The budget was announced last Friday and plenty has been written on it already.

Last year I had a couple of posts on the budget that looked at it from the government’s perspective (where the money came from and where it went) and I plan to that this year as well, but because of several emails and comments I decided to do a post on the budget that cover the personal finance aspect as well.

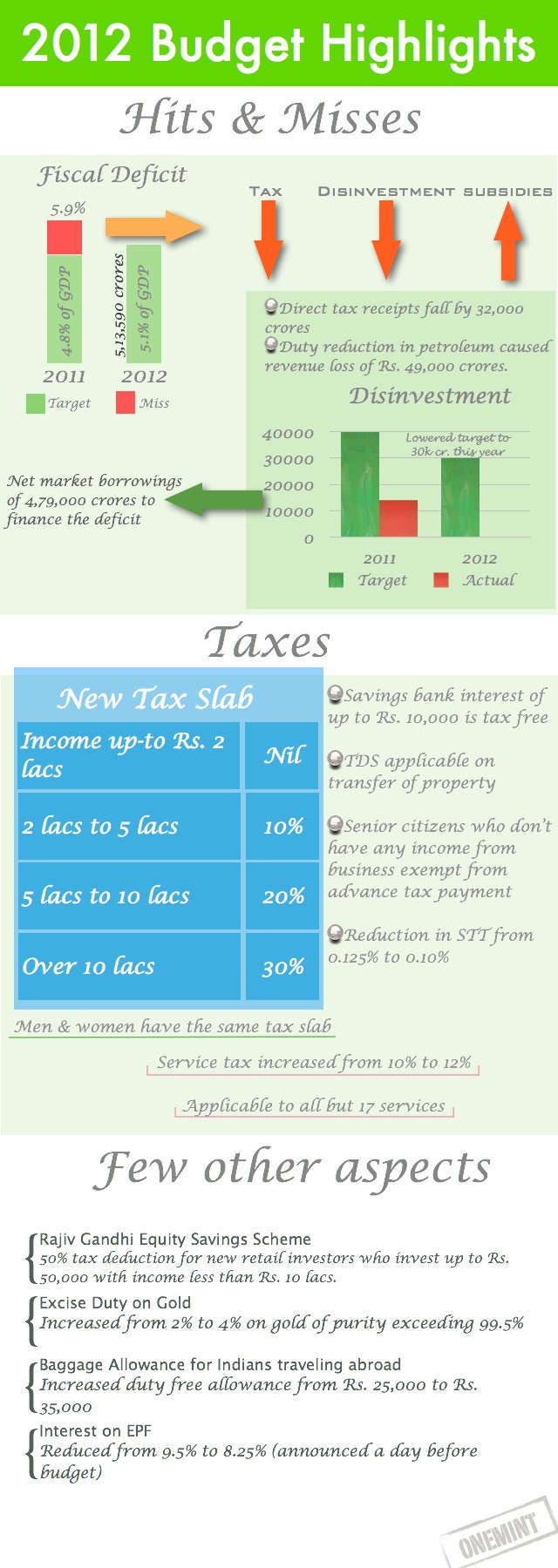

I thought of creating a graphic with some key things from the budget, as well as things that you need to refer to from time to time like the income tax slab.

With that in mind, here is an infographic with the 2012 budget highlights.

To me, these were the key things in the budget to be kept in mind from the perspective of an individual and I’m sure a lot of these will become topic of posts as well.

For instance, the Rajiv Gandhi Equity Savings Scheme is one that could do with a lot more details on who is eligible, how will they get the deduction and if this could be extended to equity mutual funds as well.

What do you make of this? Did I leave anything important?

Rajiv Gandhi Equity Saving Scheme is covered under which section? Is it under section 80 C or having different section? Pls clarify.

Also, the infographics of projected GDP numbers and current account and fiscal deficit (as absolute numbers, since % are already being widely circulated by govt and many other websites)

Regards,

You have done a great job by preparing infographics about receipts part of the budget. It would help further if you can also post the infographics about how govt spends the money. Many people do not know how much is the impact of

1. The subsidies

2. How much money goes in interest payments

3. The ratio of plan and non-plan expenditure

Regards,

Shirish

10X cover must for 10(10D).

This is going to cause havoc. But not many blogs or news papers have picked up the full impact or analyzed it yet.

Almost all insurance companies are losing sleep on this subject, yet the public is still not knowing what is brewing inside.

Finance Minister has done silently what IRDA could not bring up courage to do themselves.

In sept 2010, when IRDA implemented new rules for 10X cover, it was implemented only on regular premium ULIP Plans and not on endowment plans.

Why ?

Probably because SEBI was questioning the logic of insurance cover on ULIP plans – offering very little coverage on the insurance. So, IRDA fixed that problem partially. Single premiums escaped that rule and all endowment escaped from mandatory 10X rule.

Even plans like ICICI Pru Elite life ( regular) offers only 7x for cover for above age 45.

http://www.iciciprulife.com/public/Life-plans/ICICI_Pru_Elite_Life.htm

Now New 10X rule is going to make most of the current plans obsolete after March 31, 2012.

Several endowment plans are affected, for example very popular LIC Jeevan Anand can be used only for 15 years and above for most of the cases. For shorter duration like 5-10 years, this plan violate the 10x rule and would lose 10(10D) benefit.

This is another endowment guaranteed product that need to go. http://www.iciciprulife.com/public/Life-plans/GSIP.htm

Since computer system will not handle the same plan with different rules, all these plans have to be shelved. And since IRDA does not allow any tweaking after their UIN approval, insurance companies have to resubmit new plan proposals.

From April 1 to another 60-90 days, insurance industry is going to be stalled. Very few plans are going to escape this impact and survive.

It is good news for the industry in whole.

Manshu, if possible, pick this matter up and write a new blog. This message need to be carried to all insurance advisers.

In the finance industry, this small change is a very big step towards cleaning up the industry wastes.

RRK-reason to make premium 10% of SA is to discourage people from mixing Insurance with investment. It is a good move actually in Budget. People need to think twice before investing. Atleast by this move Insurance industry will woke up and start selling the products which are combo of Insurance and Investment. In India Life Insurance industry totally forgotten the basic concept of insurance need. So it is awakening call for industry.

Nice collections about budget points 🙂 But about Infra bonds, it was launched in year 2010 and said that it will be for one year. After that extended to 2011. But that declaration is missing in this budget means, so tax pundits claiming it is closed from this year.

Hi Manshu,

I would like to have more details about what finance minister said that a mobile based fertilizer system has been developed and 12 crore farmers will be befitted from this. I run a fertilizer news blog and so want to understand this from the learned persons like you.

Thanks

I wasn’t aware of this but I’ll certainly look it up and see if I can add something on this. I’m sure however that you know a lot more about these things than I do so won’t be surprised if there’s nothing new in my post.

To add to Jitendra’s comment, some sites say that it was announced that Infra bonds deduction has been increased to Rs. 60,000 (which would be great), however other sites say this has been removed all together. Which of these is true?

BIG misses:

– Total exemption limit under 80 (c) should have been increased to at least Rs. 1,50,000.

– Cutting the EPF interest is a blunder. It is the closest salaried individuals have to a social security scheme.

Given how increase in excise and service tax is going to make life expensive, the government should have taken the above steps to encourage savings.

Siddhanth – The budget mentioned that the limit to issue the tax free bonds has been doubled from 30,000 crores to 60,000 crores which means the total bonds that companies can issue can reach this amount.

This doesn’t refer to the individual at all.

Somehow, this was interpreted incorrectly by a few folks as 80CCF infrastructure bonds. 80CCF bonds that gave you the 20K savings were not mentioned by the budget at all. So, this is being interpreted as they aren’t being continued this year which I think is reasonable. But I won’t be surprised if they changed this and bring in the bonds for this year as well since they are fairly popular.

As for the big misses you mention – those are your wishlist items not things actually mentioned in the budget right?

Hi Manshu,

Thanks for the clarification.

Yes, the big misses are individual opinion. No, they were not actually mentioned in the budget.

Hi Manshu,

Two things which can be added here

1. There was something about health check up upto 5K

2. There is lot of confusion about tax exemption upto 20k that we get from infrastructure bonds. Is it still there or removed ?

To Jitendra:

1 – Today we get Rs 15,000 tax exemption towards medical bills. They have inlcuded upto Rs 5,000 within this itself towards preventive health check-up. So, you can show Rs 10,000 medical bills and Rs 5,000 check up bills OR you can show entire Rs 15,000 of medical bills itself.

2 – No confusion. It was there only till FY12. So, since it is not mentoned now, we cannot get 20K exemption on indrastructure bonds. Note that budget has allocated Rs 60,000 for tax free bonds. This is different. here you can invest any amount. Only the interest is tax exempt in this.

Reagrds,

Bhushan.

Jitendra – I have the same view as Bhushan in this.

Thanks Bhushan and manshu for clarifications.

To clarify Rs 5000 exemption provided under Budget 2012-2013 is under section 80D i.e. Medical Insurance Premium. Medical allowance given to employees is under different section (Section 17(2)).

Thanks Jitendra.

Thanks for the highlights Manshu.

I’ve developed a basic version of Income Tax calculator for this year and can be downloaded from the following link: http://blogbyvimal.wordpress.com/2012/03/18/income-tax-calculator-fy-2012-2013/

It would be good if you review and comment on it.

I’ll check that out a little later in the week and leave a comment. But this is for people to start using it from next year onwards right, not for filing taxes this year?

Yes, you are correct. This is for the next year onwards.