It has been over a year since I wrote my best gold ETF in India post, and since then the number of gold ETFs that are present in India have almost doubled.

There are a total of 11 gold ETFs currently present in India, and 4 out of these 11 were launched within the last year. The big change in this space has been the reduction in the expenses that sponsors charge their customers, and now you can see that almost all of them are on the same footing.

You will still see some performance difference in them because every gold ETF holds a small sum of liquid investments other than gold, and that makes a small difference on their returns.

In this post I will look at the performance, volumes, and expense ratios of all the gold ETFs currently traded in India. I couldn’t find the expense ratios of some of these funds, and instead of waiting out I have published this post now, and will update it as and when I find the information.

First up, here are the names, NSE symbols, 1 year returns as on August 12 2011, and their turnover on the same day.

| S.No. | Name | NSE Ticker | 1 Year Return as on Aug 12 2011 | Turnover in Lacs as on Aug 12 2011 |

| 1 | Quantum | QGOLDHALF | 41.07 | 37.11 |

| 2 | UTI | GOLDSHARE | 40.84 | 341.83 |

| 3 | SBI | SBIGETS | 41.26 | 397.37 |

| 4 | Axis | AXISGOLD | – | 15.24 |

| 5 | HDFC | HDFCMFGETF | – | 288.75 |

| 6 | Relianace | RELGOLD | 41.08 | 440.82 |

| 7 | Religare | RELIGAREGO | 41.95 | 9.9 |

| 8 | Benchmark | GOLDBEES | 40.19 | 5,490.42 |

| 9 | ICICI Prudential | IPGETF | – | 14.17 |

| 10 | Kotak | KOTAKGOLD | 40.43 | 1,042.38 |

| 11 | Birla Sunlife | BSLGOLDETF | – | 1.64 |

Regular readers know that every gold ETF in India holds physical gold equivalent to the number of units that are issued in the market, and their price is thus dictated by the price movements of gold.

Since all these ETFs have the same underlying asset, the price movement is also quite similar.

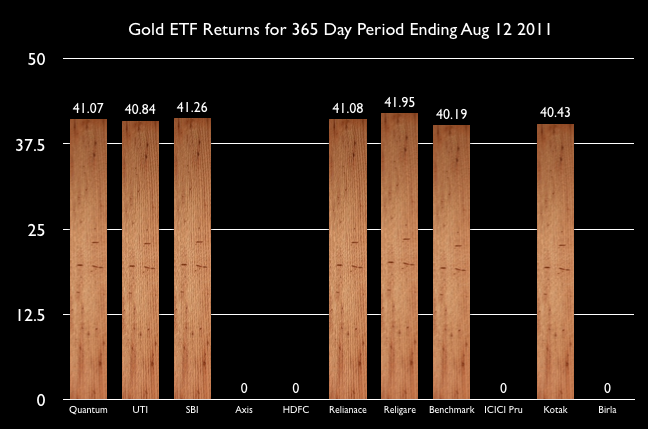

Here is a chart that gives you a better visual of the performance in the last 1 year. Some of these funds are less than a year old, and that’s why you don’t see any corresponding data against their names.

From this chart, you see that the performance are pretty close although Benchmark Gold BeES has done the worst this time period, and Religare has done the best.

When I last looked at this type of data – GoldBeES had done better than all other competitors for a 2 year period, but in the last year everyone else has done better than them.

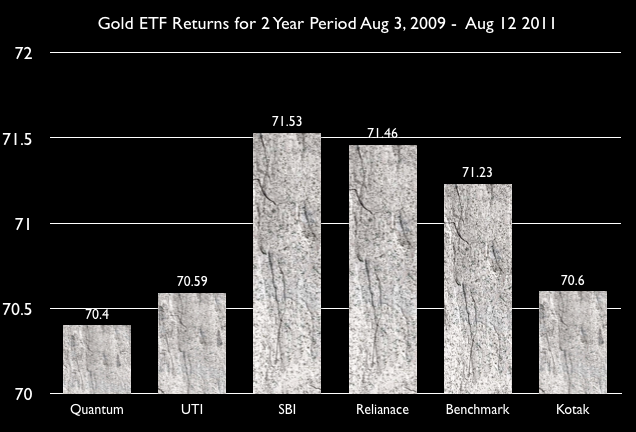

I took a look at the 2 year performance to see if that confirms this or not. Here is how the 2 year returns chart looks like.

This chart shows a different result from the first one, and to my mind – this goes to show that there is very little difference in terms of these funds performance wise.

Next up, I wanted to see what the expense ratios were like, and how much each fund was charging its customers for maintaining the fund. The tricky part here is that each fund lists down the expenses it will charge in its offer document, and then revises these charges periodically. The revised rates should be found on their website because the offer document itself is not revised, and that still contains the old rates.

When you see blanks in this table that means that I couldn’t find the updated expense charges on their website, and didn’t want to use what’s given in the scheme information document.

Here is the chart that shows that information.

| Name | NSE Ticker | Expense Ratio |

| Quantum | QGOLDHALF | Â 1.25% |

| UTI | GOLDSHARE | |

| SBI | SBIGETS | |

| Axis | AXISGOLD | |

| HDFC | HDFCMFGETF | Â 1.00% |

| Relianace | RELGOLD | |

| Religare | RELIGAREGO | Â 1.00% |

| Benchmark | GOLDBEES | Â 1.00% |

| ICICI Prudential | IPGETF | |

| Kotak | KOTAKGOLD | Â 1.00% |

| Birla Sunlife | BSLGOLDETF |

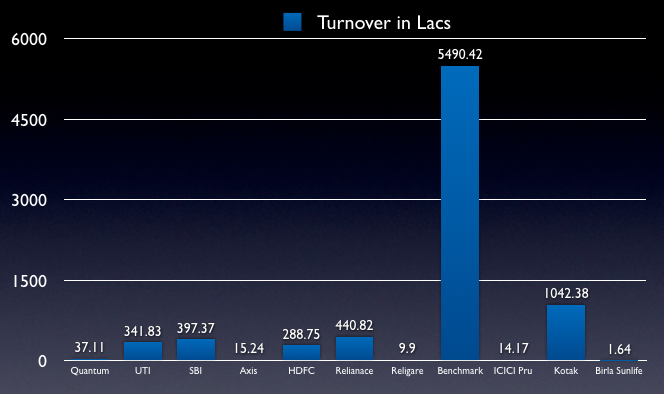

Finally, let’s take a look at the volumes of these gold ETFs because you want your fund to be as liquid as possible so it isn’t impacted by what a few big players may do. The higher the volumes, the better it is.

Here is a chart that shows the turnover of all these funds on August 12 2011.

This is where you see the staggering difference – Benchmark is just way more popular than anyone else, and a lot of that is due to the fact that they were the oldest gold ETF, and even when they had very little competition – they kept their expenses low, and gained in popularity with investors.

Conclusion

It has been interesting to see this space evolve over the years, and see so many competitors come in, which is always good for the customer. I’m fairly certain the expenses wouldn’t have come down to 1.00% without Benchmark setting that precedent and other companies coming into the space and competing. It feels just a matter of time when someone lowers the expenses to less than a percent, and market their fund.

About the choice of funds themselves, although the performance data doesn’t suggest a clear winner – the volume data shows Benchmark and Kotak to be clear leaders of the pack.

Goldbees by far seems to be the best among all gold etf’s however, i would like to know which one would you rate second, since i would like to split my gold investment across atleast two etf’s.

I’ll probably select Kotak or Quantum for the second one.

Goldbees by far seems to be the best among all gold etf’s however, i would like to know which one would you rate second, since i would like to split my gold investment across atleast two etf’s.

just wanted to understand – why is there sucha huge variation in prices of these ETFS? Benchmark adn reliance prices of units are significantly lower (3-4%) then say sbi gets or uti gold. Does one unit in each etf represent a amrginally different quantum of gold? i remember reliance gold was allotted at a par value diferent than 10

Is GOLDEX being shown in ICICIDIRECT.COM is same as GOLD BEES(Benchmark Gold ETF)?

Yes, Randhir.

There seems to be a lot of interest in this post on Gold ETF. Thanks to Manshu for putting up an interesting article with all relevant facts and data, which is very useful for those thinking of investing in Gold ETF.

Since there was a mention of gold prices going up to higher and unaffordable levels, I have a small suggestion. You can consider Q Gold ETF (from Quantum Mutual Fund) where each ETF represents 0.5 gm of gold (half gram). This will make it more affordable. The rate would be mathematically the same, but you can buy in smaller quantities and pay smaller sums within your budget. (e.g since Gold is currently around Rs.2600 per gm, every time you will have to spend so much). This will reduce by half if you opt for Q Gold.

(Repost . Please Ingnore earlier one)

Hi Manshu/Karan,

Thanks for this excellent article !! Before reading this article I was illeterate in ETF’s

I have following queries.

1. What is a diffrence between buying gold from a Jweller and buying ETF’s ? In Pune if I buy 10 Grams of gold from Jweller then there is 1% VAT and at the time of selling same Jweller will buy it for 300 Rs less (for 10 Grams) than selling price.

IF we buy ETF then there is 1% of expense ratio + brokerage

In this scenario tell me what is best, to buy physical gold from jweller or Gold ETF ?

Is there any other expense/tax on ETF apart from expense ratio and brokerage??

2. I want to buy around 200 Grams of gold at 24 K to 26 K ( 10 Grams). Do you think gold will come down to this price in coming one month ?

3. What kind of appreciation we will through 2012 in gold ?

Thanks a lot for your time !

Hi Prad,

In my opinion one of the main benefits of owning a gold ETF is that you can buy and sell easily. People buying from jewelers have felt that when they go to sell they have to pay deductions and deal with a lot of crap. That’s absent in dealing with ETFs.

As to your second or third question – I have absolutely no clue about that.

Hi Prad

1. I fully agree with Manshu. The main benefit of investing in Gold ETF is that you dont have to go through the hassles of going to a jeweller. All buy/sell/view facilities are available online and you can transact at the click of the button rather tha going to different brokers wh0 give different rates.

2. Another benefit is that with the price of Gold increasing sharply, small time jewellers have also started diluting gold with other metals amd sell it at the price of Gold. However this is not the case with ETF’s

3. The prices of gold are currently linked to the state of the economy of the US. If the US economy does not stabilize, Gold will increase further. However, this is something only time will tell how the US shapes up

hi manshu

Thanx a lot for this article. Very informative & useful.

but brother m not so comfortable wid all the tecnical terms ur using here…..but m definately want to invest in gold ETF.so is it possible for u to brief me things abt returns,expenses and where to approach….

thanks brother

Hi Seemit,

Essentially, gold ETFs will move up or down based on the price of gold. If gold moves up then ETF will move up and if gold goes down then ETF will go down. An ETF is like a share so you can buy it from the broker like you buy any share.

In terms of which ETF to buy – from this analysis – Kotak or Benchmark looks good.

thnks manshu 🙂

and is it possible for u to brief a lill more abt expense related to gold etf…..i mean how much the broker will charge….thinks like that….thanks again:)

Expenses are the same as what you would need to pay if you were buying or selling a share (except there is no STT) So, you will have to pay brokerage commission on the purchase and that’s calculated based on where your account is.

thanks manshu…..one more question….which charge the cheapest brokerage or commission……sorry m new here….n need to know everything abt gold etf….:)

I don’t know about the cheapest brokerage I’m afraid, I have never seen a comparison of the commissions of major brokerages.

thanks manshu…..one last question..sorry m asking too many questions…m sure thr is definately a procedure for buying gold etf.will u brief abt it a lill….

It’s the same way you buy shares. If you have ever bought shares you can use the same method to buy ETFs.

Dear Manshu,

Great article & very good information.

I have a Demat account in SBI. I want to invest in Benchmark Gold Bees. Please tell me the procedure. I want to invest monthly Rs. 2,000/- through online. Is it possible ? Please send the details to my email id : srinivasl2003@gmail.com.

Please tell me differences between SBI GOld ETF (22 – 08 – 11 to 05 – 09 – 11) and Benchmark GoldBees. Which is the best for middle class employees.

Thanks

Sreenivas

The way to do that is to buy them like you buy shares – have you ever bought shares, you can buy an ETF in the same manner.

Also, what you are referring to is a gold mutual fund not a gold ETF – you can read my new post on it to understand the concept and the difference between different instruments:

http://www.onemint.com/2011/08/24/sbi-gold-fund-review/

Also, please keep in mind that gold prices have really zoomed up in the last year or so and it’s not wise to get swayed by the price rise and load up on gold, a portfolio is best when it’s diversified and you don’t end up too much of just one kind of asset.

P.S. Not practical for me to reply to people in emails. And anyway, it’s much more beneficial for everyone if the replies are here since everyone can view them.

Hi Manshu,

Thanx a lot for this article. Very informative & useful.

I’m thinking of investing in Gold ETF for a time period of 6-10 months.

As its for short period, should I buy in small quantities or opt for lumpsum investment?

Also which ETF you think will be the most suitable?

Regards,

Abhijeet

Hi Abhijeet

As far as ETFs are concerned, Kotak or Benchmark are ahead in this comparison. However, I don’t know the answer to whether SIP or lumpsum will be better in the time frame you are mentioning.

Informative article, provides basic knowledge which new investor need.

I didnt know anything about GETF but after going throgh the article now

I know every basic things related to GETF.

Thanks.

Good to know that – thanks!

I want to know ,IF I WILL BOOK Rs 10 lacs in PHYSICAL GOLD IN CURRENT RATE THROUGH SBI GETS ,WILL IT POSSIBLE I WILL PAY THE WHOLE AMOUUNT OF RS 10 LACS IN 180 MONYHLY INSTALEMENT and what will be the rate of interest.

Will i can get physical gold after paying Rs 10 lacs with interest.

If understand this comment correctly – you want to know two things.

1. Can you lock into a price right now, and continue buying gold at that price even when the price of gold goes up?

No, you can’t do that.

2. Can you get physical gold after buying GETS?

No, you can’t do that either. Let me know if my understanding is correct, or you want to know something else.

Hi Manshu,

Great insights. Nice article for the bigginers who want to understand this area better. Can you direct me to the links to understand more about Gold ETFs. Can they be traded like open ended MFs? or any restrictions around this. please let me know.

Hi Ram,

Yes, they can be traded on a stock exchange like stocks. Here is an earlier post I did which should answer the basic questions.

http://www.onemint.com/2009/10/23/what-is-an-etf-2/

Thans a lot Manshu. Quite useful info.

Hi Manshu,

very detailed andnice article

Hi Manshu,

This is a great article and has helped me with lot of informaton and thanks a ton 🙂

One question however is would it be wise to invest in the ETF’s now when almost all the ETF’s are at a 52 week high.

Hi Surya

Market Timing is something which very few people are able to time perfectly.

Prices may come down a few rupees but no-one knows what would be the right price to buy. So it is always advisable to buy in small quantities and do averaging.

Waiting for Manshu’s views on the same

Hi Surya,

About two years ago I wrote a post about how gold prices look so high, and they are headed towards bubble territory, and prices kept rising in those two years and I’ve been proved wrong in being cautious about them. My personal opinion about it hasn’t changed though some very smart people own gold right now. I think it would be wise for a regular investor not to be dazzled by this recent price rise, and have limited exposure to gold, not more than 5% or at max 10% of their portfolio. Stick to the key tenets of diversification, own gold, but don’t own *only* gold. As for timing, no one can really time the market, and if you are interested in gold, then I’d say buying gold periodically makes sense.

Hi Manshu,

I want to thank you for informative posts you are providing regarding Gold ETFs.But i have one question.Is it the right time to invest in Gold?I understand that since this is time of economic uncertainity many people might invest in gold and prices may go up.But i am not sure with gold prices so high is it prudent to invest in gold right now?

Thanks in advance

@ Vijayshankar

Gold Prices are no doubt high at this point of time but if you compare the prices of Gold in 2011 to the prices of Gold in 1980, its still cheap in 2011.

If if adjust the price of Gold with Inflation, the price of Gold in 2011 shd be $2100 whereas it is only $1700.

There would certainly be some more upmove in the prices of gold in the International Market in the coming year

I have been staying away from gold for the last two years as I’ve been uncomfortable with the price rise, and especially the rationale behind the price rise. In these two years I’ve been proven wrong, but I’m still staying away from it. So, that’s my opinion which I’ve written in a few posts as well, but as other commenters have pointed out I’ve been wrong about this all the time so there is no reason why I won’t be wrong about it in future as well.

Hi Anshoo,

A small query. When you talk about Expense ratio, how it will be impacted the investors in the Equity market? For an example, if I’m buying 1 unit of GoldBees for 2500 and selling for 2600, I’m in a profit of 100. Where is the Expense ratio impact here? I’m a novice on this, so don’t mind if it is a very basic question.

Vimal – It’s Manshu not Anshoo 🙂

The expenses are deducted from the fund and you will never feel its direct impact. The NAV will reduce to the extent of the expenses and then the price will adjust to the NAV. The market price you see is what you will get, so you don’t have to worry about this after you carry out the transaction. Whatever price you see is what you get minus brokerage of course.

I’m extremely sorry for that Manshu 🙂

No problems – happens a lot and I don’t mind it at all, but I have a feeling you will become a regular commenter so just thought of leaving a note 🙂

Very informative post Manshu

With the price of Gold on an uptrend and the negative news that came from the US last week, more and more investors are now expected to invest in gold which may bring in some more players in the market leading to healthy competition which was earlier missing.

Absolutely, space is heating up, and it would be great if expenses come down a little more.

Anshoo,

Thanks for an another nice article related to Gold ETF. This is really helpful to the people who wanted to invest in Gold, but if you provide the liquidity flow in each ETFs, it would be more useful to select the proper ETF to invest in.

Regards,

Vimal Raj

By liquidity flow you mean volumes right? That’s what the last graph is.