Power Finance Corporation (PFC) is the second company after IFCI to come out with their 80CCF infrastructure bonds.

These bonds help you get tax benefit over and above the Rs. 1,00,000 that you get by investing in Section 80C tax instruments.

The face value of each bond is Rs. 5,000 and PFC will come out with an issue size of Rs. 200 crores or Rs. 2 billion.

These bonds are secured, and rated AAA/Stable from CRISIL and AAA with stable outlook by ICRA.

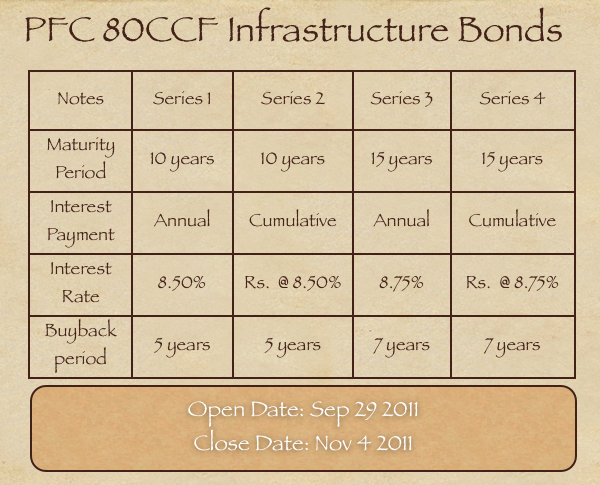

The bonds will be available in both Demat and physical form, and these are the other terms of the PFC infrastructure bonds.

Terms of the PFC 80CCF Infrastructure Bonds

It’s a good thing that PFC infrastructure bonds have opened up so much ahead of time because it gives people enough time to subscribe to them and get the tax proofs well ahead of March 31st.

PFC is a good company, and the interest rates among these 80CCF bonds aren’t going to vary much as they are capped at the 10 year government bond yields, so I think people who are looking to invest in these bonds can give PFC a serious thought.

Last year, there were some news reports that LIC was going to offer these bonds with along with free life insurance and circumvent the cap on yields, but that never materialized.

I don’t know if any other company will try to pull something similar this year or not, but with just an investment of Rs. 20,000 in these – it will not make a lot of difference in absolute terms.

I hold 4 Bonds of Rs.5000/ value each. The same are due for encashment on 31-03-2016. Inspite of letters to Delhi and Hyderabad offices, no response so far.

Please check your application form to make sure that you had opted buyback option and Apply for redemption (Buy Back) again. BuyBack will will open in July 2016

Please check with Karvy.

Dear Sir I have dispatched through registered AD 0n 5/3/2016 original certificate and other documents for buy back but till date no payment is received. details are as under series 2 27984 ISIN INE134E07083 Regd Folio No. PFA0208261 Certificate no. 208261 Distinctive Nos 0000032654~00000032657 Kindly intimate the latest status regarding remittance of amount in the notified Bank

Bonds in Demat forms have been bought back and investors got their money back.

Maybe paper bond will take some time.

Why are we going for buyback option? These bonds are paying good interest.

May be bond holder needs money for child education or for some medical emergencies.

I have purchased PFC bonds on 31.03.2011. When I have to apply for buyback ???

Dear Munendra,

Buyback window is closed now for PFC bond.

It will open again in July 2016 time.

Please check with Karvy or PFC.

Regards,

Servesh

PFC Contacts for Grievances on Infrastructure/ Tax-free Bonds

E-mail : narendra_kumar@pfcindia.com

govind_ram@pfcindia.com

Phone : PABX : 011-23456000 Extn : 200/275

Direct : 011-23456200/275

Redemption amt.of Pfc bonds not received so far.

Regd.folio no. PFA0208029

Diet.nos. 31735 to 31738

PAWAN KUMAR ARORA

Mob.no.09968300108

Dear sir, 07.04.2016

I am holding PFC bond of principal amt. of Rs.20000 having Folio & Warrant No. PFA0245915 & 951632 respectively.The redempted cheque has been accounted to my closed bank account.What can I do to revalidate the cheque to my desired bank account?

Kindly reply through E-mail.

Banshidhar Biswas

Dear sir,

I am holding power finance corporation ltd bond for Rs5000 x 4. Bonds are held in demant account of icici bank dp id in 302679-33713148

from 31 March 2011.

Now the bond matured on 31032016. For getting back my principle amount with interest where I have to claim for payment ,these details I want to know

Kindly guide me through the e mail thank you sir

Dear sir,

I am holding power finance corporation ltd bond for Rs5000 x 4

from certificate no.116157 and distinctive no. from 63828 to 63831 from 31 March 2011.

Now the bond matured on 31032016. For getting back my principle amount where I have to send the bond or I need not sent ,these details I want to know

Kindly guide me through the e mail thank you sir

I bought power finance corporation ltd bond for rs.5000×4 units ie for rs.20000 during the year 31 st march 2011. Now the period ends on 31032016, 5 years. Where i have to send the bond or not to send the bond so that i can get back my principle amount. Kindly guide me

Sir,

With ref to your redembtion of pfc infrastructure bond 1 series certificate no 134656, I wish to inform you that due to Postal non delivery of original certificate and the redembtion form sent on 25.07.2015 karvy consultant couldn’t receive the same. Once again I sent the indemnity bond alongwith redemption forms duly filled alongwith cancelled cheque leave and form no.15H. I got the duplicate Bond certificate on 14.01.2016. Now I want only redembtion of the Bond. How I can sent the same same for March,2016 redembtion . Kindly clarify and give proper instructions to M/s.Karvy Consultants under intimation to me.

Muthusubramanian

8056272972

Please tell me the procedure for redemption of 80ccf IIFC bonds…

i lost my bonds certificate 2011-2012 issue. i donot have any record only application no 44912205

kindly let me to whom i will contact for getting duplicate certificate

tkpaul

durgapur

Dear Sir,

I had applied for Infra bond in March 2011 for Rs.20000/- vide application no.2679823 but till date i have not get my Bond copy. Pl advice.

I think you should contact them on the address mentioned on this page:

http://www.pfcindia.com/Content/Bondholders.aspx

yes

PFC 80CCF tax saving bonds cant trade as there is a lock-in period of 5 years. PFC Tax-Free Bonds’ live price can be accessed from this link:

http://www.bseindia.com/bseplus/StockReach/StockQuote/Equity/830PFC2027/830PFC2027/961730/COMPANY

sir can you inform me from where i can get live price of pfc bonds and and advice me if it is right time to buy

Hi jiger… you want the price of which PFC bonds – PFC Tax-Free Bonds or 80CCF Tax Saving Bonds ??

When will PFC pay interest for the investments into bonds for FY 2010-11 ?

31March was the exact date of payments.

Regards,

S Singh

i had subscribed to your Infrastructure Bonds Series 1 on 15.03.2005. i would like to know the status of the same and when can i encash it. what is the procedure to encash it. at present i am re3asiding in baroda.

please guide.

neelam

Whether PFC has paid interest for the investments into bonds for FY 2010-11? I have not received any payment. And I could not get any details online & whom to contact to know the date of interest payment.

Please guide.

Even I am struggling to find out more about the interest payment. There is no information available online that I could find. I haven’t even received the allotment letter/advice either.

As per my understanding, the interest would be paid annually on the anniversary of the deemed date of allotment, which I think is 23rd November 2011 (the date on which the bonds were credited to my demat account) for this particular tranche.

So I am expecting the interest to be credited to my bank account by the end of this month. If anyone has more info, please add.

Thanks and regards,

Bhavin.

Hi Bhavin… Please check this link –

http://www.onemint.com/2012/10/23/interest-payment-dates-of-infrastructure-bonds-issued-in-2011-12/

Thanks Shiv. I had read that post last month, but I was a bit unsure which PFC was mine since PFC was mentioned twice. (I assumed PFS was a typo and you meant PFC.) (And I should have mentioned this link in my above comment!)

What confounds me is why does the PFC website not have any information?!! I had also bought into PFC’s 2010 bonds and they sent me a very helpful allotment letter/advice then, so there is no confusion there… but no such letter for the Nov 2011 tranche. I didn’t bother contacting them for the letter since my demat account showed all the bonds duly present, so I thought let’s wait and watch. 🙂

Cheers,

Bhavin.

You can get the allotment advice for your PFC Infra Bonds from this link –

http://karisma.karvy.com/investor/jsp/IDFC-APP.jsp

Last year’s PFC Infra Bonds are “Power Finance Corporation Ltd-Infra Bonds Tranche 1-2011”.

Thanks Shiv, this is really helpful. 🙂

Cheers,

Bhavin

Great… Cheers !! 🙂

Got PFC physical bond certificate last week…:)

That’s excellent – thanks for leaving a comment and letting everyone know here.

Me too received sms from NSDL today regarding bond allotment.. I had applied for three bonds and got the same..

Just in– NSDL sms about PFC allotment in my demat account.

Checking the PFC site, I found list of bondholders of previous issues– fyi.

That’s great to know – thanks a lot Austere!

Dear Manshu,

Thank you so much for providing such valuable info on you website.

I have few questions….would be great if you help-

1. If I take any bond like PFC (which sharekhan was not offering on their website though they are offering IFCI infra bond online) by filling up the physical form and provide demat a/c no in tyhe form …then will it get credited to my demat a/c automatically on allotment of the bonds??

2. When PFC infra bonds are getting alloted??

3. IDFC is giving 9% rate of interest….should I wait till Mar-12 to get other infra bonds having higher rate of interest??? If so …then when it is expected ???

Regards

Subi

Dear Subi,

1. Yes, it will be credited to your Demat account.

2. Austere just left a note about that so I think you might have seen that about getting the allotment done today.

3. I don’t think the issues to come will have a much higher rate of interest maybe 0.25% – 0.50% higher and on 20k – that’s not much. I’ve seen that several people wait till very end and then find it difficult to get tax proofs and struggle with it. Ultimately it’s your decision if you want to wait or not but be cognizant of this factor.

Thanks.

Thanks a lot Manshu….. And yes I got the SMS from NSDL just after posting my query….

Regards

Subi

That’s great! I appreciate your follow up comment.