This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

ICICI Securities IPO Details – March 2018 Issue

Finalisation of Basis of Allotment – On or about April 2, 2018

Initiation of Refunds – On or about April 3, 2018

Credit of equity shares to investors’ demat accounts – On or about April 4, 2018

Commencement of Trading on the NSE/BSE – On or about April 5, 2018

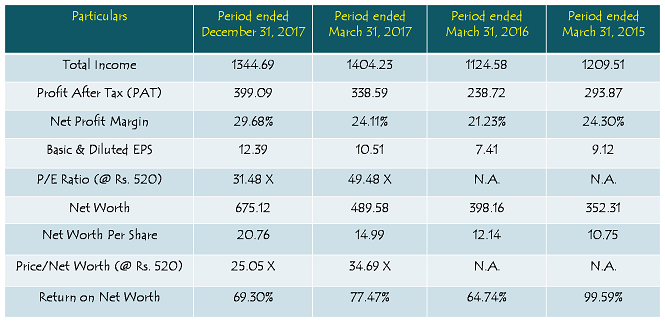

Financials of ICICI Securities

Note: Figures are in Rs. Crore, except per share data & percentage figures

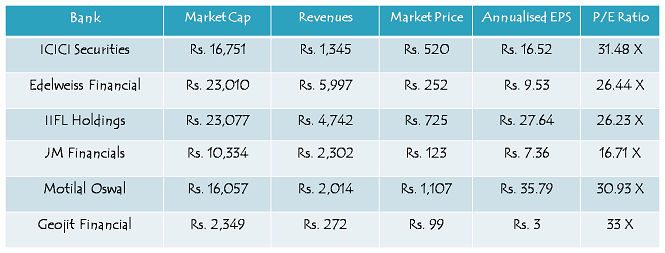

Peer Comparison

Note: Market Caps and Market Prices are dated March 20, 2018. EPS have been annualised taking 9-month EPS as on December 31, 2017.

Should You Invest in ICICI Securities IPO @ Rs. 520?

Suppose, you buy 100 shares of Infosys at Rs. 1,100 with a price target of Rs. 1,150 in say a month or so. But, within a week, without any positive news or development, its stock price zooms to Rs. 1,150 odd levels. You book your profits in this trade and start expecting the stock price to come down the very next moment you sell it. It doesn’t come down and moves to Rs. 1,200 within a fortnight. You don’t buy it, but decide to buy it again at Rs. 1,150, the same price level you sold it at. It comes down to Rs. 1,150, you buy it again at Rs. 1,150 and decide to sell it at Rs. 1,220.

It goes down till Rs. 1,100, but you don’t sell it as you had decided to sell it only when it touches Rs. 1,220 or more. It goes up again to touch Rs. 1,220 levels, you sell it at Rs. 1,220 and again start expecting it to come down as you had just sold it in the expectation of its price to come down. This way, you buy and sell Infosys five times as it reaches Rs. 1,350. This is just a hypothetical example, but I think something similar happens with many of us in a bull market.

But, when the markets start correcting or a bear market takes over, we don’t square-off the same Infosys position at Rs. 1,050 (bought at Rs. 1,100 in the anticipation of Rs. 1,150). Not even at Rs. 1,000. Not even at Rs. 950. Not even at Rs. 900. Not even if goes down to Rs. 600. Then we stop logging on to our trading platforms, become investors (from traders) and decide to sell our holdings only when they bounce back to our cost price. Though something of this sort does not happen with every trader or investor, but something similar is common with most of us. I think you would agree.

So, in a bear market, we trade less frequently, and in turn, our broking firms get less brokerage from us. Similarly, in a bull market, we make money and in turn, generate good brokerage for our broking firms. Something similar happened in the first three quarters of the current financial year and like most other broking firms, ICICI Securities too raked the moolah out of it and its 9-month revenues and profits in FY 2017-18 exceeded its full year revenues and profits of FY 2016-17.

Even with best of its financial performance, the price/earnings multiple ICICI Securities is seeking in this IPO is at 31.48 times its 9-month annualised EPS for the current financial year. I think it is on a higher side, as I don’t expect stock markets to have such similar uninterrupted upswings on a consistent basis. Like stock markets, financial performances of broking companies too are volatile. The company had an EPS of Rs. 7.41 during FY 2015-16. Imagine a similar year in which the company earns an EPS of say Rs. 8. At Rs. 520 a share or above, it would be valued at 65 times or more.

So, if you are a bull right now and have a view that the Indian stock markets will have a healthy upward movement in the next 3-5 years, and most importantly, ICICI Securities will be able to cash it one way or the other, then you should definitely subscribe to it. Conservative or risk-averse investors should avoid it.

Varroc Engineering IPO- Upcoming IPO in 2018.

Issue Open: Jun 26, 2018

Issue Close : Jun 28, 2018

Issue Type: Book Built Issue IPO

Issue Size:20,121,730 Equity Shares of Rs 1 aggregating up to Rs 1,945.77 Cr

Face Value: Rs 1 Per Equity Share

Issue Price: Rs 965 – Rs 967 Per Equity Share

Market Lot: 15 Shares

Minimum Order Quantity: 15 Shares

Listing At: BSE, NSE

Retail Allocation: 35%

More @ http://www.sharpcareerfinancialupdates.in/investment-updates-sharpcareerfinancialupdates/varroc-engineering-ipo-upcoming-ipo-in-2018/

Hi Sir,

I have an allocation of 252 shares and need advice on whether to hold or exit given that the stock has come down drastically. Is it better to sell and invest the amount in another stock? Would appreciate your response/suggestion.

Thanks,

Raghu

Excellent incisive analysis, Shiv?

Hands-on experince of several readers offers a good fodder for action.

Any thoughts for NRIs?

Very good analysis. Decided to follow your blog regularly.

Thank you.

I think you were spot on with your Infosys example. That is how most people would react. Very insightful statement “in bear market, traders become investors” 🙂

Thanks for explaining it so nicely. I’ve been a customer of ICICI Direct since 2004, but “fortunately” due to their high brokerage charges I stayed away from buying stocks and instead invested in MFs….my best investing decision ever.

The main aim of bidding process having floor price and cap price is to provide the investor a chance to buy a share with a price he feels appropriate within the price range.

In case of ICICI securities it is 519-520 as good as fixed price issue.

Its time again for SEBI to think about old CCI premium formula

Too expensive IPO of ICICI securities. When listed within 1 week we can get it in discount price.

As a DP and trading account holder of it since 2005 I have watched it closely and last year shifted to SAMCO discount broker. ICICI securities have too many restrictions. In a single day order in delivery trade the sale purchase is not adjusted ie. for purchase you have to make payment that very moment and the sale proceeds will appear after payout day

Now a days many discount brokers are offering many online services in a competitive prices do the monopoly of ICICI securities will no longer hold.

You have made accurate observations & were wise to move away from ICICI SECURITIES. I too, would not recommend ICICI Securities to anyone. Unfortunately, because of the high charges in porting our investments to another/different named Joint Demat Account, one cannot easily shift to another broker. SEBI should allow ZERO CHARGE PORTABILITY even when Demat Names are transferred from single to Joint Demat Accounts especially for Senior Citizens who opt for the safety of JOINT DEMAT instead of SINGLE HOLDER.

Hi,

I am also holding demat with ICICI and found their annual charges quite hight.

Could you please write an article on steps for Demat account portability charges which is offering best etc.

regards,

Hemant

In my opinion, ICICI Securities’ policies are not customer friendly. They are more expensive, their brokerage/charges are higher. Personalised & responsive customer service is lacking.

Hi S.K.,

That is the problem with almost all of the broking firms here in India. Companies compete here for market share just by offering relatively lower brokerage rates or convenient trading platforms. I think no broking firm differentiates itself by focusing on customer care.

Brilliant analysis ! Also I think Zerodha and other companies offering same services are taking a good share of the market.

Thanks Harinee!

Zerodha’s business model is completely different than that of ICICI Direct. But, yes, discount brokers like Zerodha have taken a substantial portion of the trading market share and probably other brokers, like ICICI Direct, HDFC Securities and Kotak Securities, would never like to match their brokerage rates with Zerodha etc.

Valuations wise ICICI is asking too much premium compared to Edleweiss Financial , JM financial etc.Hence it is better to opt the same in the secondary market rather than IPO.

Hi Subramanyam,

It is natural for ICICI Securities to seek a premium over companies like JM Financial, Geojit Financial, and Edelweiss too, as it is the oldest and pioneer in introducing online trading platform for individual investors. Its brand is bigger than any of its peers. But still it seems to be expensive.