Update: Updated data for Day 4 now.

Day 1 of the MOIL IPO is over, and I thought I’d create a subscription numbers page like I did for the Power Grid FPO. MOIL is an IPO where no new shares are being issued, and the stake of the state and central government is being sold so the money raised from MOIL IPO is going to go to the state and the center government.

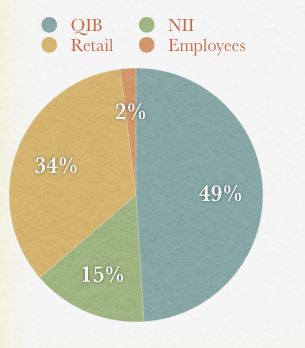

An IPO is divided into various categories like Qualified Institutional Bidders (QIB), Non Institutional Investors (NII), Retail and Employees, and here is how the shares offered are split amongst various categories.

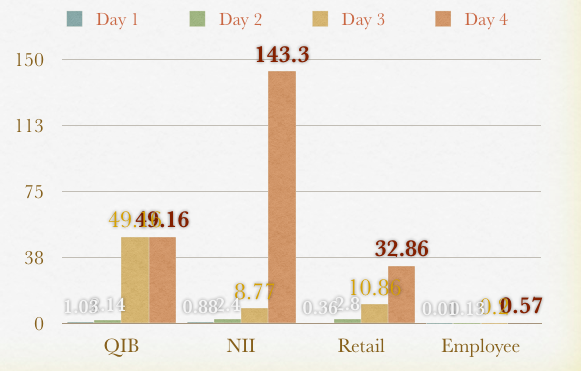

Here are the subscription numbers from NSE at the end of Day 1. I will update these numbers every day to get an idea of how the numbers move.

Update: Look at the QIB number zoom on Day 3, and looks like the retail number will also end up a lot higher than we have seen in the past. I will do a full post once the subscription closes, and update this with Day 4 numbers as well.

The green bar represents the second day from NSE. Usually you see QIB zoom up, and retail only grows on the last day but here retail is slightly higher than QIB on the second day. There are two more days left so let’s see how high the retail goes.

Also read other details about the MOIL IPO.

I have applied for Coal India IPO using my sharekhan trading account.I have applied for the IPO amounting Rs.98000/-(Rupees Ninty Eight Thousand) only.I got 199 shares of Coal India IPO of Rs.46317.25.While applying the Coal India IPO,my address in the sharekhan account was B-38,C/2,Sector 57, Gautam Budh Naga,Noida.In the meantime,I have relocated to Kolkata.The Kolkata address has not been updated in the Sharekhan account.Link intime registrar has sent the refund order cheque of Rs.51682.75 to my old address by speed post,which returned back to Link intime,Mumbai.I sent mail to registrar to resend the IPO refund cheque to my new kolkata address or you can transfer the refund amount by ECS to my dp account attached Axis Bank Account .But till date they have not sent the refund order.I tried to contact the registar so may many times.But they are not picking up the phone.It would be great help if anybody advice me what to do in this regard to get the refund order of coal india.

Thanks in Advance

Hi

If the registrar does not respond, click the link below and forward your complaint to SEBI

http://www.sebi.gov.in/Index.jsp?contentDisp=SubSection&sec_id=38&sub_sec_id=38

SEBI will send your complaint to the registrar and do the necessary followup

and click

Complaint Forms -> Type – I Refund Order and give the relevant details

Loney

Thanks for ur comments.

I haev already registered compliant against registrar in Sebi website(what u have mentioned).Sebi asked the registrar to send the refund order to my new address.Coal indiahas even sent mail to me saying that they will send the refund order to my new address.Its already been month’s time,I havenot got the refund order.I followed up the mail.But no reply from registrar.Please let me know what to do in this situation.

In this case, you may follow it up with SEBI again. Give a complaint again quoting the reference number already generated and state the facts. SEBI will further give directions to the registrar. You neednot worry. SEBI is very vigilant and they will follow it up repeatedly after a justifiable time frame.

i have trading a/c and i am at present doing trading also but i dunno anything bout mutual funds only. how to and when to and where to put in mutual funds

A SIP is a decent way to start, about which you can read here:

http://www.onemint.com/2010/03/24/systematic-investment-plan/

Regular investing in a consistent fund like HDFC Top 200 or something is a reasonable start. You can start with an amount which is much lower than your actual investing ability to get a feel of this, and explore other avenues.

I’m afraid this question is quite broad in scope, and just a comment may not do much justice to it, but this is the way I’d start.

i have applied 6 lots in sci can you tell me how many shares i will get

I don’t know about this one.

i have applied 31 lots in the moil issue can you tell me how much i will get

You will probably get close to one lot because of the heavy over-subscription on the IPO.

i have applied for 31 lots in moik issue can you tell me how i will get

hey there can anyone tell me about mutual funds.

i am thinking of investing in it.

Hmmm Neeti – at what stage are you in? I mean do you know conceptually about mutual funds, do you have a demat and trading account or are you just starting out?

Hi,

Thanks for the clarification… Any idea when it is going to be listed? I searched in the Net but didn’t get any info.

Thanks

Sayantani

Two to three weeks is my guess Sayantani – probably closer to two than to three. You can take a look at the IPO calendar here to see the difference in time between close and listing of two of the recent disinvestment IPO / FPOs.

http://www.onemint.com/2010/10/31/india-ipo-calendar/

it will be listed on 15th dec

Thanks for the info Neeti.

MOIL IPO subscription crosses 56 times

Impressive but only about a tenth of the Sinopharm Pharma IPO (Chinese) which got oversubscribed 570 times!

http://www.onemint.com/2009/09/22/crazy-oversubscription-numbers/

Yes! Only chinese economy can support such large issues. If any issue gets such a huge response in india of that magnitude, it will suck the whole liquidity in the indian markets and we will have to wait for RBI to infuse fresh liquidity into the system. I am definitely not in favour of retail investors subscribing to IPOs without knowing the financials, fundamentals and the future prospects of the company. I have been subscribing to these IPOs and FPOs of PSUs only because they have been reasonable priced. I donot want to lose money in overpriced issued like Reliance Power, SKS Microfinance etc to the greed of investment bankers. Like C B Rightly pointed out then, there should be some thing left in the table for the retail investors.

The last sentence should read …

Like C B Bhave rightly pointed out …

I don’t think even they’re able to keep up the pace now. I keep reading stories about some IPOs getting pulled up at the last minute, so I think even they are cooling down, and investors must have made some losses. 570 times is just crazy! I wonder if they calculate it differently or what.

SEBI is doing a great job. The efforts are all in the right direction, and there seems to be an honest upright person at the helm.

We can expect the retail subscription to be more than 25x

So, anybody who has applied for less than 25 lots can expect 1 lot to be allotted and those who applied more than that can expect about 18-19 shares. I don’t think anyone has a chance of getting more than 20 shares

MOIL IPO subscribed a whooping 55 times

How many i will get..i applied for 7 lots/119 shares..any guesses??

Probably one lot.

Looking at the current subscription numbers for MOIL Ipo (Retail Investors) i.e. subscribed 14 times till 12:00 Noon..I don’t think that i will be able to fetch more than 1 lot i.e. 17 shares.. 🙁 This was my first experience in the stock market..can say was not very good…

Hi MS

No need to feel it that way. My first IPO application was for Reliance Power and I was the very few lucky applicants whose application got rejected.

Also it seems that due to the increase in the limit for RII no one is expected to get more that one lot. Even those applying for the maximum in all probability is going to get only one lot. That’s why i revised my bid size to one lot so that my lien is atleast released and i can use the money.

Hi,

I applied to IPO/FPO thorugh IIFL online account. How to use the ASBA in it?

Hi,

I had bid for 4 lots of MOIL IPO through HDFC securities site; I selected ASBA retailer, and selected “Cut off price”. All other values like PAN no, DP no etc were auto-filled from my account.

The bid is in “Executed” status and I have got the Exchange order ID also.

What are the chances that I will be allotted all 4 lots? Or will I get any at all? I have read that if I select “Cut off price” then it guarantees that I will get the shares (by the logic of book building process).

Thanks

Sayantani

Hi Sayantani…looking at the current subscription rate i.e. 10 times..u may end up getting 1 lot only…

I think what you’re referring to Sayantani is the comparison between a person applying at cut – off and another applying at a lower price. The thing with that is say you apply at 375, and I do at 340, and then MOIL fixes the price at 375, then in that case I won’t get anything at all.

But you will get something. What that something is depends on the overall over-subscription in the retail category assuming you applied under that.

So, like in this case the issue is quite oversubscribed, and as Loney says there is very little chance that anyone gets over 20 shares.

Guys.. My account has not yet been debited.. I had applied for 306 shares.. any idea.. I fear if my application is rejected 🙁 any idea??

Hi Hari…lets say the amount is X for 306 shares..that X amount will be considered as lien balance (you cannot withdraw that amount) and it will be deducted only when you will be alloted shares..suppose you get 306 shares then complete X will be deducted otherwise the amount deducted will depend on the total price of the shares alloted to you…trust i have answered your query 🙂

Hi MS.. So do you mean to say that the no amount would be debited from my SB sccount till the time of allotment??

When I applied for Coal India and Power Grid, the entire amount got debited from my account and subsequently refunded post allotment..

please clarify..

The amount will be under Lien Balance (mentioned separately) in your account. The same amount cannot be withdrawn and used for other purposes. It is allocated for 306 shares, just in case you end up getting 100 shares then only amount for 100 shares will be deducted and rest of the amount will come under avaliable balance (post allotment). Currently your Total balance will be Lien Balance + Available balance (pre allotment).

As far as my knowledge goes applications process is started after all bids have come or when IPO is closed. MOIL Ipo was closed at 3 PM today, so no point your application got rejected 🙂

oh… Many thanks MS 🙂

Thanks MS, that’s certainly a very comprehensive explanation. Appreciate it.

Even though we have a very good market regulator who sees things in perpective, there are a few instances when even SEBI can go absolutely wrong. One of the things that went absolutely wrong is the enhancement of RII limit to 2 lakhs. It is one move that will hurt small investors because all issues will be oversubscribed to a very large extent and hence small investors will receive a small quantity of shares.

Take the case of MOIL ipo, now retail investors can expect to get only 17 shares irrespective of the bid size since it is so overtly oversubscribed in the retail portion.

Hi Loney,

Thanks for that detailed response. That’s very helpful, and I think a lot of people will benefit from it. Appreciate it very much.

Hi,

By mistake i had mentioned the details of my brothers dmat account for IFCI infra bonds. The bonds have been allocated to him though the cheque was under my name and the form had my Pan no. How can i transfer these bonds under my account to get the tax benefit. My bro already has done his invest of 20 in infra binds so he has excess and i have no tax benefit bonds….

kk, the prospectus says that you can’t transfer the bonds within the lock in period. You can check with your agent to see if they have a way out, but I won’t be too optimistic about it.

Also, if you leave another comment please leave it on the IDFC thread, as a lot more people following the IDFC bonds are reading that, and you have a higher chance of getting a response from multiple people.

Thought i should share the info…Moil India IPO by the end of 4th day got subscribed by 2.37 times, tomorrow is the closing day for the QIB. Almost all the category has got subscribed by more than 2 times (approx) including the Retail side. Employee category is yet to get fully subscribed.

Thanks MS, I updated the post with these numbers too. Appreciate it.

I would also like to know about the SCI FPO? Can you put your expert views on the same?

Here is a post on SCI

http://www.onemint.com/2010/11/18/shipping-corporation-of-india-fpo/

Can you please use your initials or something please. Using such a long string may cause your message to go to the spam folder, that I never check.

Thanks alot for the information…

Hi..I have bid for 6 lots (approx Rs. 45000) under Retail category..what are my chances of getting an allotment/shares. Is it like if I bid for more number lots (shares) then priority is given.

The chances depend on the final over-subscription in the retail category at the end of the IPO process. So, say the retail category is over-subscribed 10 times, you can then expect getting about 1/10th shares of what you applied.

This is given everything goes right, and there are no errors in your application etc. which can happen sometimes.

You are talking about what errors..i bid using ASBA..it only ask me for my Name, Email id, Client ID, DP ID, Name of the IPO, amount of shares, and the price/cut off price…trust i have followed the right procedure…is there anything else (some manual paper process)…please let me know…and yeah Thanks alot for the infomation provided by you…look forward to your reply…Thank you.

Errors on those forms only. If you see the Power Grid comment thread you will notice that some people didn’t get any shares at all and that was probably due to errors. So, that’s the only reason I brought it up. It doesn’t happen too often though.

http://www.onemint.com/2010/11/23/powergrid-fpo-allotment-declared/

Hi

I would like to draw your attention to the recently concluded Powergrid FPO. There the oversubscription was about 3.75.

No. of Powergrid shared bid for Allotted

65 65

130 65

105 65

260 69

Since the registrar for this issue is also Karvy, you can expect the same scheme of allotment to be followed.

Taking cue from the above trend, (assuming an over-subscription of 6 times which looks a possibility due to the IPO garnering 28x on the penultimate day), you can expect an allotment of the same 17 shares whether you apply for 1 lot or 6 lots (if the same methodology is adopted).

No. of Powergrid shared bid for …….Allotted

65 ……………………………………………..65

130……………………………………………. 65

105 …………………………………………….65

260…………………………………………….. 69

Thanks Loney, appreciate this information! Hey do you have any idea on why people who seem to have all their info filled in correctly because they are using online services are not getting any shares allotted in some cases?

Take this comment for Bhavana for instance, she applied through Kotak but got zero out of 65, whereas she should have gotten 65 out of 65. It’s a little strange….any thoughts?

http://www.onemint.com/2010/11/23/powergrid-fpo-allotment-declared/comment-page-1/#comment-111507

Hi Manshu

I read the post of Bhavana

http://www.onemint.com/2010/11/23/powergrid-fpo-allotment-declared/comment-page-1/#comment-111420

Here she mentions that she applied for the minimum lot and still got allotment. Her query is regarding the application number not fetching her the details of allotment from Karvy. This is quite common if you use online ASBA. Hence it is advisable to fetch the data using demat account number credentials rather than using the application number as a credential.

Regarding the non-allotment,

Everyone can be confirmed about their allotment if they use the online ASBA facility through online internet banking facility offered by banks like AXIS bank and SBI.

Whereever the form is filled manually, there is a possibility of typo errors leading to the rejection of application form.

So the best way is

1. Use online ASBA offered by banks

2. Use the online ASBA filled forms that can be printed from the websites of BSE / NSE Book-building live section

For MOIL

http://asbaforms.bseindia.com/bsesite/PreAddAsbaIpoEntry?id=7

For SCI

http://asbaforms.bseindia.com/bsesite/PreAddAsbaIpoEntry?id=8

3. If you are using your online broker’s services, always try to get the exchange order ID of the bid so that you can be sure that your order has been bidded to the exchange. Even ASBA applicants can get the exchange order id on request from your bank.

4. Never submit two application forms. When applications are sorted using PAN numbers and if there are two application forms with the same PAN numbers they are liable to get rejected.

Online Application, ASBA, Exchange Order ID, not more than onbe application form –> If you have all these, you can expect confirmed allotment

Hi Loney,

I guess you interpreted my question wrong. I bit for minimum lot but havent received any shares. In addition to that, I am unable to get any info from the Karvy website.

Hi Bhavana

What is your mode of application?

1. Online ASBA through internet banking of a SCSB

2. Manual ASBA submitted at the branch of a SCSB

3. Broker through online trading account

4.Broker through manual application form

Also check your application status through the karvy karisma website giving your demat account number as a credential rather than giving your application numnber as a credential. You can also try be giving your PAN number as a credential also.

With these information, we could gauge where the problem lies.

I have personally come across brokers who (in oversight or whatever) donot bid our application that our bid never goes to the exchange for bidding. The only way to prevent this from happening is to ask for the exchange order ID from the broker and then take up the matter with the Registrar. If the Registrar does not respond you can file an online complaint with SEBI. Since we are blessed with an excellent and proactive market regulator like SEBI, who also puts investor protection its top priority, you can be assured that your complaint is forwarded to the exchange and is followed.

Hi Loney,

I applied through Online ASBA through internet banking of a SCSB (Kotak). I’ve tried checking through DMAT or PAN details – there it insists for Applcation No. but I cant enter anything in that text field (i.e. the cursor directly goes to the next field, i.e. Full Name). So i’m stuck there. Looks like I’m having all the bad luck in the world with this one!

Hi

If all the details you entered in the form is correct, I think this is the classic case of your SCSB not having bidded your application in the exchange.

You can call the phone banking of Kotak and ask them for the exchange order id. If they have successfully bidded your application, they would give you one and you can take the matter with the Karvy using the id.

If they couldn’t give you the exchange order id, it means they are at fault and take the case with their higher authorities.

Thanks for your insight in this Loney. I was certainly unaware that these things happen regularly, these things so I learned something new. Appreciate it very much.

wow… thanks Loney, for all this info. I’ll definitely get in touch with them and check. Will update back on whatever I hear from them.

This is a great learning for anyone who’s new. most of the other people i talked to said i didnt get any because I bid for just 1 lot, and that ‘it happens’. thanks!

Bhavana, Thanks for discussing with Loney, and I think this discussion will be beneficial for a lot of folks, and has certainly been very useful for me.