Sourabh left a comment with a question about Ex – Dividend, Record Date, and Declaration Dates with respect to dividends, so I thought I’d do a post on it with an example because there are quite a few dates involved, and it can sometimes get overwhelming.

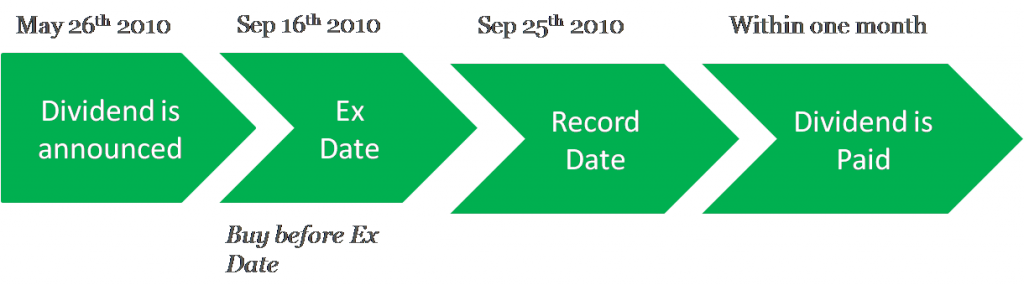

Let’s take an example of Oil India Limited’s Final Dividend to see how this works. The first date is of course the date on which the dividend is announced.

Normally, this is when the Board of Directors recommend a dividend, and it is still subject to shareholder’s approval.

In our example – Oil India’s Dividend was recommended on May 26 2010, when their directors said that the company will pay a dividend of Rs. 16 per share, if it’s approved by the shareholders in their AGM (Annual General Meeting).

The AGM was held on 25th September and the dividend was approved by the shareholders.

But, the question is who gets the dividend?

Since shares are traded throughout the year, and dividends declared just a few times in a year – it becomes necessary to fix a date, and say that whoever owns the shares on this particular date will be entitled to the dividend.

This is called the “Record Dateâ€, and in our example this is 25th September 2010, so whoever has their name in the company’s books on 25th September 2010 will get the 16 rupee dividend.

However, there is another more important date, which is called the “Ex-Dateâ€. There is a time gap between when you buy a share, and when your name gets on to the company records, so if you buy Oil India shares on 25th September – your name will not be in the books of the company on 25th itself, and you won’t get the dividend.

You need to buy the share before the Ex Date because that ensures that there is enough time for your name to get into the company’s registers, and get you the dividend.

In this case the Ex – Date was 16 September 2010. This was much earlier than the 25th September 2010 Record Date because the company closed its books from 18th September to 25th September, and in other cases (especially of interim dividend) the Ex Date can be just one or two days earlier than the Record Date.

So, if you want to buy a share for its dividend, then make sure you purchase it before the Ex Date.

Do keep in mind however, that the share will lose in value on the Ex – Date because the person who buys the share on that date will not get the dividend.

How can you find out the Ex Date?

The easiest way to find the Ex Date is to lookup the info from the NSE Website. You can input the ticker on the search box on the home page, and when the price details open up on the next page, scroll to the bottom of the page and click on “Corporate Actionsâ€, and this will open up a table that shows you Ex Date for each announcement among other things.

I don’t think it makes much sense to buy a share a few days before the Ex Date in order to get the dividend because the share will lose in value as soon as you hit the Ex Date, so I’d say knowing this concept is good for your knowledge, but don’t try to buy stocks too close to the Ex Date because the market is efficient enough to reduce the price of the share with the value of the dividend when the Ex Date is reached.

hi,

ex-date and effective date for the dividend …. both are same ?

Where can we see the exact payment date ? For ex: If I have some X number of scrips, how can we find dividend payout date for all those at one place ? Any pointers.

Thanks, Karthik

Most lucid explanation I have ever found in this context. Thanks.

Thanks for your comment Ravi.

I have received many dividend cheques, I lost many of them and many of them are in stale condition . Now can I get the details of the dividends paid to me. if so How?

please reply

I don’t know of a way to do that – sorry.

I had invested in sbi shares when it was introduced in the market but have not received any dividend as the pincode in the address was printed wrong. What should i do claim the dividend? from when wl i be entitled for the dividend? please let me know

Having explained the dates on owning the shares to benefit from the dividends, kindly advise the date at which we can sell the shares to qualify for dividend.

For example:

– Board met on May 18, 2012 and declared a dividend

– SBI books remain closed from May 26 to May 31, 2012

– Dividend disbursement from June 16, 2012

Under the above circumstances, will we qualify for dividends as we intend to sell the shares on June 4, 2012 that was bought on February 24, 2012).

You need to find out the record date. If you have the share on the Record Date you will get the dividend else you will not.

Hello Manju,

As you said that it does not make sense to buy a share few days befoe ExDate to get the dividend, then how will i know the best time to buy the share to get the dividends. As rightly said the market is efficient to reduce the price of the share. As if i buy a share and it falls down to the dividend price i might not gain anything. Is there any web site or alerts that i can follow on.

Ashish

Yes, the ex date is available on the NSE website and you should buy it before that day if you want to get the dividend but this is really a pointless exercise. You shouldn’t base your decision on to buy based on when you would get the dividend but rather be focused on a good stock at a reasonable price.

Hi Ram,

I have little confusion, in following scenario

A company’s Interim Dividend declared & the Dividend dates are as follows,

Ex-Date – 03 April

Record Date – 07 April

Am I eligible for Interim Dividend, if I purchase shares on 02 April & sell it on 4 April, ? or I need to hold the shares in my Dmat A/c till 07 April EoD

It should be on your name on the Record Date so in your example you won’t get dividend.

Hi,

I have little confusion, in below scenario

A company’s Interim Dividend declared & the Dividend dates are as follows,

Ex-Date – 03 April

Record Date – 07 April

Am I eligible for Interim Dividend, if I purchase shares on 02 April & sell it on 4 April, ? or I need to hold the shares in my Dmat A/c till 07 April EoD

I am a Finance Student. I beg Sorry in Advance coz my english is poor. Currently I am doing master in Finance From Tribhuwan Universtiy Nepal. I couldn’t get answer of my question from your article. Whether there is any rule or not. The gap between Declearation Date and Ex-divident date Differ from Company to company. Whether this depend upon the company Policy or there is any rule from the govt or international rule.

No, there is no rule that’s imposed by the government but there is a process that is followed and since everyone is aware of this process they don’t make the mistake of buying at a high price when the dividend has been paid off etc.

Impressive post.

Everything I was wondering about in relation dividend pay out seems to be cleared up!

Thanks a lot for the post, I really appreciate it!

Simply excellent post! I think you have pretty much touched everything. Your attention to detail is admirable.

Hello Manshu

thanks for prompt reply.

I think i confused you little, by dividend i meant interest . Will you help me in doing some basic calculation for these bonds

today NSE for SBI retail bond (oct2010) 15 yrs (9.5%) – Rs 10445

record date (i googled it) is 15 days before april 02, 2011 (payout date)

so how this whole calculation work,

if i buy on feb24th, at lets say @10450,

Interest Paid after apr02, 2011 (for future years) — will be always 950 per year for 10450 price (effective 9.1%)

Interest Paid on apr02, 2011 (from nov 2010-mar2011, 5 months ) — will be 950*5/12 for 10450 price

Did i miss anything, i am interested in buying these

Please suggest

thanks

Vaibhav

Hello Manshu

I want to buy the retail bond of SBI which came out in oct, 2010, which is being traded nse.

SBI pays bond dividend on april 02, so if i buy this now will i get dividend or how does it work. I might sound confused so bear with me

thanks

vaibhav

Vaibhav – The person who holds the bond at the record date will get the annual interest. For this issue I’m not sure what the record date is – you might be able to Google that up though.

Keep in mind that the price of the bond will adjust to the dividend payment, so it won’t make any sense for you to buy this bond off the market if you’re doing it just to get the dividend.

Thank you very much for your reply to my query of 09/01/11 I am

satisfied with your reply.

Thanks Madhukar – I appreciate the fact that you took time to comment again.

Hi Manshu..On a different note, What does pledging of shares mean?

Pledging of shares means that you mortgage your shares and take loans against it Chints.

Nice post Manshu, very clearly explained the things. Most of the doubt cleared now.

Thanks Khalid.

I purchased shares of public limited Co. , were credited in my Demat acctt on

16/12/2010.[nsdl ]. How do I know date when my name got into Co’s register?

Co. directors approved bonus shares on 16/12/2010 and sought opinion of

share holders thr’ postal ballot papers to be received by Co. latest by 24/01/10

[ 1 ] can there be a gap between date of entry of shares purchase in Demat acctt and date of entry in Co’ Register?

[ 2 ] Which share holder qualify for bonus shares , registered with Co. before

record date / on or before record date .

kindly guide me madhukar

Which stock was this Madhukar, and do you know when was the record date, and ex-date? The person who holds the stock on the record date is entitled to the bonus shares, that’s why companies declare a record date when they announce a bonus.

Thanks indeed

You cleared all by doubts about divident pay out in a single Post

Ali

Thanks for your comment Ali.