Also read about the REC Infrastructure bonds here or the IDFC Infrastructure Bonds Tranche 2 here.

Update: There has been a change in terms, and you can now invest in these bonds in physical form also. Here is the link to relevant IFCI page.

The issue has been extended till January 12 2011

The IFCI Infrastructure bonds are the latest infrastructure bonds to be issued with the 80CCF benefits, and are the second tranche from IFCI, which issued them earlier this year as well.

The IFCI bonds are issued with section 80CCF benefits which means that they will get you a tax benefit of reducing your taxable income over and above the Rs. 100,000 under Section 80C with a cap of Rs.20,000.

The issue has been rated “BWR AA†by “BRICKWORK RATINGS INDIA PVT LIMITED†which means that they are rated as instruments with high credit quality.

Here are some other details about them.

IFCI Infra Bond Options

There are 4 series that you can choose from with a combination of getting interest paid annually, cumulatively, and having a buyback or not.

Here are the details of the 4 series.

| Options | I

Buyback & Non – Cumulative |

II

Buyback & Cumulative |

III

Non Buyback & Non – Cumulative |

IV

Non – Buyback & Cumulative |

| Face Value | Rs. 5,000 | Rs. 5,000 | Rs. 5,000 | Rs. 5,000 |

| Buy Back Option | Yes | Yes | No | No |

| Coupon | 8.00% per annum | 8.00% compounded annually | 8.25% | 8.25% to be compounded annually |

| Redemption Amount | Rs. 5.000 | Rs. 10,795 | Rs. 5,000 | Rs. 11,047 |

| Buyback allowed after | 5 years | 5 years | NA | NA |

As you probably noticed IFCI didn’t show yields in the same manner as L&T and IDFC, where they took the tax benefits based on various slabs and showed yields at different tax slabs and interest payments. This is probably a good idea given the various limitations of the way those yields were calculated.

How does the IFCI infrastructure bond buyback option work?

At the time of selecting a series you have to select either series 1 or series 2, which allow the buyback after 5 years lock in period. To exercise the buyback you have to write to IFCI to request it, and this has to be done in the month of November for the year when you want to exercise the buyback.

Open and Close Date of the IFCI Infra Bond

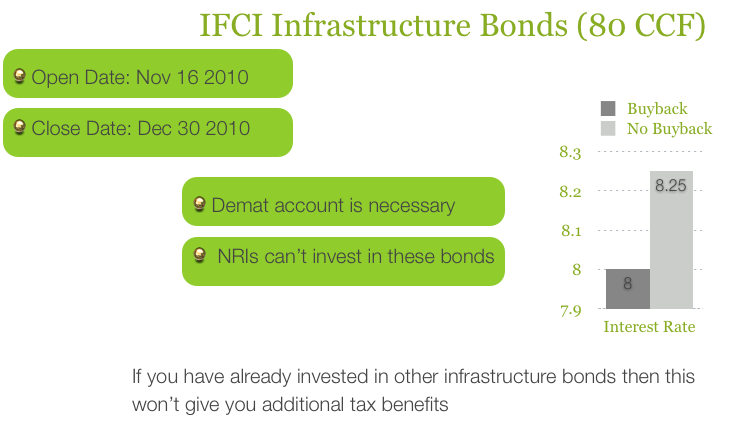

Opening date of the issue: November 16th, 2010 and Closing date of the Issue: December 31st ,2010. They can close earlier as well if their entire demand is met.

Is a Demat account necessary to apply for the IFCI Infra Bond?

Yes, right now it is necessary to have a demat account to apply for these bonds as they won’t be issued in physical format. Even the IDFC bonds started out as Demat only, and were later on changed to allow physical forms also. The target sum to be raised by IFCI bonds are much lesser than the IDFC ones, so they might not feel the need to change and include the physical format as well.

Will tax be deducted at source from the interest payment?

These IFCI 80CCF bonds will not attract TDS, however the interest itself is taxable at your hands. So, the bonds don’t attract TDS, but it doesn’t mean they are tax free.

Will the bonds list in a stock exchange?

Yes, IFCI plans to list these bonds on the Bombay Stock Exchange (BSE), but from reading the information memorandum it seems to me that you can only sell these bonds after the lock in period of 5 years.

Can NRIs invest in the IFCI Infrastructure bonds?

NRI customers are not eligible to apply for the issue.

What if you have already bought another infrastructure bond?

If you have already bought another infrastructure bond, and exhausted the limit of Rs. 20,000 then you won’t get any further tax benefit by buying this bond. There are also several banks that offer 8% interest for terms less than 5 years, so you won’t get much value out of locking your money in this instrument for 5 years.

How can you buy the IFCI infrastructure bonds?

You can buy these bonds through your broker like ICICI Direct, or can submit an application form in one of the bank branches that are accepting them. The information memorandum lists down a large number of HDFC bank branches so you can go to one near your house, and they might be selling the bonds or can at least tell you where you will get them.

Should you wait for another issue?

This issue is 50 basis points, or half a percentage higher than similar L&T bonds issued earlier, and reader Amit Khandelia actually left a comment about LIC coming up with a future issue, and possibly even offering term insurance free with their offer.

IDFC has also indicated interest in coming up with a future issue, so they might come up with another issue too.

The advantage with waiting is that you may get a slightly higher interest rate, maybe half a percentage or one percentage more, but as I said earlier if you’re able to wait and get a bond which offers a percentage higher, and you invest the maximum Rs. 20,000 in it – that means an additional 200 bucks extra in a year; what is that worth to you? How many hours of Googling and speculating is it really worth?

The advantage of getting it now is that you can get this one thing done with, and have plenty of time to receive the certificates for tax proofs or whatever else you need.

This is a personal decision really, but something worth keeping in mind the next time you speculate on whether you should wait or go ahead with it.

Please leave a comment if you have any questions or observations.

I have not received hard copy of the bond nor the same is showing in my demat.

My dob is 21/08/1977 and my pan card# is <--deleted-->

I am yet to receive the bond certificate.My PAN is <--deleted-->.Cheque no. is 78291 dated 06/01/2011.My cheque has been cleared on 14/01/2011.

The applicatton ser no is 224386 thr kotak securities.

Please find out why the infra structure bond in Demat form is still not come to account.

Pls reply in 2 days time.

Already informed earlier.

It shows the customer is not treated will.

When my friend got his Demat a/c updated why this is happening : please note the details of bond applied:

Cheq no 225520 dt 7.1.2011 Rs.20000/-drawn on Axis bank .

Regards,

C.P.Viswanathan

9094783096

I have applied for IFCI Infrastructure Bond series II in January 2011. My application No: 02365696. I have applied for 4 bonds of Rs. 5000/- each. I have got the allotment advice wherein I found that my name has been mispelt .

My correct name : SISHUTOSH PANIGRAHI

I nominate my wife Mrs MAMATA PANIGRAHI, dATE OF BIRTH: 31.12.1964. aDDRESS: Qr. No Type III/29, Narcotics Colony, 19 mall Road, Morar, Gwalior: 474 006.

Kindly do the needful.

Yours sincerely,

SISHUTOSH PANIGRAHI

This is not the IFCI website – please contact the registrar or IFCI to get this issue resolved. Leaving a comment here won’t get anything done.

I’ m applay for ifci bond for Rs. 20000 and application no iss 2283394 .please tell me status of allotment

For information of all those who have invested in IFCI Bonds, please note that after accessing the link http://www.beetalfinancial.com/bond.aspx, type out your PAN Card No. and you will come to know whether your investment has been allotted or not. Whether your investment is through the DP route or by physical form, the particulars would be displayed therein. As for the physical forms, the same would be despatched by them only by the end of March, 2011. So please have patience and wait till you get the forms. As far as the IT Return submission is concerned, there is plenty of time till 31-07-2011. To be on the safe side, you may get a copy of the particulars of your investment downloaded from the abovementioned site and use same for attachment to IT Return if necessary.

There is no need to keep sending e-mails about your allotment confirmation.

Mrs R Ravindran

Thank you, thank you, thank you so much!!!

i have invest in ifci infra bond vide application no:2429436

cheque no:493501 axis bank ltd valsad till date 09/03/2011

i have not recieved the conformation of alloted my bond in my

demet account.

I had deposited on 28-12-2010 Rs 20,000/= at Baroda vide HDFC Bank cheque No 151158 for allotment of physical form of your infrastructure bonds. So far I have not heard anything from you.

Please expedite reply.

Mrs R Ravindran

statement of ifci infra bond required

not showing in demat acct

how to get it

Dear All,

Just spoken to beetal according to them physical bond, we will get this certificate at the end of March 2011.

Thanks for that info Ashfaq – that is useful info, as there are a lot of comments on that.

I have received a physical receipt for the bonds. It is just a small 1 page document from IFCI, and I am not sure if this is the actual physical bonds.

P.S. I had been already allotted in my Demat account.

I think now everyone is waiting to get the physical bonds, if anyone receives it please post the details.

Did any recevie IFCI infrastrycture bonds in physical form ?

Physical alottment along with the cheque ( Interest on Application money) for the time period, money was with IFCI has been received…Its just a letter mentioning that you have been alotted and nothing in addition to same.

All should get by march 11.

Similar letter is also available on beetel financial’s site who is managing this piece.

Vinit

Thanks Vinit.

I applied for infra bonds vide application no.3010795& 3010799 no allotment has been received yet

I checked the status on beetalfinancial site, it says bonds allotted in physical form, but i have not yet received any bonds, any idea how much time it will take?

i check the status of your bonds online at http://www.beetalfinancial.com/bond.aspx.

I have not received my bonds yet

but it says bonds allotted in physical form. Advice sent.

I had applied for the ifci infra bonds in physical mode …..beetal financial website is showing bond allotted…….but till today i have not received the bond………had sum one has received the bond in physical form..?

Hi,

I also applied for bonds in demat form but the status showing up is “Allotment in physical mode, allotment advice already sent”.

Any idea how much time it will take for the advice/ bonds to reach in physical form?

Sailing on the same boat. let me know if you get any communication from IFCI. And by the way did you check your dp account? How did you apply?

I checked status of my application on the http://www.beetalfinancial.com/bond.aspx site; its showing wrong PAN no (one letter incorrect) with successful allotment.

Should I take efforts to correct this or I can live with this as is? Do you foresee any challenges later if not corrected now? If it is better to correct, any clues whom to reach? Beetal? IFCI?

Also status shows “Allotment in physical mode, allotment advice already sent” (I applied for physical mode). Does anyone know how much time allotment advice should take to reach me? Has anyone already received physical bond papers?

I really don’t know enough about this to say if you will have problems or not Sagar, but in general I like to follow the principle of being safe rather than sorry.