This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

SBI Life Insurance Company Limited is all set to enter the primary markets through its initial public offer (IPO) of Rs. 8,400 crore from September 20. The IPO is an offer for sale (OFS) by SBI Life’s promoters, State Bank of India (SBI) and BNP Paribas Cardif S.A. The company has fixed its price band in the range of Rs. 685-700 a share. Subscription to the issue will remain open for three days to close on September 22.

The offer would carry 12 crore shares for subscription and constitute up to 12% of SBI Life’s post-offer paid-up equity share capital. Though the company offers no discount to the retail individual investors, there will be a discount of Rs. 68 a share for the employees of the company. Moreover, around 1.40 crore shares have been reserved for the SBI shareholders and the employees of the company.

Here are some of the salient features of this issue:

Size & Objective of the Issue – SBI and BNP Paribas Cardif S.A. are collectively selling their 12% stake in SBI Life in this IPO to raise Rs. 8,400 crore. SBI Life will not get any proceeds from this offering.

Price Band – SBI Life has fixed its price band to be between Rs. 685-700 a share and the company has decided not to offer any discount to the retail investors.

Discount of Rs. 68 for Employees – The company has decided to offer a discount of Rs. 68 a share to its employees, which is approximately 10% to the issue price.

No Discount for Retail Investors – The company has decided not to offer any discount to the retail investors.

Retail Allocation – 35% of the issue has been reserved for the retail individual investors (RIIs), 15% for the non-institutional investors (NIIs) and the remaining 50% shares will be allocated to the qualified institutional buyers (QIBs).

Reservation for SBI Shareholders & SBI Life Employees – SBI Life has reserved 1.20 crore shares for the existing shareholders of its parent company, State Bank of India (SBI), and 20 lakh shares for the employees of SBI Life.

Multiple Bids by Employees & SBI Shareholders Allowed up to Rs. 2 lakh – SBI Life employees and SBI shareholders placing their bids up to Rs. 2 lakh can place their bids in the retail individual investors (RII) category as well. Technically these seem to be multiple bids, but it is allowed to place multiples bids in such a manner.

However, you need to be careful that your bid amount in each of the categories does not cross the limit of Rs. 2 lakh. If your bid amount as an SBI Life employee or as an SBI shareholder crosses Rs. 2 lakh and you place one more bid as a retail investor as well, in that case your multiple bids are liable to get rejected.

Bid Lot Size & Minimum Investment – Investors need to bid for a minimum of 21 shares and in multiples of 21 shares thereafter. So, a retail investor would be required to invest a minimum of Rs. 14,700 at the upper end of the price band and Rs. 14,385 at the lower end of the price band.

Maximum Investment – Individual investors investing up to Rs. 2 lakh are categorised as retail individual investors (RIIs). As a retail investor, you can apply for a maximum of 13 lots of 21 shares each @ Rs. 700 a share i.e. a maximum investment of Rs. 1,91,100. At Rs. 685 per share also, you can apply only for 13 lots of 21 shares, thus making it Rs. 1,87,005.

Listing – The shares of the company will get listed on both the stock exchanges i.e. National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) within 6 working days after the issue gets closed on September 22nd. Its shares are expected to get listed on October 3rd.

Here are some other important dates as the issue gets closed on September 22:

Finalisation of Basis of Allotment – On or about September 27, 2017

Initiation of Refunds – On or about September 28, 2017

Credit of equity shares to investors’ demat accounts – On or about September 29, 2017

Commencement of Trading on the NSE/BSE – On or about October 3, 2017

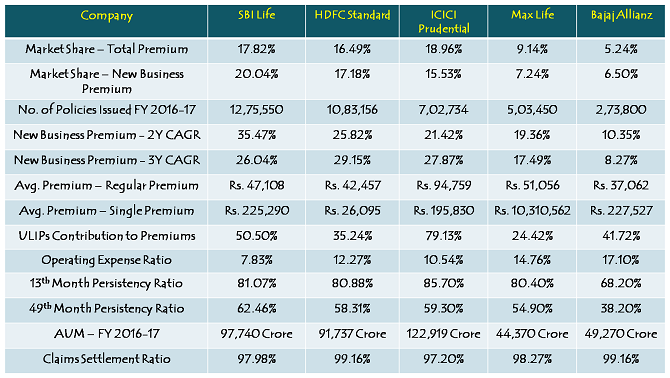

Peer Comparison

Dear Mr.Shiv Kukreja

In my opinion, SBI Life Insurance IPO is highly priced. The price to earnings ratio is over 70, which means with the current EPS it will take over 70 years for the company to earn back my investment.

However, you have collated all the facts relating to the IPO in very nice and coherent manner.

Thank you very much for the efforts.

With Warm Regards

Anand

Dear Shiv Sir,

In the recently concluded ICICI Lombard General Insurance IPO, I applied 44 shares as retail investor. I am allotted 39 shares.

As a share holder of ICICI bank, I also applied 110 shares in the right portion too. I am allotted zero shares in this catagory, though there was no that much over subscription.

My ICICI Bank Shares are in the NRO NON PINS demat account. But As I invested monet from my NRE account for the right portion, I appled through the NRE NON PINS demat account. Is that the reason for zero allotment? Kindly advise what went wrong? Thanks. A. Viswanathan

10 Points about SBI Minimum Account Balance (MAB) Charges

State bank of India (SBI) reduced monthly average balance from Rs 5,000 to Rs 3,000 and the penalty for non maintenance of minimum balance upto 50%.

More @ http://sharpcareer.in/blog/financial-update/10-points-sbi-minimum-account-balance-mab-charges/

Is there any lock-in for SBI Life shares bought under employee quota? can i seel them after they get listed if I buy under Employee Quota?

Sir,

I am a share holder of SBI.

Can I Apply 273 shares @ rs 700 per share in Retail individual catagory and SBI share holder catagory , totalling 273 x 2 = 546 shares? Will the application get rejected in I apply 546 shares in that manner?

Please clarify. Thanks. Viswanathan

Hi Viswanathan,

You can apply for 546 shares of SBI Life in this manner.

Sh Shiv Kukreja ji,

High thnxs for your comments on ICICI Lombard & SBI Life Issue.

I am a great fan of your write Ups & they are really excellent.

Pl keep me on your mailing list,

Pl specify your recommendation Yes/No for SBI LIfe

ICICI Lombard looks to be a failure as on Mon 18th.

With best wishes

VK Gupta

Thanks Mr. Gupta for your kind words! 🙂

I have expressed my views for SBI Life IPO in its review post, plz check – http://www.onemint.com/2017/09/19/sbi-life-insurance-ipo-review-should-you-invest-or-not-rs-685-700/

Though there is still enough time left for the ICICI Lombard IPO to pick up pace, but yes it is not seeing the kind of traction it was expected to get. I think it is the greed of the selling shareholders which is spoiling their own game here.

where shareholders forms are available?

Hi Bipin,

Here you have the link to download its application forms – https://ibbs.bseindia.com/asbaforms/BlankForm.aspx?ipo=1424

Pls comment on if its Worth Applying ?

Hi Rohit,

I have expressed my views in the review post – http://www.onemint.com/2017/09/19/sbi-life-insurance-ipo-review-should-you-invest-or-not-rs-685-700/

I am a shareholder of sbi. Will be getting a preference in allotment of sbi insurance. Is there any way i can utilise the above offer if i apply through asba

Hi Jaikumar,

ASBA is now mandatory to bid in an IPO. You can place your bid using ASBA.

when i apply for asba how can i indicate that iam subscribing under the shareholder quota

Shiv

Waiting for your feedback on whether to apply.Is SBI shareholder slot better to apply or General? Considering the market capitilization and size of SBI, 1.4cr slot also will be heavily subscribed to.

Hi Harinee,

Here you have the review post of SBI Life IPO – http://www.onemint.com/2017/09/19/sbi-life-insurance-ipo-review-should-you-invest-or-not-rs-685-700/

Moreover, SBI shareholders are allowed to place multiple bids in each of the categories – SBI shareholder category, as well as the retail individual investor category. I have updated the post above having this info in detail.

Also, considering the issue to be overpriced, I think it would be difficult for the SBI shareholder category to get huge oversubscription.