Bharti Infratel’s IPO is the biggest after Coal India’s IPOÂ back in October 2010, and I think I didn’t do a single IPO review in between these two as there weren’t many good companies that came out with IPOs in that duration.

The price band of the Bharti Infratel IPO has already been decided between Rs. 210 and Rs. 240, and they are offering 10% of the equity (188.9 million shares) which makes this a roughly $825 million or Rs. 4,500 crore IPO.

Bharti Infratel Overview

Bharti Infratel is a subsidiary company of Bharti Airtel and it is the tower infrastructure provider to cellular phone companies. The company builds, operates and runs tower infrastructure for wireless telecom providers. It is going to be the first listed company of this kind as Reliance Infratel which had plans to list earlier this year didn’t go through with its IPO.Â

However that doesn’t mean there aren’t other companies in this business. This is a very competitive market and there are many players in the tower business (though not listed), there are players like BSNL and MTNL who handle their own portfolio, then subsidiaries of companies like Reliance Communications and Tata Teleservices, independent companies like GTL Infrastructure Limited, American Tower Corporation, Aster Telecom Infrastructure Private Limited and Tower Vision India Private Limited.

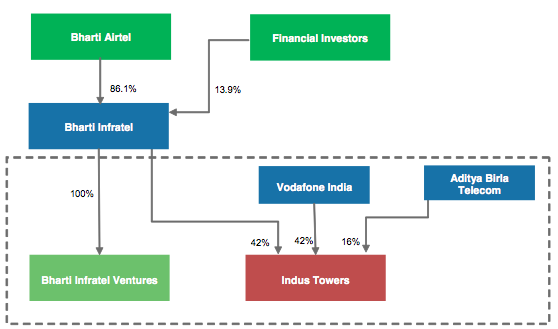

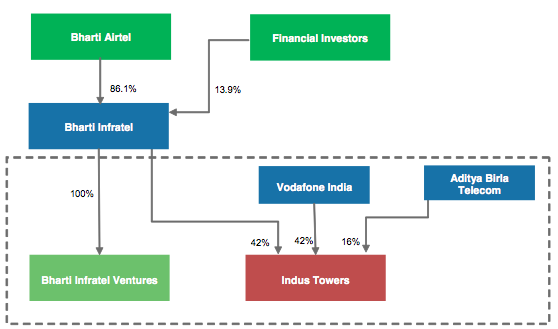

The interesting thing about Bharti Infratel is that although is a subsidiary of Bharti Airtel, it has ownership stake in another tower company called Indus and through that Bharti Infratel provides tower infrastructure service to not only Bharti Airtel, but Vodafone and Idea Cellular as well.

This ownership structure is shown in the chart below that I took from the prospectus.

Bharti Airtel owns the majority stake of 86.1% in Bharti Infratel and Bharti Infratel in turn fully owns Bharti Infratel Ventures that it uses for its business, and then it has a 42% stake in Indus Towers as well.

Indus Towers is a joint venture between Bharti Infratel, Vodafone India and Aditya Birla Telecom and while Bharti and Vodafone own a 42% stake in the company, Aditya Birla Telecom holds a 16% stake.

All of this then begs the question – how much money does Bharti Infratel make from its parent company and how much money does it make from other customers?

In 2012, Bharti Infratel’s consolidated revenues were Rs. 95,970.6 million. Indus revenues were Rs. 121,033.6 million, and Bharti’s Infratel’s 42% stake gives them Rs. 50,834.11 million from that. So, approximately 54% of Bharti Infratel’s revenues come from its stake in Indus. Â The take-away from this is that although the name and the 86% ownership stake of Bharti group may connote that the company depends on its promoter for the bulk of its revenue, that’s not quite the case and it also gets significant revenues from Vodafone and Idea Cellular.

Bharti Infratel Financials

The telecom sector has shown tremendous growth in the last few years, so it is no surprise that Bharti Airtel has also done pretty well in that time period.

Here are Bharti Infratel’s key financials for the last few years (In Rs. Millions):

| Particulars |

Year Ended

March 31st 2012

|

Year Ended

March 31st 2011

|

Year Ended

March 31st 2010

|

Year Ended

March 31st 2009

|

| Total Income |

95,970.6

|

86,257.9

|

71,288.4

|

51,772.7

|

| EBITDA |

36,841.0

|

32,464.9

|

25,085.6

|

16,369.5

|

| Profit After Tax |

7,507.3

|

5,514.8

|

2,529.7

|

1,952.4

|

The company also has a positive operating cash flow and has negligible debt, so it is in a good financial position.The diluted EPS for the 2012 was Rs. 4.29 and that gives you a rather high P/E multiple of 48.9 on the lower range of the IPO price band.

Bharti Infratel Capital Structure

The company currently has 1,742,408,730 shares outstanding and it’s going to issue 146,234,112 new shares during the IPO, the remaining 42,665,888 will be offered by existing shareholders. This means that the new number of outstanding shares of the company is 18,886,428,420.

| Existing Shares |

1,742,408,730

|

| New Issue |

146,234,112 |

| Total outstanding shares after the IPO |

1,888,642,842 |

Based on the new number of outstanding shares and Profit After Tax last year of Rs. 7,507.3 million, you can calculate the new EPS post listing to be Rs. 3.97 and the new P/E multiple based on that as 52.9 times.

The company’s profit for the first quarter of 2012 was Rs. 2,130.7 million, and if you simply multiply it by 4 to annualize it you get Rs. 8,522.8 million and at that rate the projected EPS for the next year will be Rs. 4.51 and P/E multiple will be 46.5 times.

This valuation seems to be on the higher side to me, but Reuters has a story that talks about analysts using the EV / EBIDTA method and based on that number, the analyst concludes that the Bharti Infratel IPO is cheaply valued.

Objects of the Issue

The IPO will include a combination of shares from existing shareholders and fresh issue of shares from the company. So only a part of the money raised from this issue (fresh shares) will go to the company. The rest will go to the existing shareholders.

That part of the money raised will go towards installation of new towers and upgrading existing towers. The prospectus lists down that the funds raised will be utilized to install 4,813 towers among other uses for the funds.

Issue Open and Close Date

The IPO will open on December 11th 2012 for retail investors and will close on December 14th 2012, and will offer investors an opportunity to invest in a company that gives them exposure to a new area as no other company is tower business is currently listed. The financials of the company are good, and so it’s only a question of valuation and people investing in the company will have to take a call that the IPO is fairly valued, and that they won’t be able to get this share at a lesser price in the future after the stock starts trading in the market.