Please go here for the latest post on the Muthoot NCD which opened on March 2 2012 and will close on March 17 2012.Â

Muthoot Finance has raised quite a stir by coming up with a non convertible debenture (NCD) offer that’s offering upwards of 13% to investors. Â This issue is quite different from the last Muthoot Finance NCD issue where the minimum investment amount was Rs. 1 lakh and there was just one option with a 2 year maturity.

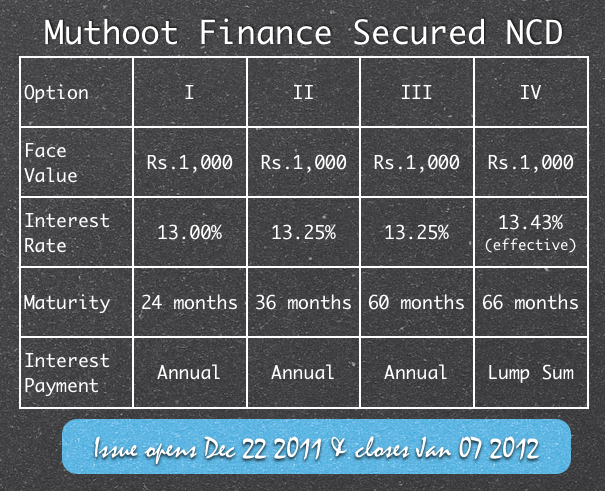

In this issue, the minimum investment is Rs. 5,000 and they have four investment options.

The offer opens on December 22, 2011 and will close on January 7 2012. The lead managers are ICICI Securities Limited, AK Capital Services Limited, HDFC Bank Limited, and Karvy Investor Services Limited.

The NCD issue has been rated ‘CRISIL AA-/Stable’ by CRISIL and ‘[ICRA] AA- (stable)’ by ICRA, which is a good credit rating from both of these issuers.

Here are details on the four options that the Muthoot NCD has on offer.

The minimum investment is Rs. 5,000 which means you will have to buy 5 of these bonds at the minimum and they will list on the BSE after the issue closes.

Muthoot Finance’s latest quarterly report shows that the company has made consistent profits, and this is a secured NCD issue which means that certain assets of the company will be attached to the NCD in case of default. However, this doesn’t mean a guarantee of any kind, and if it comes to a default then investors might get less than the face value of the bonds.

I would say what I said the last time they came up with a NCD, which is that you shouldn’t be exposed to a lot of this in your debt portfolio. The yield is good, the company is currently doing well,  and that makes it easy to get swayed by the high yield and put in a big sum in it, but I think that won’t be wise.

You don’t want a lot of your money in just one type of debt instrument simply because if anything were to go wrong with that one thing – it will be devastating for your portfolio. I know it doesn’t look probable right now, but it didn’t seem probable that the Sensex will close near 15,000 at the beginning of the year either.

This post is from the Suggest a Topic page.Â

How can I get my muthoot fainance ncd maturity amount, is it automatic cradit or any withdraw form fillup?

Have invested rs. 1 lakh in a liquid plan. I do not requiremoney

immediately. Considering that equity mutual funds give better returns i want to switch. But considering that liquid funds are taxable if withdrawn before 3 yrs. should i hold in liquid funds or withdraw

I have invested in muthoot ncd 5th series about 30000 on 5/09/2013 .its cumulative for 5 years at 12 percent interest.if I close it now how much will I get

Hi Kavya,

You will have to sell it on the stock exchanges and you’ll get the market price.

Hi,

I am wondering if the question from other Ashish was answered. If not can someone please respond. Here is the question:

Hi,

I have one basic question, someone please answer it, what happens on maturity ie on the redemption date, does it automatically goes our from our Dmat account and the money gets credited to the account linked to the dmat or we have to fill some forms and there would be some time involved in getting out money back, As that time and efforts should also be considered in calculating the returns.

thanks,

Ashish

Hi Ashish (both of you),

Once a bond/NCD held in a demat account matures, the money automatically goes into your bank account and the bond/NCD stands extinguished.

Hi,

I have one basic question, someone please answer it, what happens on maturity ie on the redemption date, does it automatically goes our from our Dmat account and the money gets credited to the account linked to the dmat or we have to fill some forms and there would be some time involved in getting out money back, As that time and efforts should also be considered in calculating the returns.

thanks,

Ashish

dear sir,

If i deposit 1,00,000 for 2 years , what will be the interest amount which i will be getting back?

please sent reply to krisjiji@gmail.com.

yours faithfully

Chris

hi Chris,

It depends in which bond/NCD you invest, as there are different coupons and zero coupon bonds, you have to calculate the YTM if you buy from the secondary market ie NSE/BSE, but incase you get it directly from the company then they would specify that in the offer document.

And the prices and liquidity fluctuates a lot in secondary market so it would be difficult for anyone to say what returns you wud receive, you should target to buy the NCD at the lowest level possible.

Thanks,

Ashish

Dear Sir,

Please inform me what is the rate of interest of FD of your company (monthly & yearly). Please tell me.

Thanks

Kabir Shran Dagar

9868266828

DEAE SIR,

MY NAME .N KALYANA SUNDARAM I AM A RETIRED CANARA BAKK OFFICER

I AM SEEKING A JOB IN YOUR INSTITUTION.KINDLY INFORM ME THE SUITABLE

JOB AVAILABLE IN YOUR BELOVED INSTITUTION AND OBLIGE

YOURS FAITHFULLY

N KALYANASUNDARAM

MY E-MAIL ADDRESS. kalyan_28150@yahoo.in

… U E-MAIL

Can anyone hepl me to get Muthoot NDC on (Option I)

If you have a broker account or trading account then you can buy these like shares.

Is it possible for me to buy this now? The interest rate looks attractive.

Even if we look at the yield, even after reduction of rates by banks this week, the annualised yield of Public sector banks for 5 years works out to 12.98 and for senior citizens 13.99 and for 10 years 14.35 and 15.57. much higher than mothoot. vide times of india, first page revised term deposit interest rates wef 24.04.2012

The advertised Yield of PSU banks is not comparable as they are for cumulative bonds. To compare with Muthoot you have to incorporate the reinvestment of interest on NCD, eg. you buy 5 year bond at 13.25%, assuming reinvestment of interest; your 1000 re become 1863 in 5 years. Using the crude formula adopted by PSU banks for advertising, Yield on Muthoot is 863/(1000*5)= 17.26%, which is much higher than PSU’s 15.57%, despite considering the tax deduction available in tax sav bonds.

My thoughts exactly.

I have a question regarding NCD.One of my friend bought a TATA NCD in 2011 with a bond value of approx Rs.1000/- now the bond value is around 900/- so the interest he is getting quarterly is decreased now.so

1- isn’t the interest amount we get on our investment fixed?

2- does it vary as per the ups n downs in the market?

if yes then we cant say NCD is similar to FD. Let me know your comments on this as i want to get my fundas clear about NCD.

i have purchased rs60000/-on dec11 no certificate has been issued i had purchaced through icicidirect.

If a invest 1 lakh in IV option than we receive 2 lakh after 5 & half years so how much tax will we deducted.

1.I am received 2 Lakh

2.I am received 2 Lakh-Tax Deduction( Pls confirm how much tax%)

Pls confirm

Tax will be deducted at your tax rate slab.

I have subscribed for the MUTHOOT finance NCD option I by visiting their office personally and filling out the physical form in Jaipur office(Rajasthan) of the same. I had opted for physical delivery of the NCDs.

By mistake they have allotted me the 66 month (Option IV) instead of Option I which I have asked for. When visiting their office again they said nothing can be done about this as this is already done. They agree to the fact that I had asked for option I and it their mistake while handling the form but nothing can be done now as its allotted now.

Is there anyplace where a official complaints (Grievance Office ) can be logged and get it corrected.