This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

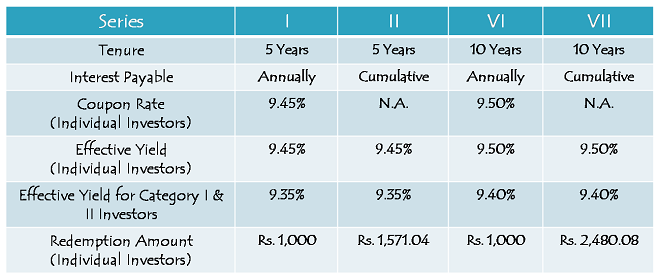

IFCI yesterday launched its second public issue of non-convertible debentures (NCDs). The issue carries annual interest rate of 9.50% for 10 years and 9.45% for 5 years, which is 50 basis points lower than its last public issue of October 2014. IFCI plans to raise Rs. 250 crore in this issue with an option to retain oversubscription up to the residual shelf limit of Rs. 790.81 crore.

IFCI has decided to issue these NCDs for a period of 5 years and 10 years only. Last time it had the option of 7 years as well. The company has also decided not to offer the monthly interest payment option this time around. Last time IFCI offered monthly interest payment option with its 5 year maturity period. The issue is scheduled to remain open for over a month to close on February 4th.

Categories of Investors & Allocation Ratio – The investors would be classified in the following four categories and each category will have the following percentage fixed during the allotment process:

Category I – Institutional Investors – 25% of the issue size is reserved

Category II – Domestic Corporates – 25% of the issue size is reserved

Category III – High Networth Individuals including HUFs – 25% of the issue size is reserved

Category IV – Retail Individual Investors including HUFs – 25% of the issue size is reserved

Allotment will be made on a first-come first-served (FCFS) basis.

Coupon Rates for Category I & II Investors – Like last time, IFCI has kept the differential between the coupon rates offered to the individual investors and non-individual investors as 0.10% only. I think this move would again make these NCDs more attractive to the non-individual investors as compared to the retail investors.

NRI Investment Not Allowed – Foreign investors, including foreign nationals and non-resident Indians (NRIs), are not allowed to invest in this issue.

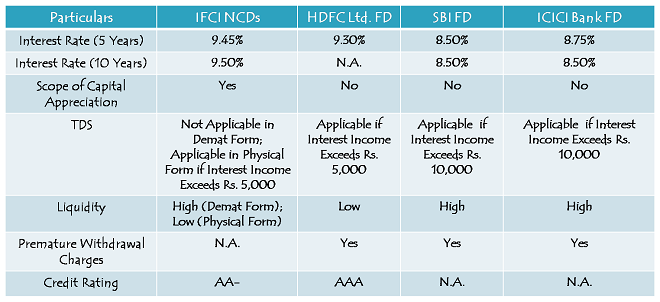

Credit Rating & Nature of NCDs – While Brickwork Ratings has assigned a credit rating of ‘AA-’ to the issue with a ‘Stable’ outlook, ICRA has given it a credit rating of ‘A’ again with a ‘Stable’ outlook. Moreover, these NCDs are ‘Secured’ in nature and in case of any default in payment, the investors will have the right to claim their money against certain receivables of IFCI.

Minimum Investment – These NCDs carry a face value of Rs. 1,000 and one needs to apply for a minimum of 10 NCDs, thus making Rs. 10,000 as the minimum investment to be made.

Maximum Investment – Like the last time, IFCI has kept Rs. 2 lakhs as the maximum amount one can invest in the retail investors category. Individual investors investing more than Rs. 2 lakhs will be categorised as high networth individuals and there is no such cap on the investment amount for such investors.

Allotment in Demat/Physical Form – Investors will have the option to get these NCDs allotted either in demat form or physical form as per their choice.

Listing – These NCDs will get listed on both the stock exchanges, Bombay Stock Exchange (BSE) and National Stock Exchange (NSE), within 12 working days from the closing date of the issue.

Taxation & TDS – Interest earned on these NCDs will be taxable as per the tax slab of the investor and tax will be deducted at source if NCDs are taken in physical form and the interest amount exceeds Rs. 5,000 in any of the financial years. However, there will be no TDS on NCDs taken in a demat form.

Moreover, if these NCDs are sold after holding for more than 12 months, the investor is liable to pay long term capital gain (LTCG) tax at a flat rate of 10%. However, if sold prior to the completion of 12 months, short term capital gain (STCG) tax is applicable at the slab rate of the investor.

Interest Payment Date – Again, IFCI has not fixed any date in advance for the purpose of its annual interest payment and that is why its first due interest will be paid exactly one year after the deemed date of allotment.

Interest on Application Money & Refund – IFCI will pay interest to the successful allottees on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment, at the applicable coupon rates. However, unsuccessful allottees will be paid interest @ 4% per annum on their money liable to be refunded.

Premature redemption & Call Option – IFCI will not entertain any request for redemption before the maturity period gets over. Investors will have to sell these NCDs on the stock exchanges to liquidate their investments. IFCI too will not carry any option to call these NCDs for redemption before their maturity.

IFCI NCDs vs. Bank Fixed Deposits vs. Company Fixed Deposit

Should you subscribe to IFCI NCDs?

These were my views when its last issue came in October – “With CPI as well as WPI inflation falling sharply, Brent crude prices declining from $114 per barrel to $84-85 per barrel, commodity prices also correcting substantially and 10-year Indian G-Sec yield falling from 9%+ to 8.39%, I think the interest rates should still head lower going forward. In the present macroeconomic scenario, it makes sense to subscribe to these NCDs. Long term investors in the 30% tax bracket will do well to invest either in debt mutual funds or explore tax-free bonds from the secondary markets.”

Inflation has fallen further, both CPI as well as WPI. Crude prices have also fallen further with Brent crude trading at $57.33 per barrel as I write. Though the 10-year Indian G-Sec yield has also come down sharply to 7.88% from 8.39% earlier, I think the pace of fall should get slowed down now.

Though I think there is still some more room left for the deposit rates to fall, especially the bank deposit rates, I think the rates offered by IFCI this time are less attractive to me as compared to the last time, which is natural as well. If you are able to buy its previous issue’s NCDs from the secondary markets at a relatively reasonable cost, then you should avoid this issue. If you face difficulty in doing so, then you should still subscribe to these NCDs for your medium to long term investment. Long term investors in the 30% tax bracket would still do well to invest either in debt mutual funds or tax free bonds.

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in IFCI NCDs, you can contact me at +919811797407