India ETF Listed in US: Which one did best?

This post is about ETFs listed in the US that allows American investors to invest in India. There are currently 7 such India ETFs, and the biggest among them is Wisdom Tree’s India Earnings Fund (EPI), which is over 3 years old and has assets worth about $1.5 billion.

Powershares India Portfolio (PIN) is the second largest with over half a billion worth of assets under management.

You can take a look at all the seven India ETFs and see how they performed in 2010 in the table below.

| Fund Name | Inception Date | Expense Ratio | 2010 Returns | Dividends last year |

| Wisdom Tree India Earnings Fund (EPI) | 2/22/2008 | 0.88% | 19.51% | 15 cents |

| Powershares India Portfolio (PIN) | 03/05/2008 | 0.78% | 14.94% | 24 cents |

| Direxion Daily India Bull 2x Shares INDL | 03/11/2010 | 0.95% | – | 29 cents |

| Direxion Daily India Bear 2x Shares INDZ | 03/11/2010 | 0.95% | – | – |

| iShares S&P India Nifty 50 Index Fund INDY | 11/18/2009 | 0.89% | – | 12 cents |

| Emerging Global Shares Indxx India Small Cap ETF (SCIN) | 07/07/2010 | 0.85% | 24.30% | 2 cents |

| Emerging Global Shares India Infrastructure Index INDxx | 08/11/2010 | 0.85% | – | – |

(1 Year returns and dividend data taken from Google Finance)

The Direxion ETFs are leveraged ETFs that aim to give you double the daily returns of their index, and by their very nature are not suited for long term investing.

The Emerging Global Shares ETFs focus on small cap and infrastructure in the Indian space, and are only suitable if you want to bet on these specific areas of the market.

That leaves us with three funds – EPI, PIN and INDY that an investor can look at if they want to invest in the broader Indian market.

Large overlap among India ETFs

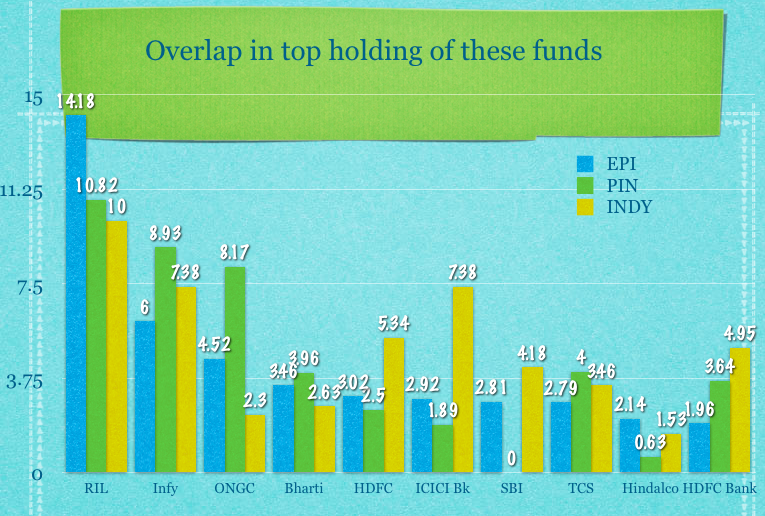

The interesting thing about these funds is though they follow different indices there is a big overlap in terms of their top holdings and the sectors they invest in.

You can see how they share their top holdings from the chart below.

These holdings are as on April 20 2011.

The holdings change for these funds but you can see that they do share a lot of common stocks and though the percentage varies, with the exception of SBI – all three have relatively big stakes in the same company.

Despite, this INDY has done much better than the other funds, but it’s anybody’s guess if it will continue to do so.

INDY’s performance made me look at how it performed against the index it was supposed to track and I was surprised to see the following chart.

As you can see INDY has beaten it’s underlying index by quite a margin!

I think this is because INDY has benefited from USD – INR exchange rate movement in the last year and while their holdings must have lagged Nifty performance by a bit (due to expenses) the currency movement has juiced up their returns and made them do better than their underlying index itself.

Conclusion on the Best India ETF

For most foreign investors – the larger question is probably whether you want to bet on the Indian market or not, but once you’re done making that decision – these 3 funds give you a good exposure and it’s hard to pick one over the other.

Personally, if I had to invest in an India ETF – out of the 7 currently present in this space – I would opt for INDY because it tracks a popular Indian index, comes from a well known fund provider, has low expenses, reasonable volume size, and has done a good job of tracking its index as well.

Disclosure: No investments in any ETF mentioned here.

Excellent summary of the options available, I always recommend INDY if you want exposure to the Indian markets.

Thanks Manish – when I first wrote about them about a couple of years ago there were hardly any options and in my original list I even had an ETF that invested in China and India.

Since then there have been more entrants and I think INDY has been the best of those new entrants.

Manshu, I want to say I have been a longtime fan of your blog, ever since I became aware of you over at Baselinescenario. Your information is solid, and you are one of my top trusted sources on News coming out of Indian markets.

I am wondering, is there a website or blog where I can look and scout for individual Indian companies listed on USA exchanges as ADR??? By that I mean not just an alphabetical list, but a place where I could look for individual companies with good value or growth prospects, with some analysis and numbers provided. Frankly I think I can cherry-pick much better than these fund managers and without the management fees. But I don’t know where to go for the analysis of individual companies and numbers. Could you point me in the right direction please????

Thanks for all the hardwork on the your Mint blog and the solid knowledge you provide. Terrific stuff.

Also, on a LESS important note, there is an Indian Steel company headed by two Indian brothers (who are supposedly good managers) that was purchasing some American steel companies, do you know the name of this company????

Thank you so much Ted!!! I’ve read several comments from you on BaslineScenario and really like what you have to say! Reading your comment here was truly a very pleasant surprise!

I don’t know of a website that has made the effort to focus on Indian ADRs and analyze those companies, so sorry I’m not able to recommend a resource to you specifically with respect to that.

TipBlog.In is a good blog that is on my reader which discusses individual stocks, though I don’t know if he has ever discussed a stock that’s listed in US. That’s the only good resource for individual stocks that I’d recommend.

I can’t think of an Indian company that acquired a US steel company but there were some reports of other acquisitions recently. Reliance has acquired some natural gas assets not long ago, and that’s normally the company associated with two brothers though they have split now.

ArcelorMittal has made quite a few acquisitions though that’s not really an Indian company (headed by an Indian), and I don’t think they ever acquired a US company either. I’m sorry I can’t be of much help for this either.

Thank you so much once again!

Excellent article with in depth analysis. Keep up the good work.

Thanks Melvin.