The GDP numbers released yesterday looked bad and marked the third consecutive decline in GDP. The economy shrank at 6.1% and the only glimmer of hope was — consumer spending.

When we entered this year, a lot of people expected recovery to begin in the second half of the year, but now it seems that the recovery is going to start only at the beginning of next year. This is what the IMF said some time ago, when they said that the global economy would shrink this year and then growth will only begin in 2010.

The only good news is that although the economy has done as badly, as it did in the last quarter — the declines came from diminishing inventories and investments, which adjust themselves to lower demand.

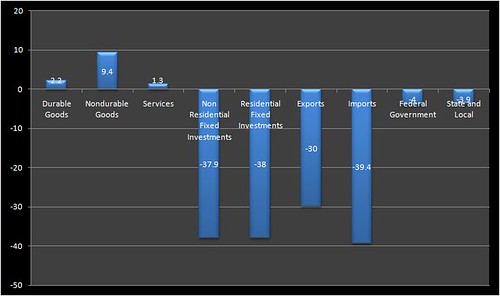

Here is a chart that compares how the two consecutive quarters fared.

The first three bars on this graph are consumer spending which fell rapidly during the last quarter and recovered in this quarter. Then the next two bars show business and housing investments, both of which were worse than last quarter.

Business investments fell because of the decline in consumer spending in earlier quarters and that makes the 6.1% – number a little less worse, than it appears. Since, consumer spending has shown sign of stabilization — business investment will also follow suit in the near future and stabilize quickly.

The fact that trade fell consistently is a really bad sign because countries use exports to claw their way out of a recession, but, if the whole world is struggling, then who can you export to?

I can’t wait for 2010 to arrive.

One thing to remember is plenty of companies actually have stronger balance sheets than any time in the past. Poorly managed companies that let follish wall street analysts push them to over-leverge had some trouble and of course the foolish companies that pay those analysts were about all over-leveraged. But the failure of banks/financial companies to manage their balance sheets was not shared by most productive companies. That is my understanding that I am attempting to find supporting evidence for. It appears that is correct, though I have been upable to find good original data sources yet.

The borrowing in the USA is led by financial companies and then government and consumers. Companies (other than financial companies which have been by far the biggest part of the problem in failure to understand appropriate financing) have actually not been huge borrowers. It seems it is rare companies today that were so foolish as too over-leverage and get in trouble (mainly financial firms that couldn’t do basic financial planning and a few that followed advice from investment bankers and over-leveraged). And the credit crisis created debt-market problems for companies that relied on short term money market borrowing as part of their debt plan. Though that problem has diminished recently.

@Mikael, My real plan is to wait for so long that the problem solves itself 😉

On a more serious note, I think there has been a lot of excess leverage by corporations and individuals and it can only be unwound with the passage of time (and considerable money) and that’s really all I meant in the last line.

Don’t you feel that this is actually one of the main problems that people have? The “Waiting” part? There are lots and lots of people making tons of money this very day because they have decided not to wait but instead ACT. Waiting for someone else to fix the problem is IMO a poor plan to follow 🙂