Also read about the REC Infrastructure bonds here or the IDFC Infrastructure Bonds Tranche 2 here.

The IDFC Infrastructure Bond post has thrown up some interesting questions from readers which were not part of the post itself, and while I am replying to them in comments – I thought I’d do a fresh post with 5 questions that I thought deserved a post of their own.

1. Is opening a demat account compulsory for investing in the IDFC Infrastructure bonds?

No, it is not.

When this scheme opened there was just the option to invest in it if you had a demat account, but some changes have been made (pdf) and opening a demat account is not compulsory now. You can buy them in physical form also. Their website tells you how to do this.

You can also subscribe to the Bonds in physical form by following these simple steps:

- Don’t fill up the demat details in the application form

- Compulsorily provide the following three documents with the application form:

- Self-attested copy of the PAN card;

- Self-attested copy of a cancelled cheque of the bank account to which the amounts pertaining to payment of refunds, interest and redemption, as applicable, should be credited.

- Self-attested copy of the proof of residence. Any of the following documents shall be considered as a verifiable proof of residence:

- Ration card issued by the Government of India; or

- Valid driving license issued by any transport authority of the Republic of India; or

- Electricity bill (not older than 3 months); or

- Landline telephone bill (not older than 3 months); or

- Valid passport issued by the Government of India; or

- Voter’s Identity Card issued by the Government of India; or

- Passbook or latest bank statement issued by a bank operating in India; or

- Leave and license agreement or agreement for sale or rent agreement or flat maintenance bill; or

Letter from a recognized public authority or public servant verifying the identity and residence of the Applicant.

2. Is the interest earned from the IDFC Infrastructure bond tax-free?

While IDFC Infrastructure bonds may not attract TDS – the interest itself is not tax – free. It’s only the Rs. 20,000 you get reduced from your taxable salary that helps save tax.

3. Has the closing date to invest in IDFC Bonds extended?

Yes, the closing date has been extended from 18th October to 22nd October.

4. When do the bonds start trading in the stock exchange?

After the initial lock – in period of 5 years is over, the bonds will list on the NSE and BSE, and start trading there.

5. Which option has the highest yield?

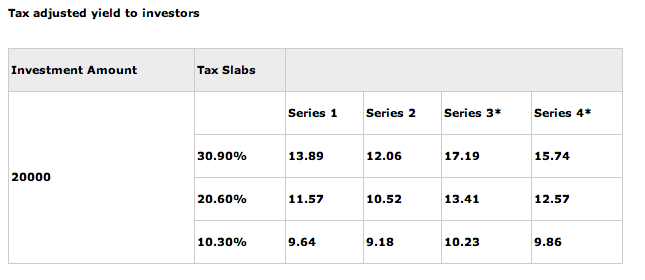

Yield table from the website. Now keep in mind this is just the yield, the lock in periods differ between various series, and that needs to be taken into account while making your decision, however since my earlier post didn’t have this yield table I am including it here.

Click here to read the earlier review of the IDFC Infrastructure Bond.

Hi Arvind.. You cannot claim the tax benefit by investing in IDFC/REC Infra Bonds as only that person can claim the tax benefit in whose name these bonds are.. You can make your wife as the second holder though for this investment.. If I’m not wrong “Life Insurance” is the only place of investment where something of this sort is allowed.. 🙂

For more info about IDFC/REC Infra Bonds, the tax benefits u/s. 80CCF or to invest (Delhi, Gurgaon & Noida only plz) you can call us at 9811797407

Can I avail tax benefits if I invest these IDFC bonds in my wife’s name. Thanks

I’m no tax expert Arvind, but so far I haven’t come across any evidence that shows that tax benefits can be availed even when bought on wife’s name. So, I’m not sure what the answer to that is.

Does people who applied to these bonds through their demat accounts get hard copy of the bond or do they get only the allotment advice?

They get the allotment advice in their mail Suresh. As good as the hard copy I’d say.

i m also want to take IDFC band . how can i get that?

Anuj

Through a trading account like ICICI Direct, from a branch that’s selling it or an agent who is selling it. If you don’t have a trading account then try out a HDFC or ICICI branch close to your home to see if they have it there, or they’d at least be able to tell you where to go.

Thanks Manshu

New IDFC bond has started from today. Can I avail tax benefit and how I can get certificate for this bonds.

Yes, you can avail tax benefit Vikramjit. To buy you will have to contact an agent, go to a bank branch selling it or go to an agent.

Mr.Inder,

Kindly get in touch with Sharekhan,as you have to get an allotment or an acknowledgement no. when you apply whether online or physically.

tanks I received my IDFC bond certificate by your suggetion

Appreciate your reply Vijay, and thanks to Shubho for sharing this link.

I have puchased 4 no. IDFC Infrastructure bond (80CCF) on dt. 18th , october ‘2010 for amount of rs. 20,000/- through demate a/c no. 8501171819 of icicidirect.com vide transaction ID no. INE043D07278 my application no. is kindly proved my bond certificate proof for onward submission to my office for tax benifit through e-mail add. bijoykr_1980@rediffmail.com

Hi,

I have invested in IDFC infrastructure bonds using my DMAT account with Sharekhan. I have applied it online and I did not get any application number for the same. How can I get a soft copy of bond certificates?

By entring the PAN number at the link http://mis.karvycomputershare.com/ipo/

it gives error.

Please Advise.

Thanks!!!

i hve received IDFC tax saving bond in my demat a/c , i wnt bond certificate for income tax purpose …….How to get it??? plz suggest

Take a look at this comment Santosh:

http://www.onemint.com/2010/10/12/idfc-infrastructure-bonds-faq/comment-page-2/#comment-117158

This describes how youc an get the allotment advice.

Thank Naresh and Manshu for your information. I checked my status and found 2 bonds are allotted but they have mention my previous address from where i have made my PAN card, rite now am staying in Bangalore and mention current address in registration form… plz guide me!!

So, since you have the allotment advice that will serve as tax proof, and now are you looking for guidance to change address on PAN card?

Here are the instructions to do that:

https://onlineservices.tin.nsdl.com

Dear B. N Raju

You can check on the following

Here is how you can generate an online Certificate for their IDFC long term infrastructure Bonds. Karvy people have been pathetic with the data entries and you will be shocked to see the addresses they have entered. But all you need is your 8 DIGIT IDFC Long Term Infrastructure Bond Application Number. The steps are given below:

* Go to http://karisma.karvy.com

* Click on the Link that says “Click for Karisma Home Pageâ€

* On the page that open click on the image “New! IDFC Bonds – Allotment Adviceâ€

* In the new page that opens, enter you Application number and Submit

You should have your certificate. Hope this helps all the people.

Regards,

Naresh B Dholakiya

Thanks Naresh.

Hi,

I applied for the IDFC Infrastructure bonds and got 2 bonds allotted, but i have not received the physical bonds yet. Before 14th Jan, 2011 i need to furnish the investment details to the company. I would like to get the soft copy or Information slip to furnish the details to company. please help me out!!

Application No : 53637244

Cheque No : 928988

Amount : Rs 10,000.

Regards

B N Raju

Hi,

I applied for the IDFC Infrastructure bonds and got 2 bonds allotted, but i have not received the physical bonds yet. Before 14th Jan, 2011 i need to furnish the investment details to the company. I would like to get the soft copy or Information slip to furnish the details to company. please help me out!!

Regards

B N Raju

I have appiled through HDFC bank in physical form.

my payment advice and deduction is as follow :

Details of transaction of 20,000 through A/C Number –deleted–.

Transaction to IDFC Bond has done on 22nd October 2010 as follow :

22/10/10 Chq Paid-TRANSFER IN-IDFC INDRA BONDS–deleted– 22/10/10 20,000.00

I did not received any allotment advice. I didnot have application number as it was filled in by HDFC -Vanijya Kunj- Gurgaon ( Haryana) by Deputy Manager – Priyanka Gautam.

Unfortunately the HDFC guy is unable to help me.

Is there a way to address above issue ?

How can I get IDFC bond advice letter delivered to my address as mentioned in the application.

PLease advise action. as Being slalried class person I need to submit Investment details for finanacil year 2011-2012

Regards,

Naresh Dholakiya

9911855839

Gurgaon

I’m sorry to hear your situation Naresh, and it looks like you don’t have any evidence that you bought the bond? Did you receive anything at all? I don’t know of a way to resolve this; I hope someone more knowledgeable can leave a reply to you.

You could try talking to IDFC reps, though I think you might have tried that route earlier.

P.S. I have deleted check and bank account details from your comment.

Hi,

I got alloted with IDFC infra Bonds, and also it is refelecting in my DEMAT account, But I am yet to get the physical copy, as the address which I submitted chnaged recently,

SO whom should I contact to get the physical copy send to my new address, I hav only my demat account#, I do not have the application number alos..

Pls advs

I had applied for IDFC bond on 19.10.2010 for 20000 and i didnt got hard copy of bond also i didnt understood the series 1,2,3,4 in that and after maturity how to get maturity amount i didnt mentioned any bank details also in that and the address what is in application form i had given got changed in your scanned copy my bank (from which cheque i had given)address is there can that be changed?please clarify my doubts my contact no 9448519609 (karnataka) in bangalore any of your branch office is there pl give contact no details

Hi Manshu,

Here is how one can generate an online Certificate for their IDFC long term infrastructure Bonds. Karvy people have been pathetic with the data entries and you will be shocked to see the addresses they have entered. But all you need is your 8 DIGIT IDFC Long Term Infrastructure Bond Application Number. The steps are given below:

* Go to http://karisma.karvy.com

* Click on the Link that says “Click for Karisma Home Page”

* On the page that open click on the image “New! IDFC Bonds – Allotment Advice”

* In the new page that opens, enter you Application number and Submit

You should have your certificate. Hope this helps all the people.

Shubho

Thanks Shubho for sharing this – I’m sure this is helpful to a lot of folks.