This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

“Insurance sirf ek rupay mein – Aisa Kaise?” The boy asks his father and the father’s response makes his daughter emotional. You must have watched this commercial on your TV sets many a times this week as the government has launched its Jan Suraksha initiative very aggessively.

Prime Minister Mr. Narendra Modi is in Kolkata today and will be launching Pradhan Mantri Suraksha Bima Yojana (PMSBY), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Atal Pension Yojana (APY) from there. These schemes are targeted to provide social security benefits to a large percentage of the low income earning population in India.

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

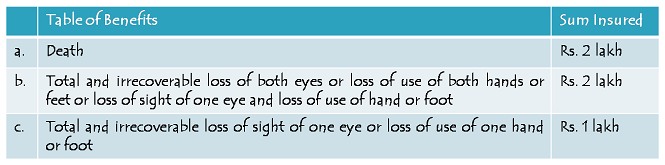

Policy Coverage – The scheme offers to provide you or your family a cover of up to Rs. 2 lacs in case of any mishappening, resulting into death or disability of the insured. In case of death or full disability, you or your family will get Rs. 2 lacs and in case of partial disability, you will get Rs. 1 lac. Full disability means loss of both eyes or both legs or both hands, whereas partial disability means loss of one eye or one leg or one hand.

Age of the Insured – Savings bank account holders aged between 18 years and 70 years are eligible to apply for this scheme. People aged more than 70 years will not be able to get the benefits of this scheme.

Premium Amount – It costs you just Rs. 12 in annual premium for having an accidental death or disability cover of Rs. 2 lacs under this scheme. It works out to be just Re. 1 a month, which is extraordinarily low. Again, your age has nothing to do with the premium payable for your insurance cover under this scheme as the premium is fixed at Rs. 12 for a cover of Rs. 2 lacs.

Period of Insurance – You will remain insured for a period of one year from June 1, 2015 to May 31, 2016. Next year onwards as well, the risk cover period will remain to be June 1 to May 31.

Administrators for PMSBY – The scheme would be offered / administered by many of the general insurance companies, both in the public sector as well as in the private sector. Participating banks will be free to engage any such general insurance company for implementing the scheme for their subscribers. National Insurance Company Limited, Oriental Insurance Company Limited and ICICI Lombard are some of the companies which would be offering this scheme.

Auto Debit Facility – You will be required to provide your consent for auto debit of Rs. 12 as the annual premium from any one of your bank accounts at the time of enrolling for this scheme. This premium of Rs. 12 will get deducted from your savings bank account through auto debit facility every year between May 25 and June 1.

Last Date for Enrolment – May 31, 2015 is the last date for getting enrolled for this scheme, but the government has given an extension of three months up to August 31, 2015 for us to get enrolled and give auto-debit consent for this scheme. This enrolment period may be extended by the government for another period of three months, up to November 30, 2015.

Those joining this scheme subsequent to May 31, 2015 will have to pay the full year’s premium of Rs. 12 and agree to specified terms of this scheme.

Toll-Free Numbers – 1800 110 001 / 1800 180 1111 – These two are the National Toll-Free Numbers for this scheme. You can check the state-wise toll-free numbers from this link – State-Wise Toll Free Numbers

Service Tax Exempt – Yes, Finance Minister Mr. Arun Jaitley has proposed to exempt this scheme from service tax. So, you will not be charged any service tax on the premium payable.

Know Your Customer (KYC) – Aadhaar Card issued by the UIDAI will be the primary requirement for your KYC under this scheme.

Application Form – Here you have the link to the application form for you to enroll yourself for this scheme – Application Form for PMSBY

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Age of the Insured – Bank account holders aged between 18 and 50 years are eligible to apply for this scheme. So, if you are aged more than 50 years, you are not eligible to enroll yourself for this scheme. But, once enrolled, you can continue with this scheme till you attain the age of 55 years.

Premium Amount – Less than Re. 1 a day or an annual premium of Rs. 330 is what you need to pay to get a life cover of Rs. 2 lacs. No matter what your age is, the premium is fixed at Rs. 330 for a life cover of Rs. 2 lacs. This annual premium of Rs. 330 has been fixed for the first three years from June 1, 2015 to May 31, 2018, after which it will again be reviewed based on the insurers’ annual claims experience.

Period of Insurance – June 1st, 2015 to May 31st, 2016 is the period for which this scheme will cover all kind of risks to your life in the first year of operation. Next year onwards as well, the risk cover period will remain June 1 to May 31.

LIC as the Administrator – The scheme would be offered / administered by the Life Insurance Corporation (LIC) and other life insurance companies like SBI, ICICI etc. through their tie ups with the interested banks like SBI, ICICI, Canara Bank etc. Participating banks are free to engage any such life insurance company for implementing this scheme for their subscribers.

Auto Debit Facility – Annual premium of Rs. 330 will get deducted from your savings bank account through auto debit facility. You will have to give your consent for auto debit of premium from any one of your bank accounts at the time of enrolling for this scheme.

Last Date for Enrolment – May 31, 2015 is the last date for getting enrolled for this scheme, but the government has given an extension of three months up to August 31, 2015 for us to get enrolled and give auto-debit consent for this scheme. This enrolment period may be extended by the government for another period of three months, up to November 30, 2015.

Those joining this scheme subsequent to May 31, 2015 will have to pay the full year’s premium of Rs. 330 and submit a self-certificate of good health in the prescribed proforma.

Toll-Free Numbers – 1800 110 001 / 1800 180 1111 – These two are the National Toll-Free Numbers for this scheme. You can check the state-wise toll-free numbers from this link – State-Wise Toll Free Numbers

Service Tax Exempt – Finance Minister Mr. Arun Jaitley has proposed to exempt this scheme from service tax. So, you will not be charged any service tax on the premium payable.

Know Your Customer (KYC) – Aadhaar Card issued by the UIDAI will be the primary requirement for your KYC under this scheme.

Application Form – Here you have the link to the application form for you to enroll yourself for this scheme – Application Form for PMJJBY

I covered Pradhan Mantri Jeevan Jyoti Bima Yojana yesterday, a scheme which provides life insurance cover of Rs. 2 lacs to its subscribers for an annual premium of only Rs. 330. I think both these schemes are quite attractive and provide a combined cover of Rs. 4 lacs for a premium of just Rs. 342, which works out to be less than Re. 1 a day.

In a country like India, where many members of a family are dependent on the primary earner’s income to survive and grow, I think these schemes would play a very important role in providing a much required social security comfort to the citizens of India. I think the government is doing a wonderful job in taking these initiatives to attract low income group people to get themselves covered against the risks of untimely death or accidental disabilities. I think you should definitely subscribe to both these schemes.

Dear Sir,

If person availed other accidental and life insurance, is he eligible for PMSBY and PMJJBY? Because bank authorities says if you are already insured you can not avail the said schemes.

As it is government subsidized scheme, is there any problem while claim settlement, as we possess other company’s insurance?

Hi Siddharth,

Bank authorities are misleading you. You can have other policies and still subscribe to these schemes. Moreover, I can’t predict whether there would be any problem with claim settlement or not.

Dear Sir,

Is there any limit to the premiums paid?. What to do if we want more coverage? Say 20,00,000 ?

Hi Jimmy,

You cannot have more than one policy under PMSBY. You need to buy insurance from other insurance companies in order to have a higher coverage.

If a person has give pmjjby pmsby application form along with debit mandate in may. Bank has give acknowledge ment slip of both to customer. But bank has debit only 12 rupee for pmsby in June and not debit 330 even lot of balance in account. Later customer is died of cancer now how can nominee claim because bank saying there is no debit for pmjjby. But he has acknowledge slip it is bank fault why nominee suffer. Please reply in my mail also most urgent sir

Hi Sandeep,

Firstly, you need to check the reason behind non-debit of premium. If it is bank’s mistake, then you can make an appeal in the banking ombudsman or even take the bank to the court of law.

Can Bank deduct premium without consent of account holder. Can bank deduct premium even if the customer has not applied by filling form / online / sms /phone.

What can be done if Bank has forcefully deducted the premium.

Hi Amit,

You can make a complaint to the nodal officer of the bank or approach the Banking Ombudsman – https://rbi.org.in/scripts/FAQView.aspx?Id=24

Hi Shiv Kukreja Sir,

Thanks for the reply and your reply would be very useful for me and many like me.

You are most welcome Amit!

Sir will you please tell me which company providing insuranace schemes to PMJY?

Hi Amol,

Please check this link – http://www.onemint.com/2015/05/12/participating-banks-insurance-companies-servicing-pradhan-mantri-jeevan-jyoti-bima-yojana-pmjjby-pradhan-mantri-suraksha-bima-yojana-pmsby/

Hi sir,im a govt employee.I have already existing in New Pension System.can i eligible for PMSBY,PMJJBY&APY?

Hi Sankar,

Every Indian Citizen is eligible for these schemes. So, if your age is within the limits, you are also eligible for all these schemes. However, being an NPS subscriber, you will not get the government co-contribution of up to Rs. 1,000 per annum.

And cn i got any recipt of balnce deduction

frm my account evry year….

Debit entry in your passbook is the proof of your insurance payment.

Sir ,

the pm’s

Scheme of rs 12/year

exidental insurance.

And 330 sss

Jivan jyoti bimas

samples of filled formare avlbl here.. cn yu pls snd me by mail

And

aftr filleng these

Cn bank gv me any certificate or document relted this… …

Hi Devender,

Application forms of these schemes carry acknowledgement slip cum certificate of insurance. Banks will provide you the acknowledgement duly stamped.

Is there any return after maturity for PMJJBY in case no event of subscriber death?

What if one get a government job after taking ATAL PENSION YOJANA?

No Rajib, there is no return after maturity in PMJJBY. As you get a government job, the government will stop making its co-contributions.

Already I’m having LIC policies. Suppose if i take these policies, will i get benefits from both the sources? kindly clarify.

Yes Madhubabu, you will get benefits from both the sources.

What is the difference between 12 rs per year & 330 per year scheme

Rs. 12 per year scheme is PMSBY, which is an accidental death & disability scheme. Rs. 330 per year scheme is PMJJBY, which is a life insurance scheme & covers death due to any reason.

I have also registered for PMSBY & PMJJBY both. The amount has been deducted from my account immediately.

Now how can I get my receipts & original Policy documents against both the security schemes.

I must have proof of having these schemes other than the bank account statement showing the debited amount against these schemes.

Please help immediately!

Hi Sanjib,

Banks are not issuing/providing any kind of receipt or certificate for online subscription. Premium payment itself is the proof of subscription.

i want to use this service

Hi

i open my policy with Kotak Mahindra Bank

but my queary is What is the policy number how get it to me.

send info in mai.

Hi Kiran,

It is a master policy in which each account holder, who subscribes to this scheme, is a beneficiary. You need to check the master policy no. with your bank.

Good morning.As an employer of small business, can I pay for these policies for my staff? If then, what is the procedure please? Thanks.

Hi Tanny,

Each of your staff needs to have a savings bank account and this schemes needs to be linked to that account. You can provide the cash benefit to your staff for the premium paid.

thank you for your reply

You are welcome Tanny!

I m in army and I want to know that are we ppl from army can also apply for both these schemes. If yes Pl guide us. How to go about it. Thanks and regards. Also Pl tell me the basic difference in both the scheme.

Yes Amit, army personnel are also eligible for these schemes. You can visit any of your bank branches and apply for these schemes. PMJJBY is a term insurance plan with Rs. 2 lakh life cover for a premium of Rs. 330, while PMSBY is an accidental disability & death insurance scheme of Rs. 2 lakh for a premium of Rs. 12.

hii

i want to apply these both schemes.through sbi net banking,

so can u tell that process

Hi Karthik,

Just log in to your net banking portal. Go to My Accounts > Account Summary > Social Security Schemes and apply for these schemes.

Can a person who have insurance policy holder other than PMSBY or PMJJBY is eligible for PMSBY & PMJJBY cause there is no statement in rules or terms and conditions of the schene

Yes Abhay, an already insured person is eligible for these schemes.

what is the last date of above scheme. Can we still join the above scheme.

August 31, 2015 is the last date for this scheme for the current insurance period.

hi,

I had registered for Both beema & accident insurance & got debit of 342.00. On 2nd of this month I met with road accident with 100 % fractured leg bone then treated with implanted rod

, I want to get clarified weather I get 1 lakh compensate on this?

Hi Prasad,

You need to confirm it with the insurance company or the bank whether 100% fractured leg bone with implanted rod is covered under loss of one limb or not.