This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

HUDCO IPO Review

HUDCO, a wholly-owned Miniratna of the Government of India, is all set to enter the primary markets and will launch its initial public offer (IPO) from the coming Monday i.e. 8th of May. It will be the first divestment candidate of the government for the current fiscal year. The government has fixed its price band to be Rs. 56-60 and it will be able to raise around Rs. 1,210 crore from this issue.

As there is a bank holiday on 10th May, no bidding will happen on this day and the issue will close on Thursday, 11th May.

Here are some of the salient features of this IPO:

Price Band – HUDCO has fixed its price band to be Rs. 56-60 a share and there is a discount of Rs. 2 a share for the retail investors.

Size & Objective of the Issue – This issue is an Offer for Sale (OFS) by the government of India and thus no fresh issue of shares is involved. The government is selling its 10.2% stake in this IPO, post which it will have 89.8% stake.

Retail Allocation – 35% of the issue size is reserved for the retail individual investors (RIIs) i.e. approximately 7 crore shares out of 20.02 crore shares. 15% of the issue size is reserved for the non-institutional investors and the remaining 50% shares will be allocated to the qualified institutional buyers (QIBs). Employees will also have the option to apply for its shares during this offer period and around 38.69 lakh shares have been separately reserved for them.

Rs. 2 Discount for Retail Investors & Employees – The government has decided to offer a discount of Rs. 2 per share for the retail investors, as well as the employees of HUDCO in this IPO.

Bid Lot Size & Minimum Investment – Investors in this offer need to bid for a minimum of 200 shares and in multiples of 200 shares thereafter. So, you as a retail investor would be required to invest a minimum of Rs. 11,600 at the upper end of the price band and Rs. 10,800 at the lower end of the price band.

Maximum Investment for Retail Investors – Individual investors investing up to Rs. 2 lakh are categorised as retail individual investors (RIIs). As a retail investor, you can apply for a maximum of 17 lots of 200 shares @ Rs. 58 i.e. a maximum investment of Rs. 1,97,200. So, investors opting for the “Cut-Off Price” option should apply for a maximum of 17 lots of 200 shares @ Rs. 58 per share.

Listing – The shares of the company will get listed on both the stock exchanges i.e. National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) within 6 working days after the issue gets closed on 11th May. May 19th is the tentative date for its listing.

Here are some of the important dates for this IPO:

Issue Opens – On May 8, 2017

Issue Closes – On May 11, 2017

Finalisation of Basis of Allotment – On or about May 17, 2017

Initiation of Refunds – On or about May 18, 2017

Credit of equity shares to investors’ demat accounts – On or about May 18, 2017

Commencement of Trading on the NSE/BSE – On or about May 19, 2017

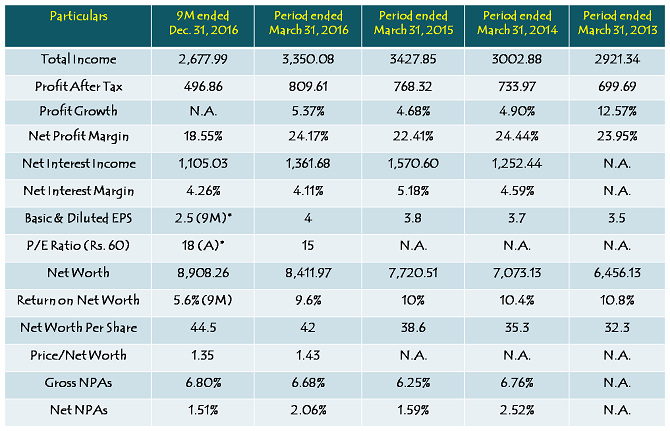

Financials of HUDCO

Here is the link to the HUDCO IPO Review

Hi,

Is there a way to check the allotment status? Any link of registrar?

Thanks

@ shiv

can you help us to evaluate psp projects Ipo?????

how it is priced ?

happy weekend

Dear Shiv,

Glad you see, you could manage so many activities.. 🙂

Probably, you should share your time management tips as well.. 🙂 🙂

Oh please, my time management skills are really really bad. God knows why, but I always reach late wherever I go. I always do things late, HUDCO IPO review is another such example. But, yes, I am very fond of keep doing physical activities, and keep learning things which I like. 🙂

Where can I download HUDCO share application form. Can you provide me the link ?

Hi Thulasi,

Here are the NSE/BSE links to HUDCO ASBA forms – https://www.nseindiaipo.com/issueforms/html/index.html

https://ibbs.bseindia.com/asbaforms/BlankForm.aspx?ipo=1333

https://ibbs.bseindia.com/asbaforms/BidEntryQuick.aspx?ipo=1333

Thank you!!

Shiv – We are all eager to get your inputs and since Monday/08May is less than 24 hours away, your views asap would be valuable. Thanks in Advance and apologies for bugging you on a weekend 🙁

Shiv Ji,

I agree with Bobby, as time is short, eagerly waiting for your inputs, though I feel apologetic .

Also kindly advise, if it is a good idea to accumulate more on Listing as in the recent past many quality IPOs have appreciated in price due to growing mutual fund and investor appetite as there are not many avenues to park the SIP money.

No need to be apologetic Vasu, I was not as busy as it seems so, was just playing badminton, cricket, learning to swim, watching IPL, and of course analyzing HUDCO IPO. 🙂

I have expressed my views regarding this IPO here, please check – http://www.onemint.com/2017/05/08/hudco-ipo-review/

Thanks Bobby for bugging me on the weekend! 😉

Hi Shiv,

When I searched for HUDCO IPO, I found application selling between Rs 1200-1500. I am not sure what is this. Can anyone update.

I also wants to know , like many other this is also on first-come first basis. If Retail oversubscribes on first day the IPO closes on 2nd day or gives opportunity till last date. Is there any info on allotment basis. Some times we apply at cut-off rate also we do not get any allotment.

Please put some light on the above in your posting or reply.

Regards

George

Hi George,

1. “Application selling for Rs. 1200-1500” is a gray market phenomenon. If you are applying for the HUDCO IPO, the gray market players are ready to buy your position in this IPO at a premium of Rs. 1200-1500. After this, you’ll get this money, and you’ll not make any further gains/losses on it. However, you’ll be liable to pay taxes on your gains, if any.

2. Equity IPOs are not allotted on a first-come first-served basis and remain open for all 3 days. So, you can apply for it anytime you want, but before your bank allows you to do it through ASBA. Please check this post to understand the New Allotment Process for IPOs – http://www.onemint.com/2012/12/26/new-basis-of-allotment-explained-with-care-ipo/

Dear Mr Shiv

Why this post is titled as HUDCO IPO – April 2007 Issue? I presume it should be May Issue as the issue is opening on 08.05.2017, this is my view. What is your views.

RK Bhuwalka

Made the changes, thanks Mr. Bhuwalka for pointing it out.

Dear Shiv

Thanks for the correction. But before your correction, I had already sent this post to many of my readers mentioning as “MAY ISSUE”.

RH Bhuwalka

Thanks Mr. Bhuwalka! 🙂

It says – ‘March 21st is the tentative date for its listing’. I think we have to get that corrected too 🙂

Thanks for your reviews and articles, they are really valuable.

Hi Pavan,

Thanks for pointing it out, stands corrected now. 🙂