Reader Miteysh H Shah sent me his story about how he developed his investing approach and I was deeply impressed with the depth of the products he covered, and the sincerity with which he took responsibility of his mistakes and decided to do his own research, learn from his mistakes and develop a strategy.

While you may or may not agree with his take on individual assets I am sure you’ll agree that all of us can learn from his amazing attitude of deciding to take it upon himself to learn about his finances better and come up with an approach that works for him.

Hats off to him for doing that, and here are his thoughts.

Dear Manshu,

My 1st investment in market was ULIP product bought on 8th Dec 2007; before that I was zero about the markets I was thinking it was just gambling because I heard many stories from people that they lost everything in that.

When I decided to enter I was searching a proper advisor but I didn’t know where I could find a decent advisor and I just ended up meeting salesmen who were more interested in commissions rather than showing me options and the right way to enter the markets. At last when I found the right person but was late because the markets had began their downwards march and even I had bought a few products not right for me.

By the time market started upwards in march 2009 – I had tried almost every product available & ways to recover my heavy losses because my family was already against it.

The most important thing I learned is that we have to take care of our own money nobody on earth is interested in the growth of your money, he is just interested until his interest is done.

So from March 2009, I started my research instead of blindly believing to false promises of salesmen in this case if I lose only I will be responsible for that & I will learn from my research.

Now when I’m losing I know where I’m wrong & I can correct that in my next opportunity, but in the salesmen or PMS case you just handover yourself completely to them.

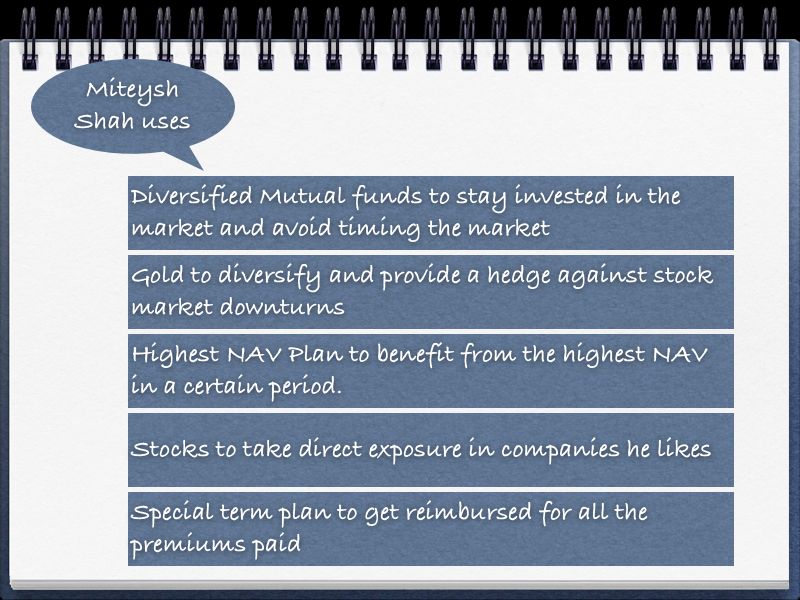

Let me now go on to state my various assets now.

Diversified Mutual funds

Always stay invested in 3-4 good diversified mutual funds through SIP, as we can never time the market. Get an appropriate mixture of large-cap, midcap, small-cap & balanced mutual funds based on your risk – appetite.

Gold

As per 1 of your past articles on gold & its moving 10 years chart – I see that gold is also a good hedging fund, so we can keep buying a few units of GOLD ETFs regularly.

I have also noted that whenever market moves downwards – gold begins its upward journey, so this can be 1 advantage of it. You can regularly invest like this by opting for your broker’s facility of auto transfer to create a SIP for your gold ETF purchase.

Highest NAV Plan

Although I don’t expect a highest NAV return plan to match a good mutual fund return I’ve still invested a part of my portfolio in it to gain some benefit of this product, which gives the benefit of the highest market level traded in the specified period.

In this I like Birla platinum ULIP plan because they provide highest NAV returns based on all the trading days in a year so you can’t miss any of the highest level on any day like in others as I know highest NAV is provided only on few dates in a month but what if the markets hits all time high on a non-record date of plan?

Reliance Super Automatic Investment Plan

I like Reliance Super Automatic Investment plan because of its advantage of 52 free switches in many of the funds available in the plan like equity fund, infra fund, energy fund, gilt, midcap, money market.

We can switch the funds as per the market movements; can book profit in down turn & reinvesting in equity at lower levels. This is a free service without any cost that too we can do online at our convenience. Also you can opt for single premium.

This fund is good to gain in such a volatile markets where in 1 day it can swing up to 500~600 points & down up to 400 points, we can take advantage of both the sides of market without getting nervous in -ve or +ve

Stocks

I have my own watch-list of stocks based on research & studies I have done myself and I have rated them myself as well. I keep accumulating the good ones at every dip but you have to be very much updated in primary equity before every buy or sell.

To select the right stocks from the various scripts, I think the right way is to think yourself what business you like to enter, what business you would invest if you have a chance… my meaning is investing in stock – take it as your own business – not just for trading then you will enjoy the earnings & you will automatically have that confidence on that scrips rather than listening on TV shows.

One more thing I would like to add here is when we feel the market is at peak & fear of down turn we can start booking profit by moving our money to balanced fund & in raising market start shifting to equity. Balanced because we cannot judge the bottom & peak point & also somewhere we believe in the India growth story.

MIP

Youngsters can use MIP which is available with 10~20% equity to gain markets exposure on +ve side. However MIP has exit load for 6~12 months in that case we can select STP to save entry/exit loads wherein you can switch to the all types of funds available with same AMC- Equity diversified, balanced, liquid, MIP, etc. for investors who don’t want to take risk at all can go with various liquid funds with no equity portion.

Now-a-days MIP is also available with debt+equity+gold such as Religare MIP plus this way you can cover all sides of safety instruments.

Insurance

For insurance we can go for special term plan wherein we get reimbursement of all the paid premiums & can fix our premium till the age we have opted for.

In fact technically if we do the math normal term plan is cheaper than special term plan considering the balance premium to be invested in MIP or debt or equity because the reimbursed amount we will get at the end of special term plan is without interest.

So overall as per my views we can be rest assured of any movement in the market. We can take every fall or rise as an opportunity to gain. This is better way to do it ourselves rather than giving our money blindly & to follow-up even though paying him the fees & charges. In all this product you don’t need to sit in front of the TV or markets you can just do it at your convenience.

There you have it, this is my approach – please leave a comment to let me know what you think!

Wow ! Thanks for sharing the mail. I really liked the following stmt and I believe it: “The most important thing I learned is that we have to take care of our own money nobody on earth is interested in the growth of your money, he is just interested until his interest is done.”

I also started the financial journey in the same way and is learning on the way thanks to such forums. And my website is also a byproduct of my journey.

It’s not that I am not making mistakes but I fall and try to learn from it.

Yeah, this is some really impressive thinking and planning done by Miytesh.

thanks for your comments. Yes you are right reg. highes nav returns it may provide conservative returns somewhat like Balanced funds.

As you all must have seen i m trying to create portfolio securing all the conditions what best can be done. so after looking to 2008 scenario this plan i have taken to protect my need in such unfortunate event.

i would like to clarify further my views for same; this plan is for mainly for securing in downfall. for returns (weath creation) SIP in MFs is best option. If you consider period after maturity of your highest nav plan, what if we need the money suddenly but unfortunately market crashsed at that time temporarily as 2008 in that time MFs NAV will be crashed but as this plan says your investment can be withdraw at the rate of highest nav touched within that period.

your comments awaited.

Very nice….

Sweet, Short & Clear…

Keep it man….would love to see more from you

thanks prashant.

btw, here’s my own little cheat sheet about personal finance management http://sandeshgoel.blogspot.com/2010/10/finan.html

Thanks for sharing, I esp. liked the point about online term insurance – I hadn’t thought about that and what you say about cutting middle man makes sense.

Apologize for leaving a comment here instead of your own blog but your blog currently doesn’t allow leaving a comment with just a name and email and I couldn’t remember any of the other ids given there 🙂

thanks for letting me know about the limitation of leaving comments on my blog, i have fixed that. as you can guess, i am new to blogging 🙂

Thanks for sharing the link. Manish has done a good job of explaining the nuances.

I see a lot of blogs on Blogger that don’t allow that capability so you’re not alone 🙂

Very interesting and quite similar to my own experience of learning to invest on my own. I also started with a ULIP policy and eventually settled to a combination of diversified MFs, gold, MIPs and term insurance.

However, I’m not sure if “highest NAV plans” are such a good bet. My understanding of the highest NAV plans is that the only way this can be delivered is by a very conservative investment approach, and is not at all good for wealth creation. For long term investing, equity MFs is the way to go (balanced of MIP funds if you are conservative). I would like to know if I am mistaken here. Have you compared the returns of such a policy with other simple MF plans?

Also as you said, insurance plans with return of premium are quite useless, you will easily get better returns by buying term insurance and investing the rest in a fixed deposit.

I am a bit skeptical about guaranteed NAV return things too because they just sound a bit too good to be true.

My initial thoughts were that they will have a conservative approach or there is some kind of a loophole that is not apparent to many, but I haven’t so far found anything along those lines. I didn’t pursue the research a lot either, but I think we will only get a good handle on them when some of these actually mature and we get some historical perspective. Personally, I am staying away from them for the time being.

Here’s a very comprehensive and accurate analysis of highest NAV plans http://www.jagoinvestor.com/2010/03/how-do-highest-nav-guarantee-plans-work.html

The point to note is that ideally the return provided by these plans should be somewhere between a pure debt and a pure equity plan, but if you factor in the ULIP costs, you could end up even below a pure debt return. If you are even a little savvy, you can manage this yourself based on your goals and risk appetite without paying the huge ULIP costs.

tks sandesh for the link, yes i understand the post & accept it very well at the time of investing in Highest NAV.

With ref to to the linked article, what i have taken into consideration is as follows;

1) i am commited to this investment for 10yrs to get the highest nav orelse if i feel at some time that market is now at 35000 & its enough for me i can withdraw at that time after 3yrs lockin

2) i get extra insurance, yes with mortality charges

3) we get our fund value as per the highest nav touched once a day multipled by our units. watever the sensex level at the time of withdrawl.

Here he forget to add most imp thing reg. differences in highest nav plans. Most imp to note that birla platinum plans capture each sensex days for its highest nav whereas others captures only 2 working days or 4 days which reduces the scope.

await ur comments.

Thanks Miteysh for sharing your story. I esp. like the point about investing in stocks as if you were going into business in that industry.

I have a similar idea of exploring companies whose products I love, and it is certainly easier to invest in such companies when you know they have a product that is of good quality.

yes. if u think very practically, it will keep your view & confidence level intact regardless to tv shows & market fears.

A very simple eg, if you have our own shop of X prdt, which is very good selling regualr item. Someday due to slowdown your X prdt is av’ble at discounted price or promotion from manufacturer … i ask you what you will do ?

a) you will sell all the X prdt is your shop at whatever price u get, becoz market is slowdown

OR

b) you will stock more by getting at discounted price

Ask yourself & you will get the answer

That’s a good point though one of the things that happens during market crashes is that we lose our better judgment and sell things out of panic at crazy distressed prices.

It is easy for me to be objective today when things are going okay, but once the panic sets in all logic goes out of the window and fear takes control. I think investing in good companies with good solid products helps a person deal with the panic type situation better.

Agree with Manshu here…

Panic does creep in when the tides turn…One can still manage to take risks when they are younger n with relatively lesser responsibilities…

What i feel is…that having patience… and faith will help in the long run.. when things go on the wrong side..just stay put… and forget all the money invested for the time being… It will surely fetch returns in the long run..

The logic or the fundamental thought being that our economy as a whole still has a long way to go… so we can still manage to take risks irrespective of the minor or temporary setbacks.

Supriya, i understands here that u r able to take risk at youger age, so what if i say give me 50,000rs, may be i give you 100,000 but not sure if i can return. WILL YOU GIVE ME ?

Dont worry Supriya; its just a case. I mean to say when investment is done purely goal based than you have rare chance to get panic or look around the other situations.

eg, if u need money in 6months you should only keep in dept not in equities but if u keep that money in equity for reap more than ofcourse everyday you need to check the status of your money.

same way, if u invest 100,000 for your 2nd homes after retirement which may be 25yrs far than you no need to be panic again.

in both the abv case nobody will get worried abt his invesment in temporary bad times, but he will ofcourse if he has not invested in right place as per his goal.

comments welcome.