This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

New Post for FY 2016-17 – Post Office Small Savings Schemes – FY 2016-17 Interest Rates – PPF @ 8.10% & Sukanya Samriddhi Yojana @ 8.60%

The Finance Ministry on March 31st announced the applicable interest rates for all the Post Office Small Savings Schemes, including PPF, Sukanya Samriddhi Yojana and Senior Citizens Savings Scheme (SCSS). These rates would be applicable for the current financial year, 2015-2016 and have come into effect immediately from 1st April, 2015.

Positive Surprise for Small Savers

To make these schemes more attractive, the interest rate for Sukanya Samriddhi Yojana has been increased to 9.2% from 9.1% earlier and for Senior Citizens Savings Scheme, the rate has been hiked to 9.3% from 9.2% earlier. The interest rates on all other schemes have been left unchanged, including PPF which is going to earn 8.7% for you this financial year.

At a time when interest rates are falling sharply and the Government is putting considerable pressure on the RBI to lower down its policy rates, this move of keeping small savings rates higher/unchanged has left me stunned. I did not expect such a move from a government which seems to me a progressive government as far as its economic reforms are concerned.

If there is a scientific method of calculating interest rates on these small saving schemes, then I think the current rates have been fixed abnormally higher. In the last 12 months or so, the yields on Government Securities (G-Secs) have fallen from a high of around 9.1% to 7.65% recently. Though keeping interest rates higher has left me disappointed, this move by the government would make small savers & senior citizens happier, for at least one more year.

The increase of 0.10% interest rate on Sukanya Samriddhi Yojana (SSY) should encourage more and more investors and parents to join this scheme now. In fact, the interest rate differential of 0.50% between PPF and SSY would make some of the investors to contribute more towards SSY now.

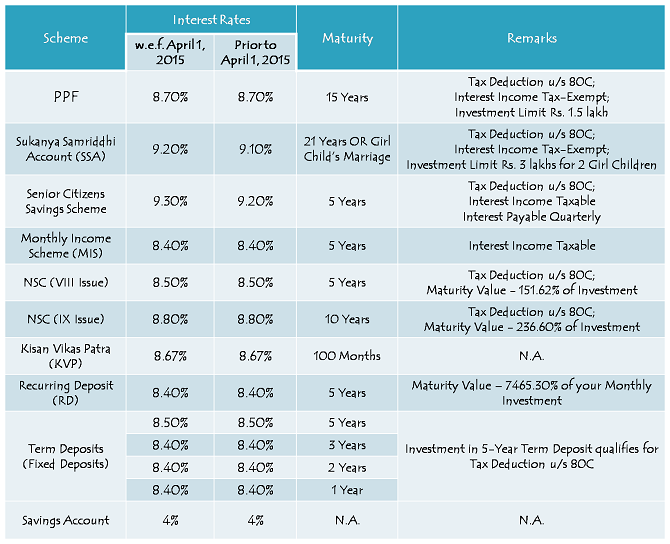

Here you have the table having all the small saving schemes with their applicable interest rates and tax benefits for the current financial year:

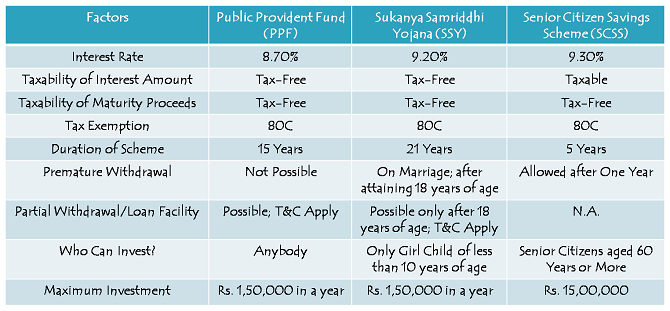

Public Provident Fund (PPF) – There has been no change in the interest rate offered by PPF, India’s most popular small savings scheme. PPF will earn you 8.70% for the current financial year as well. Interest rate will continue to remain tax-exempt on maturity and investment up to Rs. 1,50,000 will keep getting exemption under section 80C.

Sukanya Samriddhi Accounts (SSA) – Sukanya Samriddhi Yojana accounts will carry 9.20% for the current financial year, 2015-16. I was expecting the government to marginally reduce the rate here, say between 8.80% to 9%. But, in a surprise move, they have actually gone ahead and increased the rate to 9.20% from 9.10% till March 31st. I think the government’s move will increase the popularity of this scheme.

Moreover, like PPF, the interest earned will be tax-free on maturity and the investment amount up to Rs. 1,50,000 will get you tax deduction under section 80C.

PPF vs. Sukanya Samriddhi Yojana vs. Senior Citizen Savings Scheme

Senior Citizens Savings Scheme (SCSS) – Senior citizens will also feel happy about the changes announced by the Government as the interest rate on Senior Citizen Savings Scheme has also been increased by 0.10% to 9.30% from 9.20% earlier. Though your investment amount will get you deduction under section 80C, the interest earned is taxable and subject to TDS as well.

Post Office Monthly Income Scheme (POMIS) – Once quite popular with a terminal bonus of 10% and then 5%, Post Office Monthly Income Scheme is getting more and more unpopular these days. As against MIS, investors are getting attracted towards bank fixed deposits (FDs) these days as they get a higher rate of interest, better liquidity and quarterly interest payments. Interest rate has been kept unchanged at 8.40% for MIS.

National Savings Certificates (NSCs) – 5-year NSCs & 10-year NSCs will keep earning 8.50% and 8.80% respectively in the current financial year. Also, your investment will earn you tax exemption under section 80C.

Kisan Vikas Patra (KVP) – Your investment in KVP can double your money in 100 months, which makes its effective annual return to be 8.67% if held till maturity. Investment certificates in this scheme bear no name and can easily be transferred from one person to another.

Recurring Deposits (RDs)/Term Deposits (TDs) – Interest rates on recurring deposits and term deposits have also been kept unchanged at 8.40% for all tenures, except term deposit of 5 years tenure which will yield 8.50% per annum. 5-year term deposit with a lock-in clause will provide you tax deduction under section 80C.

Post Office Savings Account – Your savings account in a post office will continue to earn 4% annual interest and interest amount up to Rs. 10,000 will be tax exempt under section 80TTA.

At a time when banks are already struggling to keep their credit growth in double digits, I think keeping interest rates higher on these small savings schemes is not a wise move. It will make it really difficult for the banks to lower their deposit rates and hence there will be pressure on their net interest margins (NIMs) and profitability. I don’t know what exactly is the logic behind this move, but small savers will definitely benefit out of it. You should take full advantage of these high rates till the time the government realises its mistake.

Sir meri ladki 2018me 7year ke ho gayi hai Sukanya Samruddhi mekitne year tak paisa dalna padega

Na

Sir, meri beti ka dob 25.1.12 hai aur Maine uska sukanya account 10.8.17 Ko opening 2500 rupees per month se karwaya beti ke 21 years hone par use kitna milega.

Sir,

What is the applicable rate of ineterest on R D Account (Post Office)for the financial year 2017-18 and interest is credited monthly/quarterly/half yearly

Meri beti 8month ki hai agar mai hr mnth mai 1000daugi 14 sal to mujhe kitna milega 21year ko

Sir muje koi achi scheme btaiye jisme ma monthly saving KR saku.. 10 yr thk ke liye

Very good plan