There was a question on the forum on how you can save capital gains that arise from selling property, and Loney responded to that by the suggesting the Section 54EC Capital Gains exemption bonds.

I have not written about them earlier, so I thought I’d do a post on these bonds now. So, here is a post with some details on 54EC bonds.

Who should buy Section 54EC Bonds?

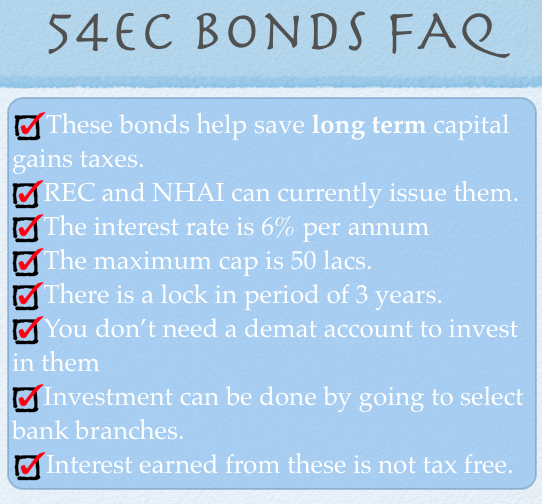

These bonds are specifically meant for people who have made some long term capital gains, and would like to save capital gain taxes on this amount.

Only long term capital gains are eligible for these bonds though, and short term gains are not covered under section 54EC.

What is the upper limit for investing in these bonds?

The maximum gains are capped at Rs. 50 lacs in a year, so you can invest in a maximum of Rs. 50 lacs worth of 54EC bonds in a year to avail of the tax benefit.

Please note that the section is not cut and dry, and there are conditions on how much money will be exempted based on whether the profit made is more than the cost itself, and I will try to detail out the sections in a later post, or if you have a link that does a good job of explaining this then please leave a comment and I’ll link to it.

Who is issuing 54EC bonds?

REC (Rural Electrification Corporation) is issuing these bonds, and from the current information present on their website I see that they will be issuing these bonds till March 31st 2011.

Here are their contact details:

(Application Form can be downloaded from the website : http://rec.rcmcdelhi.com)

Our Registrar to the Issue :

RCMC Share Registry (P) Ltd.

B-106, Sector-2, NOIDA

U.P. -201301

Ph.: 0120-4015880-81

Fax: 0120-2444346

Email:bonds@rcmcdelhi.com

Website : http://rec.rcmcdelhi.com

For Investor Grievances

& Non-Priority  Sector Bonds

Email : bonds@rcmcdelhi.com

For any assistance or clarification please contact:

Investor’s Relation Cell

Core-4, SCOPE Complex

7, Lodhi Road

New Delhi – 110003

Email: investorcell@recl.nic.in

Phone : 011-24361320, 011-2436 5161 extension 527

Tollfree No. : 1800-200-1333

NHAI is also issuing 54EC bonds, and their details can be found on this page.

What is the interest rate on 54EC bonds?

Currently, both REC and NHAI are offering 6% interest on their bonds.

What is the lock in period of these bonds?

The lock in period of these bonds is 3 years, so you can’t sell them before the 3 years.

Is the interest on these bonds taxable?

Yes, the interest from these bonds is fully taxable, and there is no exemption on that. TDS is however not charged on them.

Who can invest in these bonds?

Resident individuals, HUFs, partnerships, companies, banks, financial institutions, regional rural banks, co-operative banks, insurance companies, provident funds, super annuation funds, gratuity funds, mutual funds, FIIs, trusts authorized to invest bonds, NRIs investing out of NRO account on non repatriable basis can invest in these bonds.

So, everyone except your pomeranian can invest in these bonds.

Where can I buy these bonds?

A lot of bank branches sell these bonds, so you can ask at your local bank. Unfortunately, I don’t have a list of branches with me, so you will have to rely on other sources, or check with your local branch.

Do I need a demat account for them?

No, you don’t necessarily need a demat account for them because the bonds are issued in paper as well as demat form.

I’ve tried to cover whatever points I could think of about these bonds, but I’m sure there are several aspects that I missed, so feel free to ask any questions in the comments section, and of course any other observations are also welcome.

Is Foreign Proof of address acceptable for buying the 54EC bonds?

Do I have to route the buying of these bonds through the PIS A/C?

I understand that the maturity amount of 54EC bonds is not taxable but

the annual interest earned on these bonds is taxable?

Yes, that’s right.

i have invested rs. 8 lacs ( long term gain amount ) in rec bond on 2014 , the amount received on 2017 i.e. maturity of the bond is taxable or not?

Hi Devang,

Your investment amount will not be taxed on maturity, only the interest you are going to get every year will be taxed.

i have invested rs. 8 lacs in rec bond on 07.04.2014 , the amount received on 06.04.2017 i.e. maturity of the bond is taxable or not?

I have to avail capital gain bonds taxs . My query is that since the property sold is in my individual name can I invest along with my sons in Tax savings bonds . I will be the first applicant. Can I save the Tax u/s 54EC.

Naresh Kr Aggarwal

I have capital gain & would like to save the Tax through these bonds my query is that since the property sold is in my name but I have to purchase these Jointly with my sons, be the first holder me. Is ther any problem on the point of saving Tax u/s 54EC.

Please carify

Naresh Kr Aggarwal

My father wanted to purchase capital gain bonds. But unfortunately he died. All his finance transactions and accounts are joint with my mother.Please advise if the investment now has to be done entirely in my mothers name for the full amount desired by my father or otherwise. Thanks in advance for your valuable advise.

Hi Nitin,

Yes, in this case, your mother would be required to do the necessary investments.

Thanks Mr.Shiv for your advise.

My sister sold a residential independent house for 1.50 crore in novemebr 2012. She has alreday deposited 50 lakh in REC bonds to save capital gain tax. Can she deposit another 50 lakh in April 2013 as it will be within 6 months of the sale? Kindly advise.

Our accountant says that it is a risk as it may not be allowed. But I see in the internet that some people have said that it can be done. What is the actual position.

My mother-in-law is the 54EC Bond holder and unfortunately expired on 8th September 2012. My wife is the registered nominee for the above bond which is due for maturity by 31-3-2013. Pl advice me thro, mail what are all the necessary action to be taken at this juncture. Expecting your reply mail at the earliest. Thanking you.

If I put money into the rural bonds to avoid capital gains and withdraw it immediately as my husband’s name was not included . Can I withdraw it and put it again. You get a 6 month window and that window has not expired

Hello,

my query is about capital gains ..

we have a property and bought in 1995(land + ground floor building) Later in 2004 we constructed 1st floor and did some alternation to the ground floor as well. so in this case how the indexation will be applied to derive the actual captial gain.,

also if i invest in capital gain bond what will be rate of interest and do we have any workings/excel tool available to compute the interest earned.

thanks.

Hi. I sold a part of my Ancestral Industrial land for Rs. 50,00,000.

1). Can i re-invest that money in buying some property (Preferably Residential).

2). Can i pay tax on half of the amount and can i buy long term bonds for the other half.

3). In bonds which company should i go with REC, NHAI or NABARD.

I sold my house in April 2012 & deposited the cheque to my SB A/C & in couple of days invested in 54EC Bonds of REC. If the LTCG is more than 50L then best time to sell the property is later than October because you must invest LTCG in Bonds within 6 months & you can not invest more than 50L in a Financial Year but can invest upto 1C in two FY years keeping the restriction in mind that whole LTCG must be invested within 6 months of sale. This is my understanding but best is to check with somebody more knowledgable. Hope it helps.

Hi Everyone,

We are selling our primary residential house constructed in 1975 for INR 1Crore. We dont want to buy any more property.

Cost of the property construction in the Year 1975 was INR 5 lakhs.

Like to Save Long Term Capital gain Tax.

What will be our approximate Long Term Capital Gain Tax?

Should we deposit the Bank Check( Sale amount) in to a new Bank Savings Account or to an old Existing Bank Savings account ?

How much time from the sale date do we have inorder to buy Section 54EC Bonds (NHAI bonds) to save Long Term Capital Gain Tax ?

Hi, I want to invest 1500000/-Rs in 54EC bonds, as per 6% intrest rate my interest on whole amount will be 90000/-Rs so at what rate interest will be taxed ?

Secondly,After completing 3 years locking period ,can i utilise this amount for any purpose or do i have pay any other tax on it?Pl guide.

Tks

Hi… Rs. 90000 interest income will be considered your “Income from Other Sources” and will be taxed as per your tax slab.

After 3 years of lock-in period, you are free to use Rs. 15 lakhs for any purpose you like and there will be no additional tax on it.

Today I read an article on 54EC Bonds which confused me completely about 54EC Bonds. It mentions (towards end of article) that maturity amount (which must be same as investment amount) of these bonds is also taxable in addition to the interest paid during investment period. I think this is not correct. If this is true then what is the use of these bonds? Kindly suggest. The URL for the article is:

http://www.thefinapolis.com/files/08-HUM-TUM-1st-AUG.pdf

I guess this statement in article is not correct? Kindly reply ASAP. Thanking you. Best regards, RAKESH

Hi Mr. Rakesh… “Interest received from the REC bonds is fully taxable. Similarly the payments received on maturity of the REC bonds are also fully taxable”. The 2nd part of this statement is not correct, please ignore it. Only the interest payments are taxable and not the principal amount.

Hi Raman

You have not mentioned the cost of acquisition of the flat so it is not possible to calculate LTCG and hence the tax on this deal.

I hope you have read the comments posted above. If not go through once and you will get the answer to your queries.

The best option to save LTCG Tax is to invest the LTCG in a residential property itself. If you do not want to invest in residential property, you are left with few options like depositing in bonds etc as mentioned in the article itself. These bonds have a lock in period and give very little return (in comparison to other instruments) and also these returns are taxable, that further reduces the ultimate yield.

Sometime it is better to pay tax on LTCG and invest the after tax amount in high yield instruments. So do some googling and some homework yourself and choose the best option yourself (as suggested in comments above).

As far as I know, there will be no tax on maturity amount of bonds. As CII has not been released as yet for FY 2012-13 (at least I could not find CII for FY 2012-13 … if some one knows kindly let me know it), it is not possible to calculate LTCG as of todayfor sale in FY 2012-13. It may be

beneficial to sell after October 2012 (instead of Aug 2012) if possible to be able to split LTCG in 2 FY if LTCG is > 50L as one can invest maximum 50L in bonds in a FY but can invest up to 1 Cr in two consecutive FY (as per my understanding). Best wishes, RAKESH

I am planning to sell my flat now i.e. Aug 2012 at around Rs.65 lacs. I bought the same in Oct 2000 i.e. under construction and got possession in March 2002 at Mumbai suburbs. What will be capital gains amount and I plan to move to a rental flat. What is the option to save long term capital gain tax ? If I invest in REC bonds, there is a lock in period of 3 years, hence after 3 years ie after maturity, whether this amount will be taxable ? Or do I have any other option to earn more interest ? Kindly clarify details.

I am interested in buying a few lakhs worth of these bonds. Kindly let me have the contact details of a few agents in Kolkata.

Prithvish bose