It’s raining NCDs these days, and the latest company to offer its bonds is Manappuram Finance. Most of you will know them by their ads on TV about gold loans, and that’s the business they’re in.

They give loans against gold to customers in the rural and semi urban areas, and have been in this business since 1999.

They are primarily a South Indian company as 86% of their loans are made in Andhra Pradesh, Karnataka, Tamil Nadu and Kerala.

Manappuram Finance was incorporated in 1992, but the business has been in existence for quite some time. The gold loan business, and rising gold prices have been a boon for them as their revenues have increased rapidly in the past few years driven by that business. On March 31st 2011 their portfolio of gold loans stood at Rs. 63,705.41 million, which rose from Rs. 18,512.26 million the year before, and was Rs. 4,000.63 million in the year before that.

This is about 52.97 tons of gold as at 31st March 2011, 22.45 tons in 2010, and 13.34 tons in 2009.

Their revenues last year were Rs. 11,815.26 million, and a profit after tax of Rs. 2,826.64 million. You can see this is a fairly big company with a pretty decent profit margin, and that shows in its credit ratings which is P1 + from CRISIL for short term debt instruments which is the highest rating a company can have.

These are some of the things that have been going well for the company, now let’s take a look at some risks that the company faces as described in their prospectus.

Risks Mentioned in their Prospectus

Manappuram lends by keeping gold as a pledge, so of course the big risk they face in their business is if gold prices took a dive. Other than that you have seen that there are other NBFCs getting into the loan pledging business and the competition is really heating up here.

An interesting risk that I saw in the prospectus was deficiencies found by RBI when they had conducted a routine inspection. Manappuram Finance auctions the gold pledged against loans which borrowers aren’t able to repay, and RBI found that there was a big time gap between when the loan became overdue, and when they conducted the auction.

RBI also found that some of their branches didn’t have seemingly basic information about who won an auction, how much did they bid, mode of payment etc. There was also one case where RBI says that Rs. 95.86 million from an auction proceed were ploughed back in the company as working capital where it should have been returned to the concerned borrower.

Another RBI routine inspection in June 2011 found deficiencies in their loan documentation. Some branches didn’t have sufficient identity documentation, and others didn’t have records of the scheme under which the loans had been disbursed.

Other notable risks include the promoters having given a personal guarantee for loans worth Rs. 6.63 billion, and if the lenders require any alternate guarantee then that would put the burden on Manappuram to come up with either alternate source of funding or come up with adequate guarantee.

The promoters have also taken a loan of Rs. 1 billion from Religare by pledging their shares in the company. NSE website shows that they have pledged about 20% of their total shares.

As I’ve written before – this is a red flag that I like to watch out for because in my opinion the last thing you want to do is to pledge your ownership stake by taking loans against shares.

These were some things that stood out for me as I was going through the prospectus. Now, let’s take a look at the NCD itself.

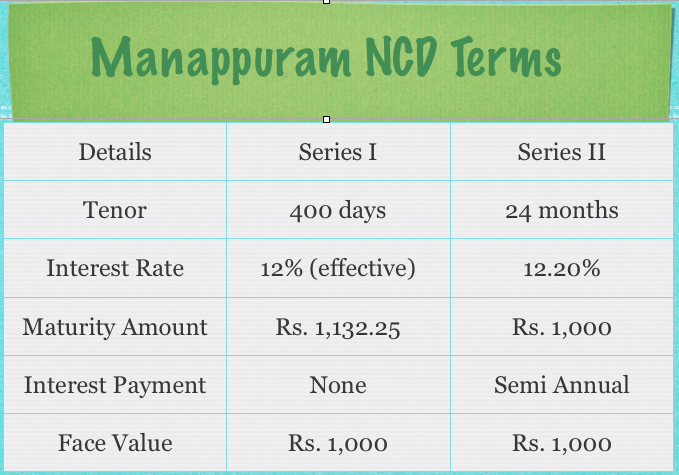

Manappuram NCD Terms

The minimum application is Rs. 5,000 and the issue will open on August 18th 2011, and close on September 5th 2011.

The issue has been rated CARE AA- from CARE and BWR AA- by Brickwork. The rating by Brickwork stands for high degree of safety regarding timely servicing of financial obligations, and the CARE rating also stands for high safety for timely servicing of debt obligations.

This NCD will be listed on the BSE, but not on the NSE, and here are the other important features of the Manappuram NCD.

These bonds are secured in nature, and let me reiterate that it doesn’t mean your money is guaranteed by the RBI or anyone else, but simply means that if the company were to go bust, there are some assets which are allocated towards this debt which will be sold off to recover your money. Now, those assets may sell for less than what the company has marked them for, or there could be other creditors who also have claim to them so you don’t get the full money back.

Secured debt is better than unsecured debt, but it doesn’t mean a guarantee in the sense that a lot of people think of it.

So overall, the good thing about the Manappuram NCD is that it’s giving higher rates than the other NBFC NCDs that I have reviewed here, and the credit rating is good as well, but the negative factors are the deficiencies found by RBI during their routine inspections, promoter’s pledge, and managing as well as sustaining its rapid pace of growth.

when will manapuram gold ncd listed on BSE?????

Manappuram is getting listed tmrw

Yeah manshu… Looks like manappuram NCDs are not as much in demand as Shreeman transport fin.

Allotment is done. Got an SMS today from CDSL . Full allotment for me.

Great! Thanks for letting me know Mithlesh – this is the first one you got full allotment for, is it not?

Hi Manshu – When will the Manappuram NCD list?

AB – haven’t seen any notices or articles with a date yet, but I’ll update this thread when I do find out. Thanks!

hi manshu, dont you think there is lack of transparency in the debt markets on information such as subscription (%), allotment status. Applicants in NCDs are in the black about everything

Any update on subscription and allotment status.

Hi sandeep, Allotment has been done

hi sir. as far as i know Manappuram finance Ltd is give best offered in NCD because it is a very largest Gold loan company. but i just want to know, is there any discount rate in manappuram NCD.? & what is the maximum amount of manappuram NCD.

I’m sorry I don’t understand what you mean by discount rate? Do you mean will retail individuals get it at a price less than others? If that’s the question then no, they won’t.

The maximum amount for being considered in the retail category is Rs. 5 lacs.

thanks. pl clarify that interst offered on NCD are fixed or it is linked to market by virtue of listing. Is Listing at discount is issue of concern, as NCD are offering fixed interst rate.

Sanjay – the interest rate is fixed, so every year you will get the interest promised. However the price at which it has been listed changes. That only affects you if you have plans to sell it before maturity, else you will get the face value on maturity.

Listing at discount is a concern – yes. That’s because it means you could have got the bonds cheaper while waiting it to list rather than investing it in the initial time period.

It means i can buy NCD from market after listing at lower rate and can get the fixed interest. but the net effect remains the same as rate are fixed and related to investment amount i.e. returns at fixed %age . kindly correct me if am wrong.

Hi sanjay, the coupon rate is a fixed % of the face value of debenture. So even if you buy NCD at 980 from market, you will get 12.2% of 1000 as interest, so your effective yield will be higher than the coupon rate.

It means NCDs are open issues like MF and can be bought from the market. kindly bear with me for my poor knowledge on finance.

yes sanjay, NCDs can be bought from market. they are listed on stock exchanges

I dont think Manappuram 400 day issue will list at discount like IIIFL. Coz as it is a fairly low risk/ low tenure instrument, which pays 1132.25 upon maturity. For eg. if above instrument is available at 950 upon listing (5% discount), YTM would be 17.4%, making it a whopping buy. Muthoot being longer term, has higher chances of trading at discount.

Dear Manshu

I always look forward for your advices. I have to make on investment decision on Muthhoot and Mannapuram NCD. can you sugget the better one. Further whether, NCD returms are taxables.

Dear Sanjay,

Yes NCDs are taxable, and I see a lot more NCDs coming in the market, also India Infoline has listed on the market with a huge discount of 8% today. I would wait a little and not invest in any NCD right now.

Pls. give what is minimum amt. of manappuram NCD.

It’s Rs. 5,000 Beena.

Thanks Manshu for the clarification.

I think Manappuram finance Ltd is give best offered in NCD because it is a very largest Gold loan company and it’s latest news he has been complited 10,000000 cr. in only Gold loan outstanding so i think it’s better opertunity for invest NCD

And finially i suggest for all please do imideatly, and dont compromise………………….

Your use of zeroes is rather liberal, and not quite factual 🙂

I think there is no interest payable in option 1. it means the gain will be treated as long term gain. hence no Tds or capital gain payable at all! am I right or it is just a wishful thinking?

Hi Ramesh, You are right in saying that it will be treated as capital gains, but they will be taxed like other long term capital gains on debt. They aren’t tax free unfortunately 🙂

Hi, any updates on the subscription allotment status of Manapuram NCD. Where is this info available on the web..Heard its not doin tht well

I haven’t seen the numbers anywhere, and I don’t think they are published on the web either.

I applied for it today (option-2). Lets see howz the allotment.I applied in STFC NCD as well and got very less allotment.

Interesting. Reminds me of this – another red flag 🙂 – http://www.dnaindia.com/bangalore/report_fraudsters-claiming-loan-with-fake-jewellery-held-in-bangalore_1399191

That’s crazy man!

Hmmm, pretty interesting facts you’ve highlighted here… Am not sure if you are aware of this, but Manappuram group recently forayed into Gold Retailing business and have opened retail chains in small cities of Kerala & TN — target customer being the low middle class. I wonder if they usurp all the auctionable gold to this new entity of theirs — and hence RBI’s red flag?

Thanks Krish – they have mentioned several dealings with promoter companies in the prospectus, and this must be one of them. From reading that info I couldn’t ascertain the size of these dealings, so it’s interesting to hear that from you.

Also, from their website and the info in the document, I see that they pride themselves on a very fast disbursement system and view it at as one of their key selling points. So, to me it felt like what they gain in speed, they are compromising in the quality of due diligence they do. Also, it seems like by being in this kind of business where the interest rate is high and they possess a dear and valuable asset of their customer, they feel that they can go a little lax on the paperwork.

Very true… Though there’s not evidence for this fact and may purely be fictional, there are rumors out there that says burglars/thieves use such NBFCs effectively to convert their looted gold… as there’s very little paper work and one can get a loan in 3-5 mins (there are ads which claim loans in 2 mins flat) such elements use this medium to convert their ill gotten gold to cash, instead of getting caught with the “maal”… It’s a win-win situation for the company too, they get the gold at a cheaper rate as there won’t be any claims!

Wow – that’s something!!!

Dear Manshu,

It is now high time to provide comprehensive list of ncd with their codes on bse and nse.

The list should also update as and when new bonds arrive.

Please… please …

they are better to trade in current market.

Yeah Sahil – you are right – I’ve started work on it already. It is a big exercise and is taking time but hopefully should be get done sometime by next week.

Hi manshu !!

It`s good that you observed the fine details of the prospectus and presented it very nicely. One thing i`ve been observing that these days you are focusing on certain investor`s myths like “practical meaning of secured debt” .

As usual nice post regarding this new issue !!

Hi Shashank – I hope that’s a good thing 🙂

Some of these questions keep popping up repeatedly, so I try to address whatever I feel people have questions on.

A good bet for short term given the outlook of worrisome stock market :)-

I think they are offering for only 2 yrs

Muthoot is offering for 4 -5 yrs Hence muthoot should be better one

Thanks Mithlesh and Manshu. Am sure there wont be a lot of listing gains here. Just wanted to make sure there is an exit route. Btwm it’s really a smart move by Manappuram. After 2 years, interest rates will come down and so will the cost of capital.

Manshu, are they listing these NCDs? I could not find their DRHP and because it’s a relatively short term bond, am not very sure whether these would be listed…

dear Neel,

as per business line news, bonds will be listed on BSE.

Yeah Neel, they are going to list on BSE as Mithlesh says – don’t know why not listing on NSE.