National Highway Authority of India (NHAI) is usually known for issuing Section 54EC bonds, but for the first time they are issuing tax free bonds as well.

Now, a lot of people confuse tax savings or no TDS with tax free, but these are truly tax free bonds, which means that the interest from these bonds is tax exempt – you don’t have to pay any tax on the interest regardless of your income tax bracket.

The bonds will list on the BSE and NSE, and if you sell them on the exchange and make capital gains on them, then that will be taxable. Listing of the bonds doesn’t however mean that the bonds will be issued in dematerialized form only and you will compulsorily need a demat account.

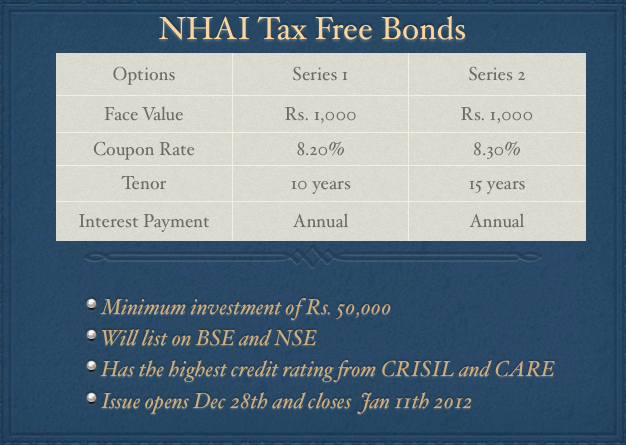

NHAI bonds will be issued in both physical and demat form, so people who don’t have demat accounts can also buy these bonds. There are two series of bonds – one with a ten year maturity, and the other with a 15 year maturity. The first series has an interest rate of 8.20% and the second series has an interest rate of 8.30%, both the series will pay interest annually.

Since some of the best bank interest rates are at 10% right now – you can see that for people in the 30% or 20% tax bracket – this issue has got great yield.

NHAI tax free bonds have been rated CRISIL AAA/Stable, CARE AAA, and Fitch AAA by CRISIL, CARE and Fitch respectively. These are very high ratings, and although NHAI has made losses in the last three years – it’s easy to see how these credit agencies assigned these bonds the highest rating.

This is a secured issue from a company that comes under the Government of India, and as such it’s hard to see how NHAI could default on its debt obligation.

I think this is a good issue especially for people in the 30% tax bracket, and won’t be surprised if it gets over subscribed in the first few days itself. This is especially so because interest rates can’t remain this high forever and this issue allows you to lock on to these high rates for 10 or 15 years, which is quite a good return for a safe debt instrument. And even NRIs can invest in these bonds, so to the extent they can manage the application process, this will be an attractive offer for them as well.

SBI Capital Markets, AK Capital Services, MCS Limited, ICICI Securities and Kotak Mahindra Capital are the lead managers to the issue so you should find the application forms in their offices. Other investment firms like Karvy should also have the application forms, and I think some of these companies will also enable it so that you can apply for the NHAI tax free bonds online, but I don’t have a definite list yet.

I’m sure as more information comes in – you will leave comments and I’ll update the post with where exactly you can find the application forms etc. at the time.

Meanwhile, many thanks to Rakesh Jain who let me know about this issue much in advance, and let’s hear any other questions or observations you have about the NHAI issue in the comments.

Application Form of NHAI Tax Free Bonds

Update: Deleted the part about allotment being on a first come first serve basis per Shiv’s comment below.

plaese print a format of application form of capital gains saving tax vizz;N H A I,R E C, etc etc

Hi All NHAI Bond Investors… NHAI N2 Bonds list at Rs. 1035, touched a high of 1041.40 & a low of Rs. 1032… Trading at Rs. 1040.10

http://www.edelweiss.in/Debt/DebtSnapshot.aspx?cn=NHAI-N2

Hi… Here is the Web Link to check NHAI Bonds Allotment Status:

http://www.mcsdel.com/index001.asp

If I purchase bonds on listing, can I get interest free tax exemption?

Also received deposit of money for the interest earned during the time of application to allotment.

dr b g zope

Received allotment SMS from NSDL now.

Full allotment since retail category.

As per DNA Money Life NHAI bonds to be listed next week Quoting from it:

On the allotment of the bonds to the various categories of investors, the official said, “Investors who have applied for `5 lakh and less in the retail category will get full allotment, while the high net worth individuals (HNI) category will get 62% of the applied amount. In the ‘others’ category, the subscribers will be allotted 35-40% of the total application.â€

The break-up of the Rs10,000 crore corpus was `3,000 each in the retail and HNI, and the remaining `4,000 crore for qualified institutional buyers.

The authority had got 60% subscription in retail while the HNI and other category was oversubscribed by two times and four times, respectively. “It is the 40% of the retail category that was transferred to the HNI bracket, which resulted in expanding the basket,†the official added.

Cash refunds to the subscribers who have not been allotted the bonds, will start on Friday. A total of`15,200 crore has to be refunded by the authority. Owing to its high tax-free interest rates, the authority got applications worth `25,200 crore for the bonds.

Hi Shiv,

any news of allotement date of nhai tax frree bonds

Hi

NHAI Tax-Free Bonds will get alloted and listed by next weekend i.e. first week of February. Retail portion got subscribed 60% of the reserved Rs. 3,000 Crores and hence, will see full allotment.

Here is the source of the info:

http://www.dnaindia.com/money/report_nhai-bonds-to-be-listed-next-week_1642196

Dear Shiv,

Do you have similar information/statistics on PFC Tax Free bonds?

Not yet Amlan, will surely share once I get it. But you can expect PFC Bonds to list around 2nd week of February.

Dear Shiv,

Any information about allotment date and listing date ? Is it advisable to sell these bonds and invest the proceeds in Railway bond issue for LISTING GAIN ?

Thanks

Hi TCB

No info yet on the allotment date & listing date of NHAI bonds. I think listing should happen somewhere around February 1st and allotment at least a couple of days prior to that.

Personally, I would stay invested in NHAI bonds as they offer better rate of interest and liquidity than IRFC and also listing gains would be capped in IRFC as compared to NHAI as the investors will get a lower rate of interest in case they buy it from the secondary markets.

What is the allotment status , or, where can I find the allotment status for this issue ?

When is HUDCO Tax Free Bonds being launched ?????

January 27th, 2012.

I too am waiting for the allotment status. Will update as and when I have the sms from NSDL.

can anyone tell me allotement status link for nhai tax free bonds . thanks

Hi,

Do you know when the NHAI Tax Free Bonds allotment will begin?

Has it already started? When do you expect any communication?

PFC – Tax Free Bond Issue still open. You can apply…

Thanks

Nikhil Shah

the allotment is firm for retaill allottees with only 1500 crore coming n rest going to HNI category

GMP is grapewine from diff sources.

The GMP has shot up to Rs 12/- in Gujarat.

This coupled with 1 % incentive,interest & capital gain of at least 25-30 rs on listing means a solid gain of 15-20000/rs on listing.Views invited

Dear Saharanpuri,

From where can I get information about GMP ? Is there any website giving this information ?

Do you know how many times NHAI bond issue was over-subscribed in retail ?

Thanks

All,

I would like to add that as these bonds will be listed in nse /bse we will also see ay appreciation in the value of the bonds assuming that interest rates will also come down from curnet levels in near future.

so Nhai bonds are also good to invest your money,both for interest and capital appreciation.