This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Indian Energy Exchange Limited (IEX), India’s largest energy trading exchange, is all set to enter the primary markets with its initial public offer (IPO) of Rs. 1,001 crore. The issue is getting opened for subscription today and will remain open for three days to close on October 11. The issue is an offer for sale (OFS) by some of its existing investors.

The company has fixed its price band in the range of Rs. 1645-1650 a share. The offer would constitute 20% of the company’s post-offer paid-up equity share capital.

Here are some of the salient features of this issue:

Size of the Issue – As mentioned above, this IPO is an offer for sale (OFS) of 60.65 lakh shares by its existing investors. This would make it a Rs. 1,001 crore IPO at the upper end of the price band of Rs. 1,650.

Price Band – IEX has fixed its IPO price band to be between Rs. 1,645-1,650 a share and the company has decided not to offer any discount to the retail investors.

No Discount for Retail Investors – The company has decided not to offer any discount to the retail investors.

Retail Allocation – 35% of the issue has been reserved for the retail individual investors (RIIs), 15% for the non-institutional investors (NIIs) and the remaining 50% shares will be allocated to the qualified institutional buyers (QIBs).

Bid Lot Size & Minimum Investment – Investors need to bid for a minimum of 9 shares in this offer and in multiples of 9 shares thereafter. So, a retail investor would be required to invest a minimum of Rs. 14,850 at the upper end of the price band and Rs. 14,805 at the lower end of the price band.

Maximum Investment – Individual investors investing up to Rs. 2 lakh are categorised as retail individual investors (RIIs). As a retail investor, you can apply for a maximum of 13 lots of 9 shares each @ Rs. 1,650 a share i.e. a maximum investment of Rs. 1,93,050. At Rs. 1,645 per share as well, you can apply only for 13 lots of 9 shares, thus making it Rs. 1,92,465.

Listing – The shares of the company will get listed on both the stock exchanges i.e. National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) within 6 working days after the issue gets closed on October 11th. Its shares are expected to get listed on October 23rd.

Here are some other important dates as the issue gets closed on October 11:

Finalisation of Basis of Allotment – On or about October 17, 2017

Initiation of Refunds – On or about October 17, 2017

Credit of equity shares to investors’ demat accounts – On or about October 18, 2017

Commencement of Trading on the NSE/BSE – On or about October 23, 2017

Financials of Indian Energy Exchange (IEX)

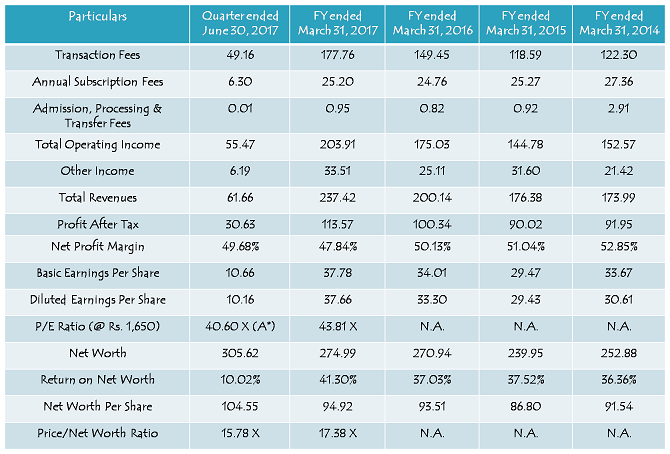

(Note: Figures are in Rs. Crore, except per share data & percentage figures)

During financial year 2016-17, IEX reported an operating income of Rs. 203.91 crore and profit after tax (PAT) of Rs. 113.57 crore, as against Rs. 175.03 crore and Rs. 100.34 crore respectively in the previous financial year, registering a growth of 16.50% and 13.19% respectively. The company registered a degrowth in its operating income and PAT during financial year 2014-15, but made a reasonable recovery in the next couple of years post that. It has posted a CAGR of 13.89% in its operating income and 14.40% in PAT during the last 4-year period.

Though the company has shown a decline in its net profit margins during the same period, it reported a healthy 41.30% return on net worth (RoNW) in the previous financial year. However, my concern remains the same as it has been with most of the IPOs in the last 3-6 months i.e. high valuations with low margin of safety in case of a sharp decline in market sentiment. At Rs. 1,650 a share, IEX is valued at 43.81 times its FY 2016-17 diluted EPS of Rs. 37.66 and 15.78 times its net worth as on June 30, 2017.

For my investments, I am not comfortable paying such high valuations for an exchange with not so high growth in terms of revenues and profitability. At Rs. 1,650 a share, IEX will have a market cap very close to that of MCX and Bombay Stock Exchange (BSE), which again I think is unreasonable. So, considering all these factors, this IPO seems to me a high-risk high-return proposition. If the market sentiment remains buoyant as it has been with most of its recent IPOs, then this IPO too could give you a healthy listing gains. But, it could turn volatile as well in case of any adverse outcome. I would wait for a few more quarters for the euphoria to settle down somewhat and the company to implement its future course of action to augment its revenues and profitability.

thanks a lot for unbiased review.43 x is just to en-cash market euphoria. will wait for correct price

43x is too much.Hopefully the craze has gone down after matrimony ipo.

Thanks Shiv again for providing the most honest analysis.