This is another post from the Suggest a Topic page, and this time we’re going to take a look at the recently launched MOSt Shares NASDAQ 100 ETF from Motilal Oswal.

The NFO for this ETF has recently closed on the 23rd March 2011, but regular readers know that it doesn’t make any difference if you missed the NFO.

The MOSt NASDAQ 100 ETF plans to track the NASDAQ 100 Index (NDX) of course, and this isn’t a fund of funds, which means that it will look to invest in the underlying stocks directly, and you won’t have to incur double fees.

The few other international funds I’ve seen so far are fund of funds which means double fees for investors as they bear the fee of the fund, and then the underlying fund as well.

While the SID (Scheme Information Document) does state this ETF can invest in other NDX based ETFs, it appears to me that for the most part the intention is to directly invest in the underlying stocks, and that’s a good thing.

The expense ratio of MOSt NASDAQ 100 ETF is 1% of recurring expenses, and that’s among the lower ones charged in the Indian ETF space, which is a good thing as well.

Having looked at the basic things, let me now explore 3 factors that are not easily apparent when you’re looking at this ETF, but are something that you should be familiar with.

The NASDAQ 100 Index

The first thing to do is to get familiar with the index itself. In this case the NASDAQ 100 Index, which comprises of 100 of the largest companies listed on NASDAQ based on market capitalization. Â These are primarily technology companies, but there are other companies like Vodafone, Whole Foods, Wynn Resorts in the index as well. The complete list can be found at the bottom of this post which I’ve taken from the SID itself.

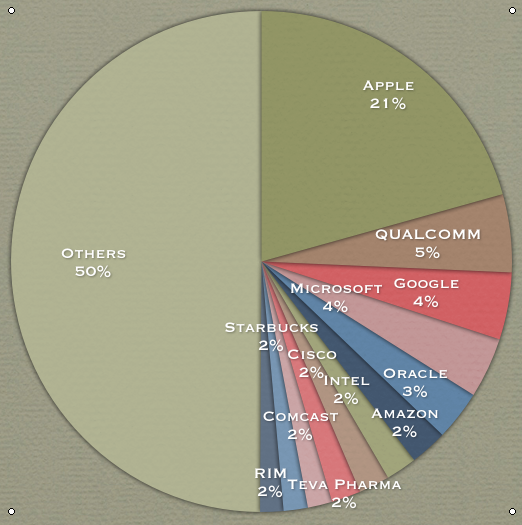

Apple is by far the biggest constituent of this index with about  20.65% weight, and QUALCOMM is the second largest constituent with 5.03% weight.

Here is a pie chart that shows the top constituents along with their respective weights and you can see that the top 12 stocks make 50% of the index.

So, if I were to invest in this index I’d have to have a good feeling about the US technology market in general and these stocks in particular – at least about Apple.

Exchange Rate Movements

Since this ETF will raise money in INR and then invest it in USD – that exposes it to exchange rate fluctuations, and this is something you need to keep in mind or it might surprise you later.

From the risk factors in the SID:

As the Scheme will invest in securities which are denominated in foreign currencies, fluctuations in the exchange rates of these foreign currencies may have an impact on the income and value of the Fund.

To understand this think of a situation where this ETF didn’t exist and you wanted to invest Rs. 90,000 in the NASDAQ 100 Index.

You’d give this money to your cousin in US and ask him to invest it on your behalf. The current exchange rate is about 45 rupees to a dollar, so this will amount to approximately $2,000 with which your cousin buys the ETF.

Let’s suppose the market stagnates for a year, and the NASDAQ 100 doesn’t move at all. Your patience runs up, and you ask your cousin to sell the holding and send you the money.

Your cousin sells the holding and gets the $2000 back, but the exchange rate has now moved to 1 USD = 40 INR, so that $2000 only translates to Rs. 80,000.

So even though the index didn’t move at all you made a loss due to exchange rate movement. The reverse is also true and if the exchange rate moves to 1 USD = 50 INR you will stand to gain.

This will be true for any international ETF and is more of a feature than a bug. Just be cognizant of this factor when investing in the MOSt NASDAQ ETF.

Taxation

This ETF is treated as a scheme other than an equity oriented fund for taxation purpose, and that’s probably a drawback given that equity funds are treated more favorably for tax purposes, and your investment really is equity investment.

Conclusion

This is an interesting product, and the people I’ve spoken to who’re interested in this product were primarily looking to diversify their equity holdings a little bit by investing in the equity of a developed market. If that’s your goal with it then I suggest that you also enable foreign trading on your equity account and see what options you have there. I’m not very well familiar with that option, but it does exist. If you were inclined to take a position on US technology stocks then of course this is a fit for you.

As always – I won’t make any recommendations on whether you should buy it or not, but if you had any other questions or observations please leave a comment.

List of all components:

| S.No. | Name of the Security | %Weight |

| 1 | First Solar Inc | 0.491 |

| 2 | eBay Inc | 1.41 |

| 3 | Mylan Inc/PA | 0.485 |

| 4 | Dollar Tree Inc | 0.306 |

| 5 | Amgen Inc | 1.158 |

| 6 | Celgene Corp | 1.133 |

| 7 | Symantec Corp | 0.677 |

| 8 | Activision Blizzard Inc | 0.578 |

| 9 | Google Inc | 4.33 |

| 10 | Marvell Technology Group Ltd | 0.565 |

| 11 | DENTSPLY International Inc | 0.229 |

| 12 | BMC Software Inc | 0.447 |

| 13 | Dell Inc | 0.45 |

| 14 | DIRECTV | 1.223 |

| 15 | Mattel Inc | 0.459 |

| 16 | Costco Wholesale Corp | 0.777 |

| 17 | FLIR Systems Inc | 0.235 |

| 18 | Cephalon Inc | 0.19 |

| 19 | Yahoo! Inc | 0.47 |

| 20 | QIAGEN NV | 0.205 |

| 21 | Fastenal Co | 0.369 |

| 22 | Microchip Technology Inc | 0.268 |

| 23 | Apple Inc | 20.651 |

| 24 | Express Scripts Inc | 1.247 |

| 25 | Cisco Systems Inc | 1.99 |

| 26 | Autodesk Inc | 0.449 |

| 27 | Electronic Arts Inc | 0.238 |

| 28 | Starbucks Corp | 1.562 |

| 29 | Linear Technology Corp | 0.495 |

| 30 | Wynn Resorts Ltd | 0.707 |

| 31 | CA Inc | 0.551 |

| 32 | Staples Inc | 0.52 |

| 33 | Biogen Idec Inc | 0.797 |

| 34 | Warner Chilcott PLC | 0.275 |

| 35 | Ross Stores Inc | 0.365 |

| 36 | Intuit Inc | 0.872 |

| 37 | Broadcom Corp | 0.877 |

| 38 | O’Reilly Automotive Inc | 0.358 |

| 39 | Oracle Corp | 3.22 |

| 40 | Intuitive Surgical Inc | 0.568 |

| 41 | Garmin Ltd | 0.252 |

| 42 | F5 Networks Inc | 0.374 |

| 43 | Paychex Inc | 0.512 |

| 44 | Amazon.com Inc | 2.402 |

| 45 | CH Robinson Worldwide Inc | 0.591 |

| 46 | Illumina Inc | 0.406 |

| 47 | Citrix Systems Inc | 0.674 |

| 48 | Xilinx Inc | 0.529 |

| 49 | Adobe Systems Inc | 0.777 |

| 50 | Baidu Inc/China | 1.397 |

| 51 | PACCAR Inc | 1.063 |

| 52 | Gilead Sciences Inc | 1.467 |

| 53 | Sigma-Aldrich Corp | 0.324 |

| 54 | News Corp | 1.03 |

| 55 | SanDisk Corp | 0.525 |

| 56 | Henry Schein Inc | 0.265 |

| 57 | Automatic Data Processing Inc | 0.797 |

| 58 | Research In Motion Ltd | 1.508 |

| 59 | Expeditors International of Washington I | 0.492 |

| 60 | Applied Materials Inc | 0.522 |

| 61 | Vertex Pharmaceuticals Inc | 0.384 |

| 62 | Virgin Media Inc | 0.391 |

| 63 | NVIDIA Corp | 0.643 |

| 64 | NII Holdings Inc | 0.32 |

| 65 | Cognizant Technology Solutions Corp | 1.013 |

| 66 | Teva Pharmaceutical Industries Ltd | 1.889 |

| 67 | Microsoft Corp | 3.919 |

| 68 | Expedia Inc | 0.325 |

| 69 | Genzyme Corp | 1.078 |

| 70 | Lam Research Corp | 0.293 |

| 71 | Seagate Technology PLC | 0.309 |

| 72 | Whole Foods Market Inc | 0.423 |

| 73 | Vodafone Group PLC | 0.989 |

| 74 | Cerner Corp | 0.353 |

| 75 | Bed Bath & Beyond Inc | 0.798 |

| 76 | Akamai Technologies Inc | 0.409 |

| 77 | VeriSign Inc | 0.26 |

| 78 | NetApp Inc | 0.968 |

| 79 | QUALCOMM Inc | 5.032 |

| 80 | Apollo Group Inc | 0.285 |

| 81 | Ctrip.com International Ltd | 0.295 |

| 82 | Fiserv Inc | 0.544 |

| 83 | NetFlix Inc | 0.446 |

| 84 | Micron Technology Inc | 0.508 |

| 85 | Stericycle Inc | 0.328 |

| 86 | Millicom International Cellular SA | 0.459 |

| 87 | KLA-Tencor Corp | 0.424 |

| 88 | Intel Corp | 2.009 |

| 89 | Flextronics International Ltd | 0.32 |

| 90 | Liberty Media Corp – Interactive | 0.414 |

| 91 | priceline.com Inc | 1.004 |

| 92 | Urban Outfitters Inc | 0.262 |

| 93 | Infosys Technologies Ltd | 0.345 |

| 94 | Altera Corp | 0.782 |

| 95 | Life Technologies Corp | 0.478 |

| 96 | Joy Global Inc | 0.404 |

| 97 | Comcast Corp | 1.587 |

| 98 | Maxim Integrated Products Inc | 0.357 |

| 99 | Check Point Software Technologies Ltd | 0.437 |

| 100 | Sears Holdings Corp | 0.394 |

Gys, Any better alternative Options( of MOSt Shares NASDAQ 100 ETF

) in ETF category, Currently or new/NFO ?

Sir,

I’m late for trading but of late i have bought stocks in MOSt Shares NASDAQ 100 ETF very recently.

I read the article but regarding ‘rupee’ i’m totally confused.

India is growing, no doubt about that but now in August, 2016, the rupee is trading at 67.04 against Dollar.

My confused question is here if the value of ‘rupee’ decrease, say ’55’ will the stock be profitable.

Interest rates were down and brought up and made to stand still due political factors, already PPF and NSC are down this year 2016, I’m sure 2017 the interest will be down just like Rajan quoted

Now the rupee stands at 67 with considerable interest rate but if the interest rates are lowered in the future, how does US stocks such as MOSt Shares NASDAQ 100 ETF react.

I’m willing to hold on for five too.

Sir, I am interested in investing in this ETF ,( SIP ) what is your advise?$at 55+inr and APPL at 660+, is it a good investment?pl let me know.thanks for your time and interst.

Have written a Blog on the performance of the MOSt Nasdaq 100 ETF in the past one year.

Here is the link – http://mostnasdaq100etf.blogspot.in/

Regards

– Kapil Visht

Very good analysis Kapil, I’m going to share on my Twitter & OneMint’s Facebook wall as well.

Manshu,

Nice reading and good explanation as to the product an

risk of exchange fluctuation.

Thanks for the G8 information.

Thanks for your comment Mr. Karmali.

Great review Manshu.

I think this ETF is too diversified..

Feel it’s safe to moderate..

Thanks Chirag – If the broader tech market falls then all these stocks will fall too. I guess it’s better than owning just a tech stock, but after all these are all stocks which are similar in nature.

Yes true.

25% weight of the ETF is GOOGLE & APPLE!

Steve Job’s statements, retirements will have a huge impact on the ETF’s prices. 🙂

LOL – let’s hope he doesn’t sneeze too much 🙂

Nice post! Pretty detailed analysis i must say! Thanks!!!

And on topic as well 🙂

Very useful post, Manshu. For people who believe that technology companies like Apple, Google, Amazon are going to continue to grow for some more years, its makes a very good investment decision.

But as you rightly pointed out, the exchange-rate risk is the dampener. If one is an optimist & believes that annual returns over 2-3 years are going to be more than 12-15%, then s/he also needs to see how much of returns would be wiped out if the rupee appreciates as well. One has to see if the differential between rate of returns in the ETF & rate of appreciation in rupee is positive (sizable), then its definitely worth a buy. Currency experts can guide us here better…

On optimistic note, considering that companies like Facebook, Zynga, Groupon, Linkedin, etc. are going to be listed in not-so distant future & would most probably be included in the index sooner (given their hefty valuations), one can definitely expect to make money in 2-3 years. But for a 5-year horizon, one definitely needs to be evaluate the currency risk better as if Indian Stock Markets appreciate then the rupee is bound to appreciate as well against the dollar.

I remember during QE1 and QE2 a lot of people felt that the long term impact will be dollar collapse or at least a significant fall in $ value. I think I wrote something about that myself, but so far nothing has happened. There are so many factors at play when you think about exchange rates that I feel it’s better just to ignore that and treat this as you’d treat any other investment. Just invest regularly if you’re convinced of the underlying shares.

I applied in this one recently.I won’t say its an excellent investment option . But , i just wanted to have some exposure to US technology stocks and invested in it.

I think its a good idea for diversification of your portfolio and you can take a small exposure to this fund.

So, what percentage did you opt for?

nothing much really…Just the minimum amount of 10k. I am over invested in indian stock market and dont have any extra money for adventures in NFOs :)-

Thanks for the nice review !!

Alrighty – thanks for your comment and I hope your positions rise quite a bit!

Excellent review. Nice product for getting an international diversification.

However it’s not cheap. A 1% expense ratio for a passive fund with no fund manager seems unjustified.

Would request you to review this international fund as well:

http://www.benchmarkfunds.com/Products/HangSeng/Overview.aspx

In an Indian context – I don’t think there is any fund that charges less than a percent do they? I wish we had the likes of Vanguard here which charge as low as 0.17% but that’s not happened yet.

Benchmark ETF (Nifty BEES) charges 0.5%

But i agree . we are not at the level of Vanguard yet.

oops I forgot about that – thanks for bringing it to my attention again 🙂 I hope GS buying out Benchmark doesn’t affect their low cost. They’re the best as far as cost is concerned.