This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Should you invest in Indiabulls Consumer Finance NCDs?

Indiabulls Consumer Finance Limited (IBCFL) is a wholly owned subsidiary of Indiabulls Ventures Limited. The company has a limited track record as it started its lending operations during 2016-17 only. It has a presence in three lending segments – personal loans (29% of total loan portfolio), secured SME loans (52%) and unsecured SME loans (19%) as on September 30, 2018.

IBCFL reported profit after tax (PAT) of Rs. 191.52 crore on a total income of Rs.700.07 crore during FY 2017-18, as against PAT of Rs. 6.69 crore on a total income of Rs. 57.24 crore during FY 2016-17. During the six-months period ending September 30, 2018, the company reported PAT of Rs. 199.29 crore on a total income of Rs. 657.87 crore.

The company launched its lending App ‘Indiabulls Dhani’ in the first half of FY 2017-18 for sourcing its personal loans along with sourcing of business loans, and has been able to scale up its operations significantly post that. Gross loan portfolio of the company stood at Rs. 10,140 crore as on September 30, 2018. Although, the asset quality parameters stood comfortable with Gross NPA ratio of 0.13% and Net NPA ratio of 0.03% as on September 30, 2018, the asset quality of its loan portfolio is yet to be tested as its loan portfolio remains largely unseasoned.

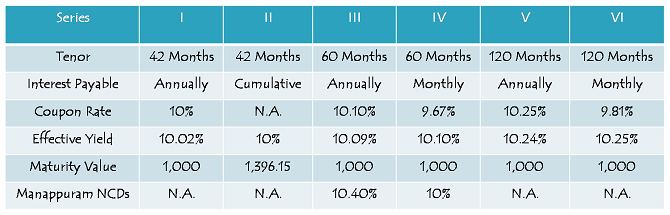

Now, the important question is “Whether this NCDs issue carrying high interest rate of 11% worth considering in this volatile, uncertain scenario?”. The answer could be simple theoretically, but it has really become very difficult to take a decision post the recent IL&FS and DHFL developments. DHFL NCD issues were rated ‘AAA’ till last week, and all these issues received overwhelming response from the institutional investors, corporate investors, and individual investors as well. So, when the NCDs from a ‘AAA’ rated company like DHFL are yielding more than 17-18% and are trading at a discount of more than 25-30%, then it really becomes difficult to take a decision whether to take any further exposure to NCDs of a similar private NBFC or not.

Personally, I would avoid any such NCD issues from a private issuer, at least for the time being, as the problem is that it is not easy to foresee any such problematic scenario well in advance for any such issuer. So, what should be done? Whether we should avoid all such NCD issues from the private companies? The answer is ‘Yes’, if you are a conservative investor, and you don’t want to lose your hard earned money, or if you don’t trust the management of the issuer, or you don’t know anything about the company and its management, or you don’t understand the business of the issuer, or you foresee a decline in the fortunes of the issuer or the industry it is operating in.

So, now when I’m writing these points for this post, I’m getting more and more closer to all those points which I consider while investing in equity shares of a company. Yes, that is the whole point. If you are a prudent investor, rules of investing should be similar for both equity, as well as debt investments, if not the same.

Although, on the other hand, I have a view that the interest rates it is offering are quite attractive and the growth it is showing in expanding its business network is also encouraging. So, if you have faith in Indiabulls Consumer Finance, and its management, and its business prospects, only then you should invest in this issue. Conservative investors should still wait for the NHAI to launch its bonds issue sometime in the last two months of the current financial year.

Application Form of Indiabulls Consumer Finance NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in Indiabulls Consumer Finance NCDs, you can contact us at +91-9811797407