The much awaited bank stress test results are finally out today and personally, the thing that interested me most was what they call — Buffer, in the report is exactly the opposite. I went to the tables first and got confused by that number, so, then had to read the report from the beginning.

The SCAP (Supervisory Capital Assessment Program) ran tests on 19 banks and came out with some numbers, which are not quite as bad as the IMF or the Roubini Estimates.

Of course, the Stress Tests are no longer “stress” because it is quite likely that the scenarios listed down while conducting the tests will play out and are no longer — worse case estimates.

Here are some numbers:

1. These tests ran on 19 firms, which hold two thirds of the assets and more than one – half of all loans in the US Banking system.

2. The losses at the 19 banks for 2009 and 2010 under the “adverse” scenario could be $600 billion.

3. The bulk of these losses will come from residential related mortgages and consumer related loans (houses and credit cards).

4. The 19 banks need to add $75 billion to their capital by the end of 2010 to reach their SCAP Capital Target.

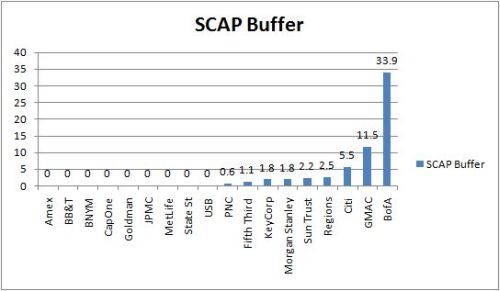

5. 9 out of the 19 banks are good and don’t need to add any more capital.

6.. 10 of the 19 banks need to augment their capital (Tier 1) to reach the SCAP Capital Target.

7. These 19 firms have US Preferred Treasury Equity securities worth $216 billion dollars.

Here is a chart of the estimated SCAP Capital requirements for the 19 banks:

wher is test result for delhi date 22.05.009