India’s somewhat scary fiscal deficit has turned a lot of attention to these two words, and a lot of people who were going on about their lives blissfully unaware of what a fiscal deficit is suddenly feel the need to understand these two words, and see if it is cause enough for them to worry about.

What is the fiscal deficit?

I think the easiest way to understand the fiscal deficit is to think of the government as a regular person with income and expenses, but unlike most regular people, the government, specially the Indian one, often ends up spending more than they earn.

When they end up spending more than they earn they have to come up with the shortfall somehow, and in the government’s case they plug the shortfall with borrowings.

Fiscal deficit is the amount of money that the government needs to borrow in a given year because their expenses were more than their revenues.

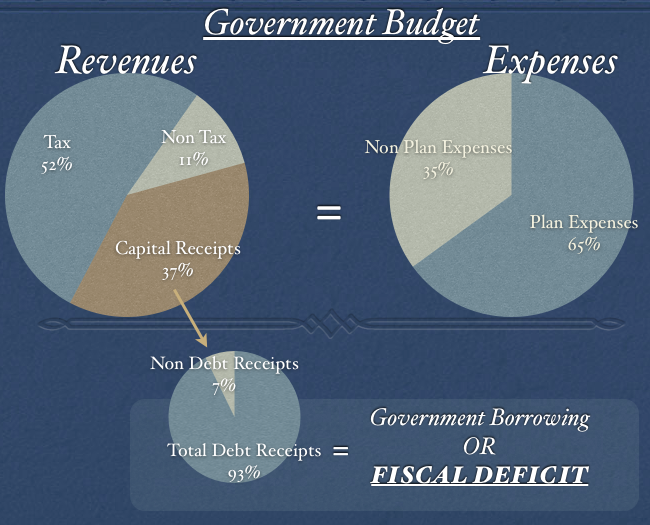

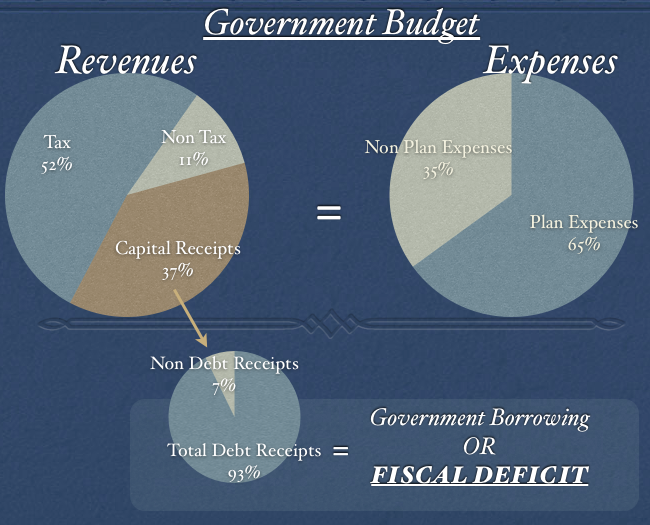

To further understand this, take a look at this picture below (the numbers are based on the last budget), and read the explanation that follows.

Budget: Government’s Revenues and Expenses

Every February, the government comes up with its budget for the coming year, and in this budget the finance minister lists down how much the government is expected to earn and spend in the ensuing year.

The revenues should always match the expenses but the government doesn’t always earn enough to cover for its expenses and then that shortfall is met with borrowings.

Expenses

There are two heads of government spending – Non Plan Expenditure and Plan Expenditure. Non Plan Expenditure is money that’s spent on sustaining the country like defense, postal deficit, subsidies etc. and Plan Expenditure is the money that is spent on improving the country like the money spent on dams, roads etc.

Revenues

Revenues of the government are split into three categories.

- Tax Revenue: This is the revenue raised from taxes like your income tax and corporate tax.

- Non Tax Revenue: This is the revenue the government earns by things like dividends from PSUs, royalty from selling petroleum, spectrum fees etc.

- Capital Receipts:Â Includes mostly borrowings

The Fiscal Deficit

To build on what we have covered so far, the government budgets how much it will spend and earn in the next year, and both of these should be equal.

The source of income for the government is tax and non tax revenue, and they have to add these two to see if it will cover all the expenses that the government is supposed to incur.

If there is a shortfall then the government will have to borrow this money, and this borrowing is called the Fiscal Deficit.

Conclusion

The worry about India’s fiscal deficit is that the government has to borrow a lot more money than they originally budgeted for.

For example, in the current year, the revenues from disinvestment are a lot lower than expected, and expenses on subsidies are a lot more than what they had expected, and this leads to a bad situation where you will have to borrow more than what you wanted without spending it on things that build the country like dams or roads, and hence the cause for concern about the fiscal deficit.

The other negative effect of this is that the government accumulates debt and a greater share of its income is just spent in paying interest on this debt in future years.

So, while India has run a deficit for many years, and that by itself is not a cause of concern, the missed targets show that either the revenues are lower or the expenses are higher, and for India, this seems to be the case perennially and thus the cause for alarm.

If while going through this post you were wondering, why does the government has to do all this and why can’t it just print money to become rich, read this older post about why a country can’t print money to get rich.Â

Hi Manshu, I have few doubts. why is disinvestment considered as revenue ? It is sale of stake in a PSU and it involves the capital+interest which was originally invested in it. If the govt manage to sell / disinvest many PSUs in a single year, let’s say in the above example, which might yield lakhs of crores and clearly it might make the revenue exceed expenses. Can we claim there is no fiscal deficit for that year ?? Also i have heard about a term, fiscal consolidation related to disinvestment. Could you please explain that as well. Kindly enlighten me on my doubts. Thanks.

Naresh

The government receives revenues by selling their stake in PSUs so that’s why it’s considered money. Same way the dividend from these companies is also considered revenue.

If they did manage to disinvest all companies in a single year then yeah that could be a fiscal surplus year.

I think fiscal consolidation w.r.t. disinvestment probably refers to the fact that the deficit is getting reduced because of the extra money the government is getting from the stake sale though I don’t think I’ve ever heard of this.

Nice article Manshu..to be honest with you..I did come across this term recently and wasn’t really sure what it exactly meant and what were the implications of a high fiscal deficit..

Sir , can govt print more paper currency to lower the deficit and whether this steps will add to inflation

No government can do that my friend, else everyone will be doing it and there would be no problems in the world. Please click on the link at the end of the post to read the details on why this is not possible.