Power Finance Corporation (PFC) is the second company after IFCI to come out with their 80CCF infrastructure bonds.

These bonds help you get tax benefit over and above the Rs. 1,00,000 that you get by investing in Section 80C tax instruments.

The face value of each bond is Rs. 5,000 and PFC will come out with an issue size of Rs. 200 crores or Rs. 2 billion.

These bonds are secured, and rated AAA/Stable from CRISIL and AAA with stable outlook by ICRA.

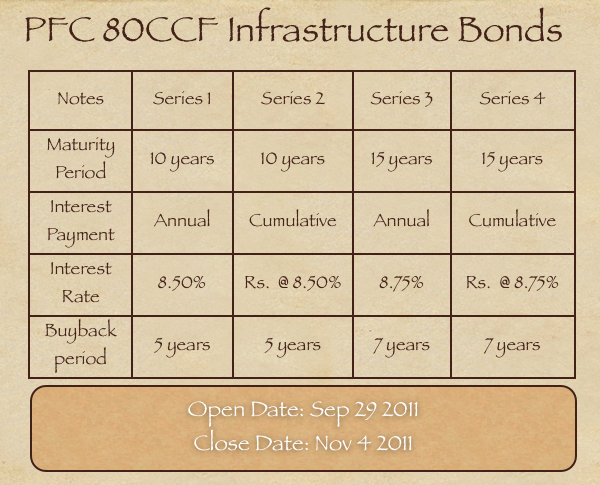

The bonds will be available in both Demat and physical form, and these are the other terms of the PFC infrastructure bonds.

Terms of the PFC 80CCF Infrastructure Bonds

It’s a good thing that PFC infrastructure bonds have opened up so much ahead of time because it gives people enough time to subscribe to them and get the tax proofs well ahead of March 31st.

PFC is a good company, and the interest rates among these 80CCF bonds aren’t going to vary much as they are capped at the 10 year government bond yields, so I think people who are looking to invest in these bonds can give PFC a serious thought.

Last year, there were some news reports that LIC was going to offer these bonds with along with free life insurance and circumvent the cap on yields, but that never materialized.

I don’t know if any other company will try to pull something similar this year or not, but with just an investment of Rs. 20,000 in these – it will not make a lot of difference in absolute terms.

Sir

My PFC bonds maturity was in the last year.I have purchased bonds worth Rs20000 on 31-03-2011. Application no 19602907 and DP ID/CL ID/Folio no IN 303028-52828973.

How to claim the amount with interest.

Please let me know the procedure to claim the amount

I have taken power finance corporation ltd infrastructure bond in 2011 my NO as per BGSE is IN302148-10414333 total amount Rs 20000/-

I am not receiving any interest can you please tell me how much I will get at the time of maturity

I hold 4 tax savings bonds of the face value of Rs. 5000 each in demat for.

Details: DP ID 300749

Client ID : 10300542

I would like to know:

1. Whether these bonds are locked or can be sold / redeemed and how.

2. If not, is there any provision for buy back by PFC ?

3. When will they be finally redeemed ?

Regards,

Can I purchase bond today

Sir, my PFC bonds maturity on 1st April, 2016. But I hadn’t redeemed the bonds. Now how to redeem the bonds and am I get additional interest on gap period on the bonds( gap period is 01/04/2016 to 03/04/2017, today’s date). My PFC bonds are in physical mode. Please clarify me.

Thank you

Vamsee krishna

Sir, I had PFC infrastructure bonds in physical bond form. Now let me know how to convert these bonds into demat account. I had demat account with steel city securities. Thank you

Hi Vamsee,

You need to contact your broker Steel City Securities for getting your bonds dematerialised.

I want to know whether interest received on these PFC Bonds eligible u/s 80 CCF is taxable .

Yes Ankita, interest received on infra bonds is taxable.

I have purchased Rs. 20000/- bonds of Power Finance Corporation Ltd. on 22.03.2011. I want to go to buyback pl advise me the procedure and any performa to be completed.

R.K.Goyal

Dear Ravinder,

Please check your application form to make sure that you had opted buyback option during purchasing the bonds. Apply for redemption (Buy Back) again. BuyBack will will open in July 2016. If you had not opted for buyback then it will be redeemed after maturity only ( which is 10-15 Years I guess)

Please check with Karvy.

Please refer your letter no 36496 dated 26 Jun 2015 regarding offer for Buyback of PFC Long Term Infrastructure bond.

My registered folio is PFA0214195 and I had purchased 04 in no. S02 series bonds in 2011 bearing distinctive no 56081-56084, which I had opted for buyback option in your above stated letter.

On 05 Aug 2015, I had sent the buyback consent form along with cancelled cheque (ICICI Bank, Mohali chq No: 235351) and PAN copy to the Karvey, Hyderabad address as directed in the said letter. but I had not received the amount in my account as on date.

Please confirm the status of my buyback option request.

Thanking you in anticipation.

SS CHEEMA

09815500724

To whom I have to apply?

What moderation you want?