a good option but banks are already increasing deposits rate for them after deregulation.HDFC & SBI has done that and more banks will follow.

In all probability the investment will be wiser if one can earn a good differential returns as comparison to products available. If FD even after post tax fetches returns almost equal to this bond it becomes a more viable option due to its liquidity.Hence, invest or not to invest should be based on two factors- Return differential & Liquidity. Credit risk will always be one of the criteria while investing in any bonds.

Fully agree with the above comments from Mr. Jitendra.

I went to ICICI Bank collection centre today and obsevered people are investing in this bond in lacs and crores. 🙂

It seems it will be over-subscribed in the first day itself.

A confirmation please –

Does the investments in NHAI bond allow for relief under 80CCF ( to the limit of Rs20000 like IDFC and IFCI ?)

No.

No Ashish,

There is no 80CCF benefit in NHAI bonds.

Amlan / Stock Guru

The basic fallacy in your calculation of compounded returns from FDs is that you’re deducting tax after compounding @ 9.25/9. 5% for 10 years, and while tax has to be paid every year on accrued interest. Hence we should be ideally be compounding at a tax free rate of approximately 6.3-6.5%.

Also if we take into consideration the returns generated by investing yearly interest of NHAI bonds, I’m sure the bonds will be quite an attractive proposition.

Would like to hear from everyone about this.

dear sir,

if invester invest in nhai bonds who would fall in 30% tax bracket then a invester have a better option in FMP(fixed maturity plan) because current fmp are giving 9.7-9.8% yield and they have indexation benefit in fmp it would approx 9% after indexation.so it would be a better option.

plz clarify it sir.

ARIHANT JAIN

9529222992

Arihant Rightly said, FMP are an option with 9.7-9.8% yield, indexation benefit. But as of today the FMP with max. no of days open is , ICICI Prudential FMP Series 60-27M Plan I which is for 835 days or 27 months opening on 26 – Dec closing on 09 – Jan.

NHAI are bonds for 10 years at 8+%.

It is another good option to be considered for diversification.

Hi Manshu.. Like IDFC Infra Bond and L&T Infra Bond issues, please check another Web Link to download the NHAI Tax-Free Bond Application Forms online:

http://www.sbicapsecu.co.in/pdfstamping/NHAI_KUKREJA.aspx

Note: Just want to tell the investors that the photocopies of a form cannot be used to invest, as each form has a unique application no. To get multiple forms in order to invest in different names, just click multiple times.

In case any reader has any query regarding this link (E-Form), NHAI Tax-Free Bonds as such or wants to invest in NHAI Tax-Free Bonds, Call/SMS 9811797407 (Gurgaon, Delhi or Noida) or mail us at ojascap@gmail.com

if i am getting 9.5% in Bank FD at a lock-in of 555 days, why should i take NHAI at alock-in of 10 years. i fall in 30% tax bracket.

Dear anupma if you are in tax bracket of 30%then your 9.5%fd will give you actual

return=6.65 (9.5 – 30% of9.5) Where as this being a tax free instrument your returne will be 8.2 or 8.3% depending upon the term you choose.

In the 30.9% Tax Bracket, effective yield works out to be 12.01% (8.30% = 12.01% * (1-0.309)). Also, you are getting 9.5% because at present Inflation is high, Interest Rates are high. Interest Rates will not remain this high for a very long period and this safe issue offers the investors an opprtunity to lock-in at quite high Tax-Free interest rates of 8.30% & 8.20%, which will remain constant throughout the tenure.

9.5% interest rate might fall to 7.5%-8% after 555 days, then your average returns would be lower. Now, compare 9.5% & 12.01% and you will find your answer yourself.

Guys!

I did a very detail calculation/cost-benefit analsyis and here are my observations:

1. For Bank FD, please remember that the interest is quarterly compounded, whereas most probably NHAI will provide simple interest in yearly basis.

2. It totally depends upon how you will invest the yearly interest earned from NHAI tax free bonds. If you don’t invest that well, the effective yield from NHAI bond (in 10 years) can be less than bank FD even if you pay 30.9% tax on interest earned from FD.

if you need detail calculation excel, let me know and i will send you in email.

Amlan Basak, All

For 10 years, 8.2% p.a. Simple Interest (as offered by NHAI Tax Free Bond) is BETTER than 9.5% compounded quarterly (as apparently offered by some banks) for an individual whose income falls in 30.9% tax bracket.

The effective rate of interest Taxed Avenue comes out to be 4.26%

The effective rate of interest Tax Free Avenue comes out to be 9.84%

Currently SBI is giving 9.25% for 10 years FD.

let’s assume you invest 1,00,000.

With quarterly compounding interest the maturity amount will be 2,49,544 (though it is surprising but it is the power of compounding).

Interest component = 1,49,544

Tax @30.9% = 46,209

So, effective maturity value = 1,00,000+1,49,544-46,209=2,03,335

for NHAI, simple interest of 8.2% will yield 82,000 in 10 years

So, final amount = 1,82,000

It is less by 21,335

Please let me know if I made any mistake in the calculation.

(Note: I am not considering how we are going to invest the 8200 per year that we will get as interest)

First of all, on a simple interest basis you found out that It is less by 21,335.

Now take a case, When you invest your yearly interest of 8200/- and put that at 6% at Qtr compunding then you will earn 6000 (Keeping rate 6% assuming that you’re in 30% bracket and post tax yield will be 6%). This is for first year and investment for next 9 years. Now think interest earnings on all years. I am sure that will lead to 30-35k.

But if you will take FDs from IDBI Bank (which is also SAFE bank like SBI) and Giving 9.5% return with Qtr compunding. Hence compunding return would be around 252304 and post 30.9% tax -> 206612.8. Which is almost same if you will invest NHAI yearly interest at 8-9%. More, IDBI is having ZERO penalty for premature FD Exit.

I think, only point to invest in NHAI is SAFETY but which we can assume with IDBI like bank.

But investing the yearly interest say in a FD will give you earnings only after the bond maturity. For ex the 2nd year investment (if done in a 10 year fd) will give you maturity only after 12 years from now and so on. should that also not be considered?

Thanks to all for providing different aspects associated with this issue.

However, i would still like to agree with the mathematical solution of Amlan. Alman, your calculation would be further comparable with the SBI FD example that you have chosen if calculations are made with 8.30% which is being offered on the cumulative tranche of the NHAI bond.

Hi Amlan,

catch is , you forgot tax on your 1 Lakh(principle). So consider the persons those want to save 20000 more from tax (apart from normal 1Lakh) they could get benefit from infra bond.

-sumit

How is this bond different from 80D Infra bond? Under which section tax is exempted?

Hi Aakash.. Infra Bonds do not fall under 80D. They carry tax benefit u/s 80CCF and 80D is for Health Insurance. The interest earned on NHAI bonds is fully exempt from Income Tax u/s 10 (15) (iv) (h) of the Income Tax Act, 1961.

NHAI Tax-Free Bonds investment does not provide any tax exemption under any section of I-T Act. Its just that the interest earned is tax-free. Whereas, Infra Bonds provide tax exemption u/s 80CCF but the interest earned is fully taxable as per the investor’s tax slab.

IFCI Ltd, one of India’s oldest financial institution is offering Tax Free Infrastructure Bonds (Series IV) the issue for which is open till 16 Jan 2012. Very recently the issues of L&T as well of that of IDFC have closed. I came across the Blog http://www.infrastructurebond.in, which only shares general information on Tax Saving Infrastructure Bonds.

These are not tax free. The interest income is taxable.

It really appears to be a reasonably safe investment with reasonable returns. However owing to chances of oversubscription and proportionate allotment, it has become difficult to quantify how much to invest. Any suggestions?

It will be available through ICICI direct. I got email from them

That’s great to know – thanks for leaving the comment.

Thanks Manshu for a quick response. Yes I also feel as NRI’s have allowed now, they would also provide online facilities. thanks again.

Any possible impact on tax free interest after DTC?

How to invest online? is it possible through ICICIdirect?

thanks

DTC should not have any impact on these bonds. The government would really be cheating investors if they changed something like this on a product that people only buy because of the tax benefit.

Online, it might come in ICICI Direct, though not sure yet, will update once I find out.

Sure, here it reaches you. More detailed analysis on Monday. I’m dead tired servicing investors with IDFC and L&T Infra Bond issues. There was huge response for both the issues. Probably they marketed it quite nicely.

Great to hear that – happy that you were busy and response was good. Early Christmas for you 🙂 Nice!

Hi Manshu.. “Terms of the Issue” as well as the Application Form itself says so. It says “Basis of Allotment: For Category I and II on first come first serve basis (determined on the basis of date of receipt of each application duly acknowledged by the Bankers to the Issue). For Category III on proportionate basis.”

Instruction No. 45.2 in the Application Form states “For Category III, the allotment shall be done on a proportionate basis.” It also says “In case of oversubscription in Category I Portion and Category II Portion, allotments to the maximum extent, as possible, will be made on a first-come first-serve basis and thereafter on proportionate basis, i.e. full allotment of Bonds to the applicants on a first come first basis up to the date falling 1 (one) day prior to the date of oversubscription and proportionate allotment of Bonds to the applicants on the date of oversubscription (based on the date of submission of each application to the Bankers to the Issue, in each Portion). In case of oversubscription in Category III Portion, all valid applications received during the Issue Period, shall be treated at par and considered for allotment on a proportionate basis.”

Ok yeah looks like the later version changed the terms and I didn’t have that. Thanks for pointing that out Shiv – can you please send me an email with the doc?

Thanks!

Hi Manshu… “First-Come-First-Serve” is for Institutions and HNIs only and not for Retail Investors investing less than Rs. 5 lacs. They will get allotment on Pro-Rata/Proportionate basis.

Also, for a change, these bonds allow NRIs to invest. NRIs would be too tempted to invest their money in a 8.2% or 8.3% Tax-Free instrument. I’m 100% sure that the Institutional Category & HNIs Categoty will get over-subscribed on the 1st day itself and probably the Retail Categoty as well.

Hi Shiv,

From the prospectus I see that they are going to classify investors in 3 categories, and retail investors come under the third category. And this is what it has to say about allotment:

Applicants belonging to the Category III, in the first instance, will be allocated Bonds upto [â—]% of Overall Issue Size on first come first serve basis (determined on the basis of date of receipt of each application duly acknowledged by the Bankers to the Issue);

Further ahead it says this:

In case of an oversubscription, allotments to the maximum extent, as possible, will be made on a first-come

first-serve basis and thereafter on proportionate basis, i.e. full allotment of Bonds to the applicants on a first

come first basis up to the date falling 1 (one) day prior to the date of oversubscription and proportionate

allotment of Bonds to the applicants on the date of oversubscription (based on the date of submission of

each application to the Bankers to the Issue, in each Portion)

My interpretation is that if the reach full subscription on the 3rd day for that category then they will allot full quota to the applicants in the first two days, and then proportional to the applicants on the third day.

This is on page 151 on the prospectus that I have.

Did they issue a later version in which this condition changed or do you have any other source of info that tells you that all retail investors will get proportional investment regardless of when they invest?

I think the later version changed the terms for the Retail Investors.

Hi

Thanks for providing this update. For me its a new thing. Do we have any other Tax exempted bonds in past which are available for trade in stock exchange ?

HUDCO had also come up with tax free bonds some time ago – I don’t know however if they have listed or not.

PFC also came up with the Tax-Free issue, just before HUDCO launched it. Both PFC as well as HUDCO had 8.09% (10 years) & 8.16% (15 years) as the coupon rate.

PFC is also expected to launch one more Tax-Free issue by end of the month on similar lines as NHAI is. Coupon Rate is also expected to be the same at 8.20% & 8.30%.

Thanks Shiv and Manshu for this information. I tried searching PFC on BSE. Is it listed there ?

Thank you for all the details.

Once PFC issues such tax-free bonds, please let us all know in this forum.

Many thanks.

Just now got the notification that PFC has launched the same Tax Free bonds.

Interest Rate: Same

Credit Rating: Same

Issue Opens on 30-Dec

Issue Closed on 16-Jan

Minimum Applictaion Amount = 10,000 (1,000 X 10 bonds)

Thanks Amlan – I’ll write a new post on that and also do some returns calculation as well in that.