Recently I wrote about the IFCI Tier II Bonds, and Shiv and Value Investor commented on that post letting me know that Muthoot Fincorp has also come up with a debt offering.

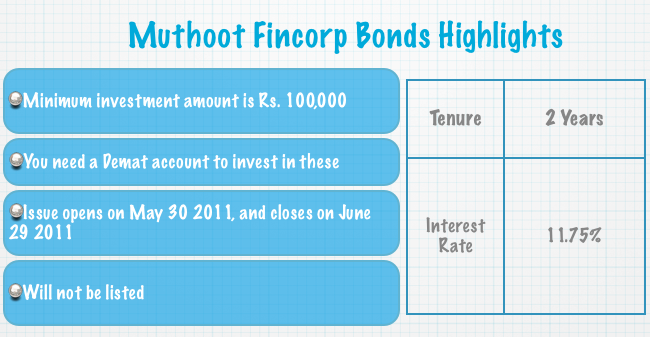

They come with an interest rate of 11.75% per year, and have a tenure of 2 years.

Krish and Mithlesh left a comment on the IFCI post about Lakshmi Vilas Bank offering an interest rate of 10.50% for 1 year – 2 year deposit, and as far as I know this is the highest any bank is offering right now. So, investing in Muthoot’s debenture gives you that much extra yield (for the extra risk of course).

The debentures are secured debentures, and the issue opened on 30th May 2011, and will close on 29th June 2011.

The minimum investment required in the Muthoot Fincorp Debentures is Rs. 1,00,000 and unlike the IFCI bonds they’re not going to list on a stock exchange, so you must shell out at least Rs. 1 lac if you want to get in on these bonds.

They don’t have any tax benefits, and will only be issued in Dematerialized form, so you need a Demat account to invest in these.

How does it compare to the IFCI issue?

Since the IFCI issue is also open now, the natural question is how the Muthoot bond issue compares with the IFCI one.

To me, the benefit of the IFCI issue is that you get to lock down to a high interest rate for a reasonably high duration. This is unique to the issue, as banks these days allow you to get a good interest rate for a year or two, but as the duration increases the rate of interest decreases. This probably indicates that banks think that rates will be lower in the years to come, and in such an environment bond issues like SBI and IFCI allow you to lock on to a high interest rate for longer durations. The fact that they’re listed mean that you can sell them off if you need money before the maturity.

The Muthoot bond has a maturity of only two years, so it doesn’t have these benefits. It won’t list either, so someone who wants to buy the bond should primarily be convinced that the additional 1.25% or so is worth the additional risk.

These are secured bonds which means that the loan is backed by real assets, but I don’t know of the details about what assets are used to back the loan, how are they valued etc. For whatever it’s worth the issue is rated high by CRISIL so you can probably take that into account in your decision making as to what the additional risk is worth.

In my mind, this additional 1.25% is definitely not worth exposing a large part of your savings, and I personally would never invest more than 5% or so of my savings in this, if even that.

Hi

i need to know current rate of interest on muthoot fincrop debenture for senior citizens

Dear Mani,

Please find the details for senior citizen , muthoot is offering

1yr – 11.5% p/a, if they want to take the interest monthly then it is -11%.

18mths -12.5%

24mths – 12.5%

36nths-12.5%.

which is the best instrument for tax saving purpose(5 years fixed deposit)? and what is the minimum amount is multiple of?

Best depends on you’re risk appetite really. There is no one answer that suits everyone. IF you can take a little bit of risk then try ELSS mutual funds. If you want safety then try 5 year bank fixed deposits. If you’re okay with having money invested for a longer time then PPF is pretty good as well. Here is a list of all instruments. You will have to read through them to figure out what makes sense, unfortunately, there’s no one size fits all solution here.

http://www.onemint.com/2011/01/05/section-80c-tax-saving-schemes/

Also, if I were to buy the IFCI issue where will I sell my bonds if I have to??

Hi How does one buy/sell bonds in the open market? I have an account w ICICI Direct but they do not offer such a service on their website. Also, is the STFC bond issue out? How does one invest in these issues if your normal broker isn’t offering them. The bond market is so much more attractive compared to others in the current scenario.

Is there TDS for IFCI bonds ?

Thanks, I got what you were trying to say. I was just expressing my views on Subodh’s comment regarding asset allocation.

And I do agree, it is a completely personal choice depending on a lot of factors that are specific to an individual.

Personally I have never followed any thumb rules and have been doing great so far!

There is no TDS on IFCI.

Is Avon Corporation Ltd Fixed Deposits safe for a FD as its assuring 14.19% return?

Details: http://www.hdfcsec.com/ContentPages.aspx?docid=201009090611037343750

So, the rate of interest is 11.75% per year for 3 years, not 14.19% – that’s high, but not as high as 14.19%. I’m not familiar with Avon Corporation, so I’ll not be able to say how secure it is – personally I try to keep away from such issues though.

Thanks for this article Manshu! Looks like IFCI is a much better option as it gives a good interest rate for a longer period and it will be listed on exchange and hence the liquidity option.

Thanks Mithlesh – I guess that depends on what an investor is looking for – I’m sure there will be a class of people who are interested in a slightly higher yield and not looking to lock their money on for long. This will be good for them. To each, his own!

Hi Manshu

I have sharekhan and emkay trading accounts and cannot see such issues there. is there no way to apply online or only a few dmat accounts offer such bonds?

I’m not aware of such a way Mithlesh. In fact I wasn’t even aware ICICI Direct has that option before someone left a comment. How much does an ICICI Direct account cost extra? It seems that if something is available online, it is present in ICICI Direct.

No, this muthoot one is not availaable on icici direct.

Edelweiss is offering IFCI bonds for online purchase…

Forgot to mention that even TMB is offering 10.5% for 20mths 20 days.

Also minimum amount of one lac is too much for small investors…

Yeah, as Shiv pointed out in the last issue – the size is so small that they can probably just get HNIs to invest in these and get the full subscription.

I do agree with you. Investing more than 5-10% of total portfolio in debt instrument doesnt make sense. Better to do systematic investment in selected Equity or balanced Mutual funds.

Even I think 10% is max one should invest in debt. Since my portfolio is largely skewed towards equity, I am aggressively evaluating high interest bearing long term debt instruments.

Although I have applied for the IFCI bonds, I was a bit hesitant due to their unsecured nature.

Also, some banks like Tamilad Mercantile are offering 10% for 5-10 years. http://www.tmb.in/interest_d.htm.

Was wondering if these kind of banks are worth for long term commitments. How does one evaluate?Any suggestion?

The government guarantees Rs. 1 lacs for banks, so in that way at least that amount is secure. Plus I don’t think there have been a lot of bank runs in India. Co-operative banks may have struggled but other than that we’ve had a pretty stable banking sector.

I think this is actually a good idea for a post to see how many banks have gone bust in India since liberalization. I’ll see if I can find some data on it.

Just to clarify – I meant 5% in this issue alone, not Debt as a class. I don’t have anything against even having as much as 80% of your portfolio in debt if that’s what you’re comfortable in. Just don’t get too exposed to one bank or one company. That’s what I meant actually.