Systematic Investment Plans or SIPs are really popular with Indian investors, and provide a way to invest regularly in mutual funds.

In the past there have been some discussion about how someone can set up a SIP with ETFs, and a lot of people have shown interest in setting up a SIP in ETFs or more specifically in gold ETFs.

I had a post on the topic with several roundabout ways of doing this, and before I tell you about the new way I discovered last week, let me recap them from my earlier post for you:

1. Kotak’s Auto Invest: Kotak has a plan called “AutoInvest†that in an online trading account based on systematic investment planning in Gold ETFs, equities and mutual funds.

2. Set up reminders with your offline broker: If you trade using an offline broker – you can tell them to remind you by giving you a call at a certain day of the month, and remind you to place the trade.

3. Set up reminders in Outlook or Gmail: You can set up reminders using Outlook, Gmail or any other tool that reminds you to invest at a certain day of the month.

4. Buy a fund of funds that owns ETFs: As stated in the comment in yesterday’s post – you can set up an SIP for a fund of funds that invests in a particular ETF you are interested in – and that gives you an indirect way of getting into a SIP for an ETF.

5. Value Averaging Investment Plan (VIP) from Benchmark funds: This is an idea given by another commenter on the earlier post. This product from Benchmark is akin to set up an ETF – I am not sure how effective this is because I haven’t used it myself or done any great deal of research on it, but it does give another option to investors.

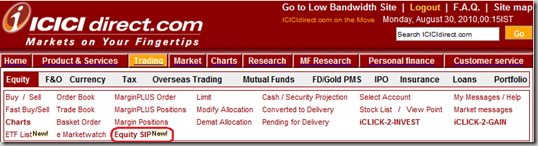

Now, you can add ICICI Direct to this list. Last week I saw that they have a new option called “Equity SIP†that lets you set up a systematic investment plan in a list of given stocks. These stocks include some ETFs also like the Benchmark Gold ETF or Benchmark S&P CNX 500 Fund.

Investors have been asking for this option since a long time, and it is great that they have one more way of setting up SIPs in ETFs. If you know of more ways than are listed here, then please do leave a comment, and I will update my post to include those options as well.

Hi Manshu,

Just a q on this – In SIP for ETF, do you know how does ICICI determine the price/quantity? Let’s say I start a SIP for 4000, then on a particular day how many ETF units would be brought, and when (ie- since market price is varying through the day anyway).

Thanks in advance if you have any info on this!

I’d imagine they have a set time that they execute the order in the day but I’ve not done this myself or know how the mechanics work exactly. It can’t be very complicated though.

I would like to invest in GOLD ETF of any good managed fund manager through SIP, but with the facility in which I can invest any day of month on my own choice.

Your requirements are met best by either going by a SIP from a broker that offers it – both online or offline, as the other options will limit you from buying the funds from their fund houses.

I have ICICI Direct account but didn’t noticed that addition. Thanks for pointing out. Now it would be easy to invest in gold as well with the popular method of SIP.

To average out the highs and lows of the market, split your investments in the month e.g.

if the minimum investment in a mutual fund is Rs. 5,000- and you invest Rs. 10,000- in the fund, split it into 2 investments of Rs. 5,000- each on different dates of the month say the 5th & 25th

if you invest Rs. 5,000- each in two mutual funds, invest the amounts but on different dates of the month

can we do it same with mutual fund SIP?? I mean to say…suppose i pay Rs 5000 monthly..can i make Rs 2500 on 5th of the month and other Rs 2500 on 25th of the month…is it possible??

I am confused whether Judy is explaining about SIP for ETF or SIP for Mutual funds..so asked the above question

Yeah, her comment is with reference to MF SIPs, though this type of thing can be done with ETF SIPs as well.

So if I am ivesting Rs 5000 in a ‘X’ MF then i can invest Rs2500 on the 5th of the month and remaning Rs 2500 on the 25th of the month…Am i right? If Yes…then it is great way to distribute risk…

Yes – you can invest both on the 5th & 25th.

Hello SirIn this valtoile market gripped in uncertainty , i will suggest you NOT to invest in equities if your time horizon is 6-7 months.I will advise you to invest in Debt instruments only where you are getting attractive returns currently due to high interest rates. For now , capital protection should be your aim.Mutual Funds are ideal if your investment horizon is 5 years+.ThanksSalil