This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

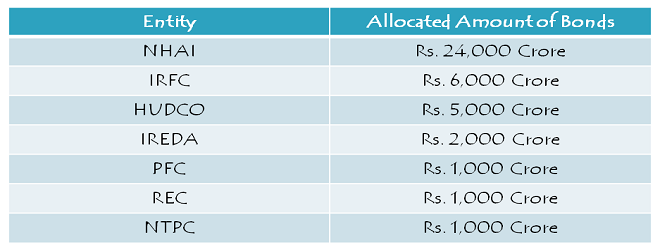

After a gap of one year, tax free bonds would be making a comeback this year. Central Board of Direct Taxes (CBDT) on July 6 issued a notification in this regards and allowed seven CPSEs to mop up Rs. 40,000 in the remaining nine months of the current financial year.

These CPSEs include NHAI, IRFC, HUDCO, IREDA, REC, PFC and NTPC. Out of total Rs. 40,000, NHAI alone would be mopping up 60% chunk of the total allowed amount to be raised i.e. Rs. 24,000 crore worth of bonds. IRFC would raise Rs. 6,000 crore, HUDCO Rs. 5,000 crore, IREDA Rs. 2,000 crore and REC, PFC & NTPC Rs. 1,000 crore each.

Here is the link to the Notification No. 59/2015 – Tax-Free Bonds Notification – FY 2015-16

Before we check the advantages of tax-free bonds vis-a-vis fixed deposits, let us first focus on the main points of the notification:

Tenure of Bonds – These bonds will be issued for a period of 10, 15 or 20 years.

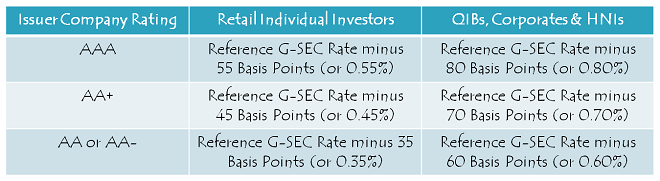

Interest Rate Ceiling – Interest rates offered by these companies will be subject to a ceiling on the coupon rates based on the reference Government Security (G-Sec) rate. The ceiling coupon rates would be as under:

AAA Rated Issuer – Reference G-Sec Rate minus 55 Basis Points (or 0.55%) for RIIs

AAA Rated Issuer – Reference G-Sec Rate minus 80 Basis Points (or 0.80%) for Other Investors

AA+ Rated Issuer – Reference G-Sec Rate minus 45 basis Points (or 0.45%) for RIIs

AA+ Rated Issuer – Reference G-Sec Rate minus 70 basis Points (or 0.70%) for Other Investors

AA or AA- Rated Issuer – Reference G-Sec Rate minus 35 basis Points (or 0.35%) for RIIs

AA or AA- Rated Issuer – Reference G-Sec Rate minus 60 basis Points (or 0.60%) for Other Investors

Here, the reference G-Sec rate will be the average of the base yield of G-Sec for equivalent maturity period, reported by FIMMDA on a daily basis prevailing for two weeks ending on the Friday immediately preceding the filing of the final prospectus with the Exchange or Registrar of Companies (RoC).

These ceiling rates will be applicable for annual payment of interest. In case the payment of interest is made on a semi-annual basis, the interest rates will have to be reduced by 15 basis points (or 0.15% per annum). Moreover, in case the bonds are sold or transferred by a retail individual investor (RII) to a non-retail individual investor, the interest rate applicable will be reduced accordingly by 0.25%.

Eligibility – As per the notification, the following investors will be eligible to subscribe to the bonds:

(i) Retail Individual Investors (RIIs)

(ii) Qualified Institutional Investors (QIBs)

(iii) Corporates (including statutory corporations), trusts, partnership firms, limited liability partnerships (LLPs), co-operative banks and other legal entities, subject to compliance with their respective Acts

(iv) High Networth Individuals (HNIs)

Retail Investment Limit – Individual investors, including HUFs through Karta, investing upto Rs. 10 lakhs in a single issue will be considered Retail Individual Investors (RIIs). Above Rs. 10 lakhs of investment, these individual investors will be categorised as high networth individuals (HNIs) and will earn a lower rate of interest.

NRI Investment – Non-Resident Indians (NRIs) will be allowed to invest in these bonds, on repatriation basis as well as non-repatriation basis.

Public Issues – At least 70% of the money to be raised by each individual company will be raised through public issues and rest of the money they can raise through private placements.

Credit Rating – These issues will be rated by a credit rating agency which is approved by the Securities and Exchange Board of India (SEBI) as well as the Reserve Bank of India. In case the issuer is rated by more than one rating agency, the lower of the two ratings will be considered.

Expected Rate of Interest – Power Finance Corporation (PFC) on July 14 raised Rs. 300 crore through a private placement at 7.16% for a 10-year maturity period. The Company had also fixed 7.39% coupon for 15-year bonds and 7.45% coupon for 20-year bonds. Had it been a public issue, the retail individual investor would have got these bonds offered at 7.41% for 10 years, 7.64% for 15 years and 7.70% for 20 years.

What makes Tax-Free Bonds Popular?

Tax-Free Interest – Unlike fixed deposits (FDs), interest earned on these bonds is exempt from income tax for the investors. This is what makes these bonds highly popular among the tax paying retail investors and high net worth individuals (HNIs).

Scope of Capital Appreciation – There is no scope of capital appreciation with bank fixed deposits or company deposits as such investments are not directly linked to interest rate movement in the bond markets. Unlike bank/company deposits, tax free bonds get listed on the stock exchanges and their market value goes up when there is a fall in the interest rates.

Tax Free Bonds issued during FY 2013-14 with coupon rate of 8.75% to 9% have been trading at a premium of 15-25% apart from their regular interest payments.

Easy Liquidity – With tax-free bonds, you can sell your bond holdings whenever you want to. These bonds get listed on the stock exchanges and due to big issue sizes, these bonds can easily be sold whenever required.

Highest Credit Rating – These bonds get issued by the public sector enterprises most of which are AAA rated. So, from the safety point of view, these bonds are highly secured and attract a big number of risk-averse investors. To me, it makes perfect sense to invest in these bonds as against riskier company deposits.

Tax-Free Bonds to be issued this year would not carry as attractive interest rate as they did in 2013-14. The 10-year G-Sec yield has come down by more than 100 basis points or 1% since then. I do not expect these bonds to carry coupon rates above 7.75-8%.

With crude prices coming down once again, Monsoon rains being above expectations and inflation remaining under control, I think the interest rates would remain under pressure going forward as well. So, it is in the interest of the investors and these companies also if these bond issues get launched as soon as possible. Are these companies already working on that?

Application Form for Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in tax-free bonds, you can contact me at +919811797407

All RBI Bonds are taxable, Jyoti, your question seems incorrect 🙂

As regards tax free bonds, most of them are available for purchase in secondary market at a premium, and it is much easier to go through someone who can do this off-market. Buying online is tough since you may not get the volume and number of bonds you need when you need it. I can recommend someone if you need

Are the RBI 6.5% non-taxable bonds available for purchase?

Hi Shiv,

Can I claim a LTCG loss on buying a tax free bond from the market at a price above its face value and then getting the original lower principal back on maturity.

Suppose, I buy a tax free bond on NSE for 1100 Rs and it matures in 5 years. When it matures, I get 1000Rs back per bond.

Can I take 100Rs LTCG loss?

Hi Shiv, Any tax-free bonds coming up in FY2016-17? If not, how do I choose the best one to buy on the market? Thanks.

Dear Mr Shiv,

(1)What are the likely dates,size and rate of interest, for retail investors,for HUDCO&NHAI Tranche II,

(2) Whether investor would continue to be retail investor if his total investments in NHAI Bonds exceeds Rs.10 lacs after getting TFB in Tranche II,

(3) Similarly if total investment in TFB of a PSU exceeds Rs 10 lacs after local purchase through stock exchange, does it loose the character of retail investor,

(4) What are the BSE/NSE Codes for 2013-14 TFBS for retail investors or else from where to get these ?

Thanks and regards,

S C Poddar

CAN WE GET OVERDRAFT FACILITY FROM ANY BANK AGAINST PLEDGE OF THESE TAX FREE BONDS

IREDA 7.74% Tax-Free Bonds Issue – http://www.onemint.com/2016/01/02/ireda-7-74-tax-free-bonds-january-2016-issue/

Dear Mr Shiv,

which are TFBs opening in Jan-Feb’16?

Hi Mr. Dubey,

IREDA, HUDCO & NHAI Tranche II would be available for subscription in the next 3 months. IREDA issue worth Rs. 1,716 crore is opening from January 8th.

Hi Shiv,

I was going through prospectus of these tax free bonds, especially ‘classification of investors’ from secondary market perspective. Most of the issues this year have been oversubscribed and as I’m looking to buy some bonds post listing wanted your help to understand rate of interest/coupon for secondary buyers. Below are the two items i didn’t understand (from prospectus of REC tax free bonds)…

c. If the Bonds allotted against Tranche I Series 1B, Tranche I Series 2B and Tranche I Series 3B are sold/ transferred by the RIIs to investor(s) who fall under the RII category as on the Record Date for payment of interest, then the coupon rates on such Bonds shall remain unchanged;

f. Bonds allotted under Tranche I Series 1A, Tranche I Series 2A and Tranche I Series 3A shall carry coupon rates indicated above till the respective maturity of Bonds irrespective of Category of holder(s) of such Bonds;

How would i know whether I’m buying from Series A or Series B seller on screen? I will not hold more than 10lacs worth of bonds on record date but if i buy from Series A sellers will i still be getting lower rate?

Link:

https://www.edelweisspartners.com/Mutual%20Fund%20Info/Product%20Note%20-%20REC%20Tax%20Free%20Bond.pdf

Appreciate your help in advance.

Thanks

Dev

Hi Dev,

Bonds issued to the retail investors carry different BSE/NSE codes as compared to the codes which are there for the non-retail bonds. So, if a retail investor buys these bonds which are meant for the retail investors, then there is no problem, he/she will get the same rate of interest. But, if you buy bonds which are meant for the non-retail investors, then you’ll get a lower rate of interest, even if you are a retail investor.

I heard that Irfc issue opens next week on 26 Nov. Any confirmation?

Thank you Shiv for continued advice with tips and analysis. These discussions are providing very valuable inputs to investors like us. Can you advice, for investors with more than 10 lakh (I think they get classified as HNI and not retail) would it be better to split investments across bonds or invest lump sum in one bond ?

Any idea when NHAI tax free bonds are going to come out?

REC tax-free bonds issue update – Issue opens 27th October, Issue size Rs. 700 crore. Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.14% p.a. vs. 7.36% PFC offered

15 years – 7.34% p.a. vs. 7.52% PFC offered

20 years – 7.43% p.a. vs. 7.60% PFC offered

Demat account is NOT mandatory for the REC issue as well

Sir

When is allottment of PFC tax free bonds likely to be done. From where can we know the ststus of our applications.

Hi Shiv, the interest rate on tax free bond is also linked to the credit rating it is assigned. Higher the rating, lower the interest rate. Are all the remaining bonds after NTPC & PFC rated AAA or is there any AA rated bond in pipeline likely to give higher interest rate than others?

Hi Jason,

I think only HUDCO carries a AA+ rating, rest all companies would carry AAA rating.