This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Before leaving for his three-nation tour to China, Mongolia and South Korea from May 14, Prime Minister Mr. Narendra Modi will launch three of his government’s social security schemes on Saturday – Pradhan Mantri Jeevan Jyoti Bima Yojana (Life Insurance), Pradhan Mantri Suraksha Bima Yojana (Accidental Death & Disability Insurance) and Atal Pension Yojana (Pension Scheme).

These schemes would be an extension to Pradhan Mantri Jan-Dhan Yojana (PMJDY) and would be covered under the government’s Jan Suraksha initiative. These schemes are designed to be pro poor and promise to provide protection against the risks of dying too early (Pradhan Mantri Jeevan Jyoti Bima Yojana) or living too long (Atal Pension Yojana) or unable to work & earn due to partial or full disability (Pradhan Mantri Suraksha Bima Yojana).

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Age of the Insured – Bank account holders aged between 18 and 50 years are eligible to apply for this scheme. So, if you are aged more than 50 years, you are not eligible to enroll yourself for this scheme. But, once enrolled, you can continue with this scheme till you attain the age of 55 years.

Premium Amount – Less than Re. 1 a day or an annual premium of Rs. 330 is what you need to pay to get a life cover of Rs. 2 lacs. No matter what your age is, the premium is fixed at Rs. 330 for a life cover of Rs. 2 lacs. This annual premium of Rs. 330 has been fixed for the first three years from June 1, 2015 to May 31, 2018, after which it will again be reviewed based on the insurers’ annual claims experience.

Period of Insurance – June 1st, 2015 to May 31st, 2016 is the period for which this scheme will cover all kind of risks to your life in the first year of operation. Next year onwards as well, the risk cover period will remain June 1 to May 31.

LIC as the Administrator – The scheme would be offered / administered by the Life Insurance Corporation (LIC) and other life insurance companies like SBI, ICICI etc. through their tie ups with the interested banks like SBI, ICICI, Canara Bank etc. Participating banks are free to engage any such life insurance company for implementing this scheme for their subscribers.

Auto Debit Facility – Annual premium of Rs. 330 will get deducted from your savings bank account through auto debit facility. You will have to give your consent for auto debit of premium from any one of your bank accounts at the time of enrolling for this scheme.

Last Date for Enrolment – May 31, 2015 is the last date for getting enrolled for this scheme, but the government has given an extension of three months up to August 31, 2015 for us to get enrolled and give auto-debit consent for this scheme. This enrolment period may be extended by the government for another period of three months, up to November 30, 2015.

Those joining this scheme subsequent to May 31, 2015 will have to pay the full year’s premium of Rs. 330 and submit a self-certificate of good health in the prescribed proforma.

Toll-Free Numbers – 1800 110 001 / 1800 180 1111 – These two are the National Toll-Free Numbers for this scheme. You can check the state-wise toll-free numbers from this link – State-Wise Toll Free Numbers

Service Tax Exempt – Finance Minister Mr. Arun Jaitley has proposed to exempt this scheme from service tax. So, you will not be charged any service tax on the premium payable.

Know Your Customer (KYC) – Aadhaar Card issued by the UIDAI will be the primary requirement for your KYC under this scheme.

Application Form – Here you have the link to the application form for you to enroll yourself for this scheme – Application Form for PMJJBY

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

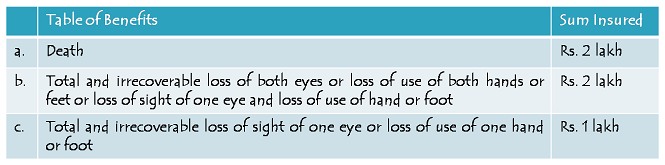

Policy Coverage – The scheme offers to provide you or your family a cover of up to Rs. 2 lacs in case of any mishappening, resulting into death or disability of the insured. In case of death or full disability, you or your family will get Rs. 2 lacs and in case of partial disability, you will get Rs. 1 lac. Full disability means loss of both eyes or both legs or both hands, whereas partial disability means loss of one eye or one leg or one hand.

Age of the Insured – Savings bank account holders aged between 18 years and 70 years are eligible to apply for this scheme. People aged more than 70 years will not be able to get the benefits of this scheme.

Premium Amount – It costs you just Rs. 12 in annual premium for having an accidental death or disability cover of Rs. 2 lacs under this scheme. It works out to be just Re. 1 a month, which is extraordinarily low. Again, your age has nothing to do with the premium payable for your insurance cover under this scheme as the premium is fixed at Rs. 12 for a cover of Rs. 2 lacs.

Period of Insurance – You will remain insured for a period of one year from June 1, 2015 to May 31, 2016. Next year onwards as well, the risk cover period will remain to be June 1 to May 31.

Administrators for PMSBY – The scheme would be offered / administered by many of the general insurance companies, both in the public sector as well as in the private sector. Participating banks will be free to engage any such general insurance company for implementing the scheme for their subscribers. National Insurance Company Limited, Oriental Insurance Company Limited and ICICI Lombard are some of the companies which would be offering this scheme.

Auto Debit Facility – You will be required to provide your consent for auto debit of Rs. 12 as the annual premium from any one of your bank accounts at the time of enrolling for this scheme. This premium of Rs. 12 will get deducted from your savings bank account through auto debit facility every year between May 25 and June 1.

Last Date for Enrolment – May 31, 2015 is the last date for getting enrolled for this scheme, but the government has given an extension of three months up to August 31, 2015 for us to get enrolled and give auto-debit consent for this scheme. This enrolment period may be extended by the government for another period of three months, up to November 30, 2015.

Those joining this scheme subsequent to May 31, 2015 will have to pay the full year’s premium of Rs. 12 and agree to specified terms of this scheme.

Toll-Free Numbers – 1800 110 001 / 1800 180 1111 – These two are the National Toll-Free Numbers for this scheme. You can check the state-wise toll-free numbers from this link – State-Wise Toll Free Numbers

Service Tax Exempt – Yes, Finance Minister Mr. Arun Jaitley has proposed to exempt this scheme from service tax. So, you will not be charged any service tax on the premium payable.

Know Your Customer (KYC) – Aadhaar Card issued by the UIDAI will be the primary requirement for your KYC under this scheme.

Application Form – Here you have the link to the application form for you to enroll yourself for this scheme – Application Form for PMSBY

Should you subscribe to Pradhan Mantri Jeevan Jyoti Bima Yojana?

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) is a term life insurance scheme and we all know that a term plan is the cheapest form of covering ourselves against the risks of untimely death. I think the government is doing a wonderful job in taking the initiative to attract low income group people to get themselves covered against the risks of untimely death.

I think the premium is reasonably justified for people in their middle years, probably between the age of 40-50 years. For younger people, you might still find cheaper life cover policies with some of the private insurers, like Max, Aviva, Aegon Religare etc.

I’ll keep on updating this post as and when I have some interesting data to insert into. If any of you has anything to share about this scheme, please feel free to do that, I’ll update that as well here in the post.

I covered Atal Pension Yojana in March this year and I have covered Pradhan Mantri Jeevan Jyoti Bima Yojana in this post. I will cover Pradhan Mantri Suraksha Bima Yojana also as soon as possible.

My father is of 49 years 9 months old is he eligible for PMJJY? one of the bank said he is not eligible

Hi Srinath,

I think your father is eligible for PMJJBY. I don’t know why the bank has refused to accept your father’s subscription.

My wife suffered with right breast cancer during 2014 and now fully cured after surgery in the month of June 2014. Can we apply for PMJJBY & PMSBY.

Hi,

If your wife has fully recovered, then she can apply for this scheme. Death or disability due to pre-existing diseases will not be covered under both these schemes.

Regarding PMJJBY, Is there any money returned to insurer on maturity of policy? or only death coverage before 55 years only exists? What about the other policies by Lic, state bank, kotak listed in comparison?

Hi Vineeth,

No term insurance scheme, including PMJJBY, returns any money back to the insurer in case he/she survives the policy period.

Your comment is awaiting moderation…

Regarding PMJJBY, Is there any money returned to insurer on maturity of policy? or only death coverage before 55 years only exists? What about the other policies by Lic, state bank, kotak listed in comparison?

Is it possible to enroll under both the schemes PMJJBY & PMSBY at a time ?

Yes, it is allowed to get yourself enrolled under both the schemes.

Dear sir,

Could you please give details about ATUL PENSION SCHEME.

Here you have the link to our post on Atal Pension Yojana – http://www.onemint.com/2015/03/13/atal-pension-yojana-government-guaranteed-pension-scheme-for-the-unorganised-sector/

I am having a saving account in SBI. Being a account holder I have taken a accidental cover of Rs.4 lacs under “SBI Personal Accident Insurance Policy” in July’2014 thereafter Rs.200.00 deducted from my said account.

Now, I have enrolled myself for Rs.2 lacs cover under “Pradhan Mantri Suraksha Bima Yojana” for Rs.12.00 in this month.

My query is “Whether at the time of any eventuality my family would be entitled to get (Rs.4+2)= Rs.6 lacs under both policy coverage or not?”

Pls guide me.

Hi Prem,

In case of any eventuality, your family will get Rs. 6 lakhs under both these policies.

Some social sites are informing that if any individual has any kind of insurance with LIC, Max etc. and then also insures with pmjjby, he will not get any claim in case of any eventuality despite premium being deducted fro his account. Only people with NO insurance will be benefited. Please clarify on this. Thanks.

Hi Dipak,

That is completely incorrect information. We are eligible for PMJJBY even if we have other insurance policies and we will get its benefits in case of an unfortunate event.

Respected sir,

1-My father is 60 years old, he is suffering from cancer & hepatitis c last august 2014. Can he eligible for these pmsby & pmjjby.

2-kya yeh scheme ke liye medical certificate submit karna jaruri hai?

3-yadi mai pitaji ke naam se pmsby aur pmjjby karwadeta aur kal ko kuch ho jata hai to kya hum claim kar sakte hain? Pls sir answer these questions.

With regards.

Hi Gopal,

1. Your father is not eligible for PMJJBY. In case of PMSBY, your father is eligible, but death/disability due to accident only is covered. Also, you’ll have to disclose accidental disability, if any.

2. Medical certificate is not required if you subscribe to it before June 1, 2015.

3. Agar death kisi pre-exisiting disease/disability ki wajah se hoti hai, to in dono schemes mein claim nahin milega.

dear sir,

what happen in case of joint a/c ,either both a/c holder can take these policies or not ?

Hi Shashi,

Yes, both joint holders can subscribe to these schemes.

Hi sir,

I appreciate that the newly implemented schemes by PM will be very beneficial for all.congratulations!!!..And i also appreciate your kind patience to answer our queries.

Sir,i want to know that if a person doesn’t die within the cover period in both PMSBY and PMJJBY ,will he get the premium back??will money be refunded to the nominee?

Thanks and regards..

Thanks Kanika for your kind words!

No premium will be paid back to the subscriber if he/she survives the policy period. Nominee will be paid only the sum assured if something happens to the subscriber.

Can a person already having a life insurance policy can enrol for Prime minister Bima Yojana? Kindly confirm.

Yes Mr. Rajesh, you can get yourself enrolled for PMJJBY & PMSBY even if you have other insurance policies.

Dear Shiv

My wife is second holder in joint a/c with me at ICICI & HDFC Banks, I joined in both scheme through HDFC Bank’s a/c. Now to join my wife for same suggest what to do

Hi Mr. Panwala,

You can use either of your joint accounts for her as well.

Dear sir,

My date of birt is 01 04 1965 am i eligible for pmjjyby pl advised me any other policy thank you sir

Dear sir,

please let me know which policy i can opt for my age sir i appreciate your reply

I think you are eligible for both these policies – PMJJBY & PMSBY.

Dear Sir,

I was born on 1.4.1965 am i elgible to pmjjyby policy pl let me know sir

Hi Syed,

I think you are eligible, but you need to confirm it with your bank.

Hi Mr. Shiv ,

The main advantage of other Insurance companies over PMJJBY is that they provide longer period of Term i.e, till the age of 65 Years or more in some companies.That is the period of age ( >55 yrs) when you need life cover the most.

Hi Mr. Sudhir,

Yes, I agree with you that longer period coverage with other insurance companies is an advantage. But, then these insurance companies charge very high premiums for covering you till 65-70 years of age. Also, I do not agree with you that 55-70 is the age group when a person needs life cover the most. I am of the view that 25-55 is the age group when you need a life cover the most, as this is the time when you earn and there are dependents on your income. Loss of life in this age group hurts a family the most in financial terms.

good thought about public by pm .very imp for public

Yes, I agree.

hi,

Dear any new plans are there deposit

Hi Mr. Rajesh,

Your query is not clear.

Hi sir is it pmjjy scheme is eligible for govt employees and atal pension is eligible for house wife who r working at home.

Hi Rajeshwari,

Govt. employees are eligible for PMJJBY and housewives are eligible for APY. In APY, there are certain conditions to be eligible for government contribution.