Another post from Suggest a Topic.

This time we’re going to cover the recently announced SBI retail bonds, and if last time was any indication these will become hot as hell when they open for subscription.

For this post I’m going to cover the features of these SBI Retail bonds, and then answer some questions leveraging what people asked last time around.

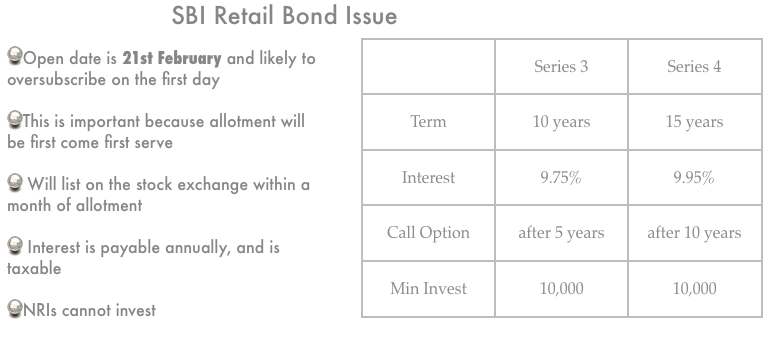

SBI Retail Bonds: Open and Close Date

I think only the open date is important in this issue because last time around the issue got over-subscribed the first day itself, and it’s quite likely that it gets over-subscribed this time again.

The open date for Tranche 1 is February 21, 2011 and close date is February 28 2011.

If you decide to buy these bonds, then I’d highly recommend doing so on February 21st itself. If you’re not able to buy them on February 21st then make sure to check how much they have been over-subscribed by since these SBI bonds are on first come first serve basis, and there might be no point in applying for them after the 21st.

Interest Rate on the SBI Retail Bonds

For retail investors these bonds will pay out 9.75% for the 10 years series, and 9.95% for the 15 years series.

| 10 years | 15 years |

| 9.75% | 9.95% |

There are banks that give you 10% for fixed deposits, but none of them allow you to lock in to that rate for this long a period. In that sense – these SBI bonds are offering quite a good deal compared to whatever is available at present.

I say at present because that’s important. When SBI came out with their retail bond issue last time around – there was a huge demand for that and it was a pretty sweet deal too. But, that was at a lower rate than the current offering, so you don’t know how interest rates are going to look like 5 years from now or 10 years from now.

Your money does get locked in with the SBI bonds since this is not like a fixed deposit that you can break at your will. If you go for the 10 years tenure then it will be redeemed at the end of 10 years.

SBI has the option of redeeming them at the end of 5 years and 10 years as well (more on that later), but they will only do so if the interest rates are lower at that point in time, so in that sense – keep in mind that you are committing to the redemption time period.

SBI Bonds will list on the stock exchange

These bonds are going to list on the stock exchange so you will have the option to sell them in the secondary market even if you can’t redeem them.

Keep in mind though that bond prices move about in the secondary market, so this is not the same as redemption because the prices will depend on the demand and supply plus the interest rates at that time.

Minimum and Maximum Application

The face value of one bond is Rs. 10,000 and that’s the minimum investment for the retail investor. The maximum application amount for the retail investor is Rs. 500,000.

Compulsorily in Dematerialized form

These bonds will not be issued in physical form, so you will need a demat account in order to apply for these bonds. Since this is a short point I’ll add that for the 3 of you who care these are unsecured bonds, but are rated AAA by CRISIL.

Can I get loans against these SBI Retail bonds?

No, you won’t be able to pledge these bonds like fixed deposits, and get loans against them. Similarly, you can’t break them before time like I said earlier.

Can NRIs apply for these bonds?

No, NRIs are not allowed to apply for these bonds.

When will the bonds start trading in the stock exchange?

You won’t have to wait for a long time for the SBI bonds to start trading on the stock exchange. If last time was any indication then the trading will start in less than a month of allotment.

What kind of listing gains can I expect?

I wish I knew because then I could make money without doing any real work, but alas that’s not to be. I’m sure there is going to be a lot of speculation around this, and the only input I can provide is that last time around the SBI retail bonds listed at a 5% premium.

Can I apply for the SBI bonds online?

No, there’s no option of applying for these bonds online – you have to necessarily apply using the physical form.

Is the interest from these bonds tax free?

I’ve had at least a couple of questions last time on this, and I think somehow the fact that the bonds are listed makes some people think that the interest is tax free or that there is no capital gains tax on it. This however, is not true – the interest is taxable, and if you make any capital gains selling the bonds then that’s liable to tax as well.

Where can I buy the SBI bonds from?

You can get the application form in a bank branch, and then fill it and submit it there. Someone told me last time that it helped to go to the bank before hand and get the forms and fill it because of the rush later on. I don’t know how true this will be for everyone, but sounds like a good idea.

What does the call option mean?

There is a call option with this bond which means that for the bond with 10 years tenure SBI has the option to redeem it after 5 years if they want to, and for the bonds with a 15 year tenure SBI has an option of redeeming it in 10 years if they want to.

Remember, this is their option – not yours. They will exercise it if they see it fit, but you can’t ask for buyback after 5 years if you want. In that sense this is different from the infrastructure bonds, which are the other bonds currently selling in the market.

I’ve tried to answer all questions I could think of, and have kept the post as simple as possible. Please feel free to ask any question that I have left out, and I’ll try to answer them, and of course there are a lot of other smart readers who answer questions these days, so you may not even need me.

how much time taken by bank to list the bond in nse bse

less than a month.

thanks manshu

pls tell me if i will sell my bonds after three month can i receive my interest ?

No, I’d expect the first interest payment to be in April of next year, so as far as I can tell you won’t get any interest. The price may be higher (in all likelihood) than what you paid for but you won’t get any interest.

I dont think so Manshu. They will pay the interest however small it may be on 2nd April.(else they would have to compound the interest) Also the prospectus talks about 4% interest rate for people who did not get allotment and 7% for the people who did get it. The prospectus says this interest will be credited separately(2 separate transactions. Refund interest and if applicable, refund)

Neel,

Thanks for your comment, and I think what you say makes sense. In fact, holders of infra bonds recently got a small credit in their bank accounts like some 36 bucks in one case or something which was the refund of application money, so what you’re saying appears to be correct.

SBI will pay interest on the bond from allotment to 2nd April, however small that may be.

Thank you for pointing out my error, and I apologize for the mistake.

Ah, no error mate. In fact, this was the most comprehensive article I found on SBI Bonds! Thank you for that.

Hi,

Thanks for the details on SBI bnds. I wish to know if I can apply in physical form?

R only in demat?

No, you need a demat account.

Thanks Manshu…

It is little odd to see SBI bonds require Demat accts but doesnt allow to apply online brokerages … what clould be the reason?

SBI Bonds can be purchased online too from edelweiss broking..

Hope this helps people from the hassle of going to bank branches…

Am not sure about other brokers ..hopefully others also should be following the suit….

Thanks for this info Kapil – have you used this option yourself? I’m a bit surprised that the online option is available since I don’t think it was there last time around at all.

Yes thats right.. Edelweiss Broking is offering the option of applying it online.. I’ve my Demat A/Cs. with both Edelweiss & Kotak.. Kotak is not offering this facility..

Shiv,

I too have Demat A/c with both edel and kotak…Nice to see member like me…

Cheers Kapil!!… 🙂

Hi Manshu,

I have used this option by edelweiss for purchasing the ifci infrastructure bonds..

In fact it is just one click ..;)

Edelweiss Broking website is quite user friendly..

yes – thanks Kapil – that was a very useful piece of info and I actually wrote a full post about it with due credit to you. Did you see that yet?

Awesome – thanks again!

HOW MUCH TIME IN LISTING & ALLOTMENT IN SBI BOND ?

HOW MUCH MAX.TIME GIVEN FOR LISTING & ALLOTMENT BY SBI ?

Within a month (please don’t use all caps as it’s harder to read).

Since the interest rate for Indivisual and HNI are differnt how much liquidity will be there for bonds purchased by retail people

i.e. Can Retail buy 15 yr bond 9.95 and sell it on listing date and same can be bought by HNI

My worry is if all retailers try to sell on listing date and if HNI cant buy them I doubt if retailer would find any buyers

Thanks

Yeah, they’ll be marked with different series and will trade for different prices due to the varying interest rates so there is no restriction on buying from the secondary market when it lists.

hi

SBIN-N2 is quoting 10,355. they will pay interest on 02/04/2011.

Let suppose i buy it today from nse/bse.

then will i get interest from today???

or from the date of issue of bond???

Interest will be paid to the person who holds it at the record date. It doesn’t matter when you buy it as long as you own the bond on the record date you will get the interest. The price of the bond will of course adjust accordingly.

hi, thx for the reply

i have another question.

isn’t SBIN-N1 running in discount???

yesterday quote was 10,231.63

but it’s value is 10,000+268(interest accumulated from 4-11-10to18-02-2011)=10,268

Don’t know about that. I have no real world experience of dealing in bonds so there might be something I’m unaware of and I’d rather not comment with my part knowledge.

is the interest cummulative/compound?

Hi Mr. Prakash… Interest is paid annually..

Hi All

The SBI Bonds are going to attract Long Term Capital Gain Tax of 20% with indexation and 10% without indexation. So if an investor applies for these bonds & sells them after March 31, 2012, he/she will get “Double Indexation Benefit”. Taking benefit of this & paying 20% with indexation, the tax liability would be almost near to zero or probably notional Capital Loss itself. So the investor will have a good time paying no taxes at all.

Suppose you invest Rs. 1,00,000 in these bonds, Cost Inflation Index (Notified by the Govt. every year) for 2010-11 has been 711 and assuming it to be 806 for 2012-13, your Cost of Investment comes out to be 1,13,361 (1,00,000*806/711). Taking into account 9.95% interest, the market value at that point in time would be near about Rs. 1,11,000. So there would be a notional Capital Loss of Rs. 2,361. I would recommend investors to apply for these bonds as its an all gain investment whether you want to invest for 9.95% (15 years)/9.75% (10 years) interest, Short Term Listing Gains or Long Term Capital Appreciation. These rates are very attractive from a bank like SBI. These bonds are just 2nd to RBI Bonds. Happy Investing!!

To invest in SBI Bonds or for any other info you can Call/SMS us at 9811797407 (For Delhi, Gurgaon & Noida).

Hi,

Couple of questions:

1) Why do we say money is “locked” in this article?. As its mentioned as we go below in the article, we can always sell it in the market once its listed. So, technically we are not locked . Just wanted to understand this.

2) Wondering why only SBI only is offering bonds and no other big banks are offering the same (and that too in such quick succession).

Cheers,

Ravinder

Hi Mr. Ravi

Its mentioned here as locked because SBI will not buyback the bonds from the investors during the tenure of the bonds and the market liquidity is subject to the availability of sufficient no. of buyers for these bonds.

Nobody can answer why other banks are not offering these kind of bonds but I think SBI is offering these bonds to popularise the corporate bond market for its bonds and to make retail investor friendly image for itself, apart from the requirement of long term funds.

It could also be that the bank’s outlook on interest rates is bearish. If the bank wants to raise more capital but expects interest rates to be higher in the near-term (5 years when the first bond becomes callable) and perhaps also in the long-term (10 years), then it’s a good deal from the bank’s perspective.

If that is the true case, we should expect to see other banks issuing such bonds if there is consensus on that outlook.

hi, i want to ask if there will be tax deducted at source on the interest on these bonds. Normally TDS is not there on demat bonds if i am right. It would be of great help if you can clear my doubt.Thank you.

I don’t think there would be but I myself am not very sure about that.

Hi Sohil.. There would be a TDS on these bonds if the interest amount exceeds the prescribed limit of Rs. 10,000, in a Financial Year..

Thanks Shiv – appreciated as always.

Thanks! for the arcticle.

If I Invest as aretail investor then I would be eligible for 9.75% on 10 year bond while the non retail investors would be eligible for lower interest.

Then if I have to sell the bonds then can I sell to any investor (institutional or retail) or I have to sell to other retail investor only and through an exchange how can i monitor that?

Would there be separate listing for the retail and insitutional bonds for similar tenor.

can the inistutions later buy the higher interest rate bonds through the stock exchange??

Regards

Rishi Kumar

Yes you can sell to anyone on the secondary market, and they will be listed separately and have different prices as well.

Thanks for the information on the bonds. It seems like a good return on a relative low-risk investment. Since 10/15 years is a long time (relatively), do you know if beneficiaries can be added to the bonds?

You can nominate someone – yes.

How can I sell these bonds on the exchanges? I am not able to find the code for the earlier bonds issued by SBI.

PS: In other words, how do I buy the bonds issued by SBI a few months ago, from the market?

Another reader – Parth Patel had answered this question earlier, so I will just paste his response here:

“Pankit,

You do not require a different platform, they can be sold normally like any other stock.

In Odin, the NSE scrip id is 20518 for the N1 bonds (9.25%), and 20520 for the N2 bonds (9.5%).

Give your broker this info if you need help with Odin.â€

Manshu Hi,

Thanks for posting this well researched and informative piece. I do not how how to clauculate the payout on these bonds. Could you please illustrate the payout on say an investment of 1 Lakh (in the Sbi bonds) for a duration of both 10 yrs and 15 yrs. I would highly appreciate it.

Rgds,

Amit

Since they are going to pay out interest annually this is simply the amount of interest in your principal every year.

So, if you invest for 10 years then you will get 9,750 for the first 9 years as the interest, and at the end of tenth year you will get 109750.

The interest is fully taxable so tax will depend on the slab that you’re in and I’m not considering it here.

Small, silly doubt here… regarding call option, you had mentioned that if the interest rates have come down at the end of 5 years from the present levels, SBI may use the call option at end of 5 years for a 10 year Bond. And I also understand that it’s at the sole discretion of the bank to use the call option.

My question is, if SBI uses the call option, it’s the subscriber who can decide whether to use it or extend the bond till maturity period, right? It’s not something like a forced redemption if call option is utilized, right?

Yes it is. Usually callable means that the company can withdraw the contract. Here, the option lies with the bond issuer.

Yeah you could call it a forced redemption. If they call their bonds – you can’t refuse them, and they will pay you the money and redeem them.

CALL OPTION MEANS “RIGHT TO BUY”. ITS CALLED C+. THE OTHER SIDE TO IT IS C- i.e. OBLIGATION TO SELL. HERE SBI HAS THE RIGHT TO BUY & THE INVESTOR HAS OBLIGATION TO SELL. SO IF CALL OPTION IS EXERCISED, WE HAVE TO SELL IT.

Hmmm, interesting!! Thanks Manshu, acethecfa & Rahul for answering my query. Anyone knows of a previous instance when a bond issued by a bank was redeemed using call option and investors couldn’t get the max returns?

Though I doubt interest rates will be lower at end of 5 years from the present levels, looking at the way Indian economy is heating up and inflation soaring.

I think these issues just started recently so I don’t think there has ever been a precedent of them.

Thanks for this very comprehensive artical.

To RASHID A. DADLA:

Interest will be payable on annual basis.

A what intervals is interest paid, monthly, bi-yearly, annually or on maturity?

Interest is going to be paid annually Rashid.

I think there were two options interest pay out yearly or interest accumulate – By mistake I choose interest payout yearly – is there are any way I can change the option of SBI bond from interest payout yearly to interest accumulate? Thanks

Thanks for all the details.

You’re welcome Natti.