Update: I have done a more recent comparison on gold ETFs and that data can be found here. The methodology is the same which you can read there as well, but reading this post gives a good perspective on how this space has evolved. Â Updated Article.Â

This question keeps popping up in emails and comments from time to time, and I thought I’d address this with a post. Let me begin this post by saying that this is just my way of deciding which is the best gold ETF in India, and you are free to poke holes in this methodology, or even reject it outright, but if I were to invest in a gold ETF – this is the way I would go about it.

First off – I’d compare the expense ratios of all existing Indian gold ETFs, and see which are the ones with the lower expenses. I have already done that research earlier on this blog, and know that right now the Gold BeeS ETF from Benchmark Funds has the lowest expense ratio of 1%. Quantum Funds comes second with 1.25%. All the other funds charge higher expenses. The lower the expenses – the better it is because it leaves more on the table for investors.

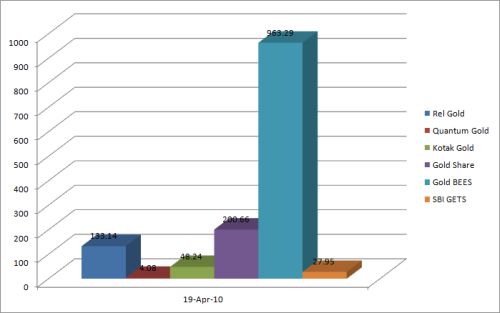

Expenses alone are not enough for me because I want my investment to be liquid, and need the fund to have good volumes too. I went to the NSE website and gathered the volume data for all gold ETFs for the last month or so. I am presenting you yesterday’s volume data of all gold ETFs here. I am presenting just one day’s worth of data because that is pretty much representative of the overall volumes and is easier to read.

As you can see from the image – Gold BeeS, which has the lowest expenses also has the highest volume, and by a large margin too.

That does it for me – and if I had to invest in a Gold ETF – it would be this.

Keep in mind though that this is just my opinion and not expert advice tailored to your investing situation. Also bear in mind that I am not going to invest in this ETF because I am not looking at investing in gold right now, and even if I was – I would probably go for the more direct option of buying gold coins.

Update: I have done a more recent comparison on gold ETFs and that data can be found here.Â

HI,

i am planning to open gold ETF.

Assuem i opened XXXX Gold ETF for 2 years and i have some amount of in ETF. i would like to know after the maturity date shall i redeem physical gold coins for that amount?