This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

The initial public offer (IPO) of India’s second largest asset management company, HDFC Asset Management Company Ltd (HDFC AMC), is getting opened for subscription from today, July 25. HDFC AMC is the 56.97% subsidiary of HDFC Limited, while HDFC’s JV partner Standard Life owns around 37.98% in the company. This IPO is a 100% offer for sale (OFS) of around 2.55 crore equity shares by these promoters.

The company has fixed its price band in the range of Rs. 1,095-1,100 a share and no discount has been offered to the retail investors. The offer would constitute 12.01% of the company’s post-offer paid-up equity share capital. The issue will remain open for the next three days to close on July 27.

Here are some of the salient features of this issue:

Size of the Issue – This IPO is a 100% offer for sale (OFS) of 2,54,57,555 shares by the JV partners, HDFC Limited and Standard Life. This makes it a Rs. 2,800 crore IPO at the upper end of the price band i.e. Rs. 1,100. HDFC Limited and Standard Life are selling 85,92,970 and 1,68,64,585 of their shares respectively in this IPO. Post this IPO, HDFC will hold 52.92% stake and Standard Life will have 30.03% stake in the company.

Price Band – HDFC AMC has fixed its IPO price band to be between Rs. 1,095-1,100 a share and the company has decided not to offer any discount to the retail investors.

Retail Allocation – 35% of the issue has been reserved for the retail individual investors (RIIs), 15% for the non-institutional investors (NIIs) and the remaining 50% shares will be allocated to the qualified institutional buyers (QIBs).

No discount for Retail Investors or Employees – The company has decided not to offer any discount to any of its investors or to its employees either.

Bid Lot Size & Minimum Investment – Investors need to bid for a minimum of 13 shares in this offer and in multiples of 13 shares thereafter. So, a retail investor would be required to invest a minimum of Rs. 14,300 at the upper end of the price band and Rs. 14,235 at the lower end of the price band.

Maximum Investment – Individual investors investing up to Rs. 2 lakh are categorised as retail individual investors (RIIs). As a retail investor, you can apply for a maximum of 13 lots of 13 shares each @ Rs. 1,100 a share i.e. a maximum investment of Rs. 1,85,900. At Rs. 1,095 per share, you can apply for a maximum of 14 lots of 13 shares, thus making it Rs. 1,99,290.

Listing – The shares of the company will get listed on both the stock exchanges i.e. National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) within 6 working days after the issue gets closed on July 27. Thus, these shares are expected to get listed on the stock exchanges by August 6.

Here are some other important dates as the issue gets closed on July 27:

Finalisation of Basis of Allotment – On or about August 1, 2018

Initiation of Refunds – On or about August 2, 2018

Credit of equity shares to investors’ demat accounts – On or about August 3, 2018

Commencement of Trading on the NSE/BSE – On or about August 6, 2018

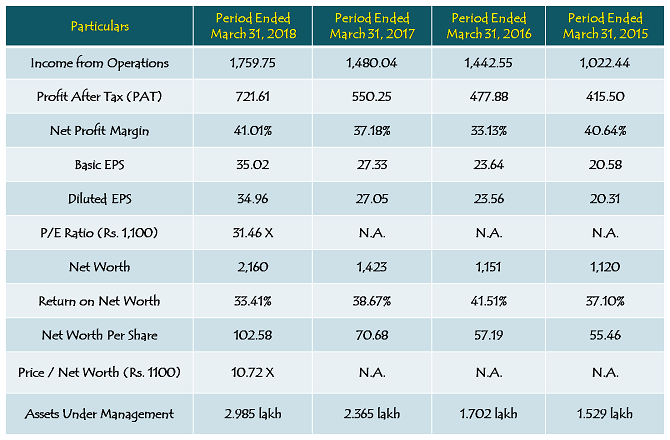

Financials of HDFC AMC

(Note: Figures are in Rs. Crore, except per share data & percentage figures)

Should you invest in HDFC AMC IPO or Not @ Rs. 1,100?

I will update this post soon with HDFC AMC IPO Review.

Thanks for sharing this useful information with us. I really like to read your blog.

Do you make mistake while investing in mutual funds? then get the right advice at Nivesh.com

very good and informatics. thank u.

Thanks Arup!

please keep me in your mailing list and notify me on the HDFC IPO

Hi Vivek,

Please subscribe to our free newsletters – https://feedburner.google.com/fb/a/mailverify?uri=onemint%2Ffeed