This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

With stock markets rising by 35-40% and bond markets giving 15-20% returns in the last one year or so, mutual fund investments are gaining popularity. More and more people are now recognising mutual funds as a highly efficient vehicle to ride with the pace of corporate profitability and Indian economic growth. What makes mutual funds more attractive is their taxation treatment.

While selling equity mutual funds after holding for more than 12 months makes long term capital gains tax-free, selling non-equity mutual funds after 36 months provides indexation benefits, which make them extremely tax efficient vis-a-vis fixed deposits or post office small saving schemes. Short term capital gains on equity mutual funds are also taxed at a lower rate of 15%. Moreover, dividend received is also tax exempt in the hands of mutual fund investors.

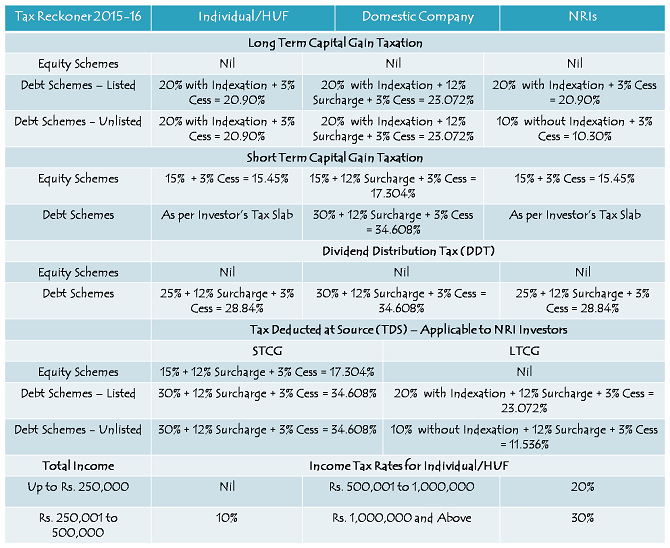

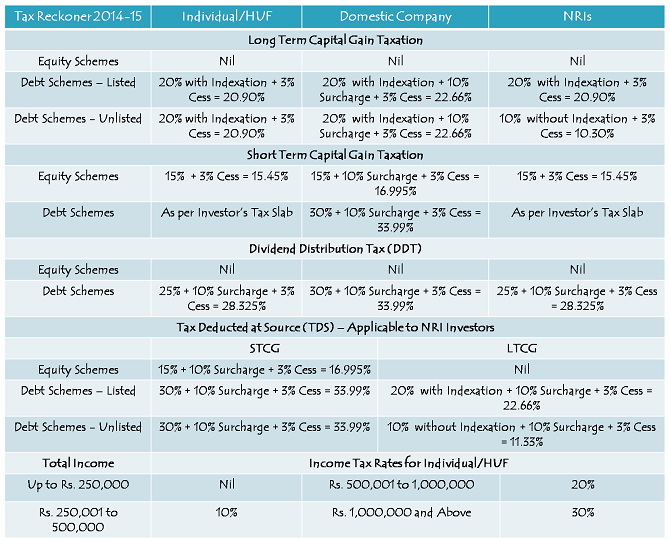

Last year in July, the Finance Minister, Mr. Arun Jaitley increased the holding period of debt mutual funds from 12 months to 36 months for these funds to quality as long-term capital asset. Though Budget 2015 has not tinkered with the tax rates applicable to mutual fund investments, some changes have been proposed as far as surcharge is concerned for high net worth individuals and domestic companies.

Mutual Fund Taxation for Individuals/HUFs

Equity Mutual Funds – Units of equity mutual funds held for more than 12 months qualify as long-term capital asset and long term capital gains (LTCG) on equity mutual funds are tax-free or exempt from tax, while short term capital gains on equity mutual funds are taxed at 15%.

Non-Equity Mutual Funds – Units of non-equity mutual funds held for more than 36 months qualify as long-term capital asset and long term capital gains (LTCG) on non-equity mutual funds are taxed at 20% with indexation, while short term capital gains on non-equity mutual funds are taxed as per the slab rate of the individual/HUF investor.

Dividend Income – Dividend income is tax-free or exempt from tax in the hands of individual/HUF investors. Dividend Distribution Tax (DDT), which is applicable to non-equity schemes only, is paid by the mutual fund/asset management company.

Tax Reckoner Financial Year 2015-16

Some Important Points:

- Surcharge at the rate of 12% will be applicable to Individuals/HUFs having total income exceeding Rs. 1 crore.

- Surcharge at the rate of 12% will be applicable to the domestic companies where the income exceeds Rs. 10 crore. Where income exceeds Rs. 1 crore but is less than Rs. 10 crore, surcharge of 7% will be applicable.

- In order to qualify as long-term capital asset, the units of mutual funds (other than units of equity oriented funds) should be held for a period of more than 36 months. In the case of equity oriented funds, the units would qualify as long-term capital assets if held for more than 12 months.

- In cases where the taxable income, reduced by the taxable long term capital gains of a resident individual/HUF is below the basic exemption limit, the long term capital gain will be reduced to the extent of this shortfall and only the balance of the long term capital gain is chargeable to income tax. The benefits of this provision are not available to NRIs.

- For the purposes of determining the dividend distribution tax payable, the amount of distributed income shall be increased to such amount as would, after reduction of the dividend distribution tax on such increased amount at the specified tax rates, be equal to the amount of income distributed by the Mutual Fund.

- Rebate of up to Rs. 2,000 available for resident individuals whose total income does not exceed Rs. 500,000.

- (i) In the case of a resident individual of the age of 60 years or more but less than 80 years, the basic exemption limit is Rs. 300,000.

(ii) In the case of a resident individual of the age of 80 years or more, the basic exemption limit is Rs. 500,000.

(iii) Education cess is applicable at the rate of 2% on income-tax and secondary and higher education cess at the rate of 1% on income-tax.

Note: The rates above are based on the proposals in the Finance Bill, 2015. They will become a law once passed by both the Houses of Parliament and when they receive the assent of the President.

Tax Reckoner Financial Year 2014-15

Mutual funds, especially equity mutual funds, are the most tax efficient investment options for investors here in India. But, due to market volatility, most resident individual investors remain skeptical about it. I think they need to understand that it is their wrong timings of entry and exit which make them suffer losses in these funds. If they invest when the markets are down due to overly negative sentiments and sell when the markets are up due to euphoric sentiments, then I think they should be able to earn reasonably higher returns.

If you have any general query regarding mutual fund investments or their taxation treatment, please share it share.