I have already written about some of the key features of the budget, and now let’s take a look at how the government gets its revenues. There are three sources from where the government gets money. The first two are revenue sources, and the last one is borrowings and capital asset sales.

These are listed here:

1. Revenue Receipts – Tax Revenue: This is the tax that the government collects in the form of corporation tax, personal income tax, customs, excise etc.

2. Non Tax Revenue: These are things like interests on bonds held, dividends from PSUs, and grants. They are revenue sources meaning they don’t have to be repaid and are smaller than tax revenues.

3. Capital Receipts:Â These are borrowings of the government like the market loans, short term borrowings, external commercial receipts etc.

Now, some charts and the source for the data is the budget website.

Breakup of Government Revenues

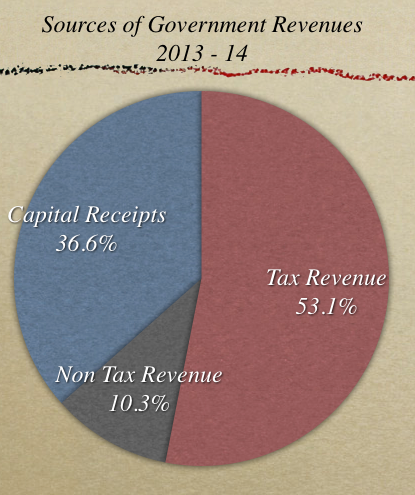

First, let’s take a look at how these three sources contribute to the government’s kitty.

| Head | In Crore of Rupees |

|---|---|

| Tax Revenue | 8,84,078.32 |

| Non Tax Revenue | 1,72,252.38 |

| Capital Receipts | 6,08,966.62 |

| Grand Total | 16,65,297.32 |

Here is a pie chart that shows the relative contribution of these three sources.

From the chart above you can see that tax revenues form the biggest chunk of government receipts. What’s also interesting is that Capital Receipts form 37% of the receipts. This is quite high because most of this is in the form of borrowings, and if this was the budget of a family they would be in trouble since they have to finance 37% of their expenses by borrowing money.

What’s amazing about this break up is that it is identical to the budget last year. Click here to look at that chart.Â

Breakup of Tax Revenues

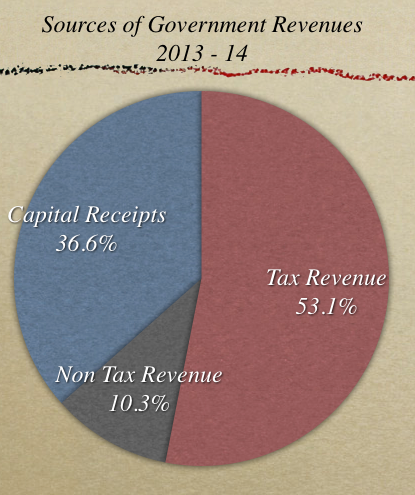

Tax revenues are the biggest sources of government funds, and now let’s take a look at what constitutes our tax revenues.

| Head | In Crore of Rupees |

|---|---|

| Corporation Tax | Â 4,19,520.00 |

| Income Tax | Â 2,47,639.00 |

| Wealth Tax | Â 950.00 |

| Customs | Â 1,87,308.00 |

| Excise Duties | Â 1,97,553.95 |

| Service Tax | Â 1,80,141.00 |

| Taxes on UT | Â 2,758.13 |

| Grand Total | Â 12,35,870.08 |

The grand total here is a lot bigger than the tax revenue grand total in the first table because the first table has the tax revenues reduced by the state’s share of it.

Here is a chart that shows the percentage contribution of these various sources, and for people not familiar with this breakup – the biggest surprise for them will be that Corporate Taxes contribute a lot more to the kitty than the personal income tax. If you compare this with last year’s number you will see that the the contribution of income tax has gone up 2 points in the overall pie.

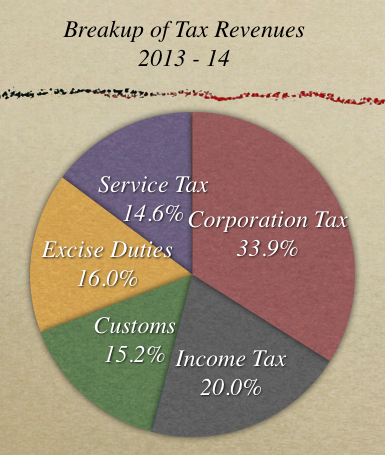

Non Tax Revenues

Non tax revenues are not nearly as big as tax revenues and a lot of them come from PSU dividends and then some come from petroleum royalties that are covered in the Economic Services section below.

Here is the break up of non tax revenues.

| Head | In Crore of Rupees |

|---|---|

| Interest Receipts | 17,764.39 |

| Dividends and Profits | 73,866.36 |

| Fiscal Services | 87.82 |

| General Services | 12,254.71 |

| Social Services | 2,684.42 |

| Economic Services | 62,972.64 |

| Grants | 1456.13 |

| Non Tax Rev of UT | 1165.91 |

| Grand Total | 172252.38 |

Here is how the various heads look like in a pie chart.

The one thing that I always think about when I look at this number is the fact that India is slowly divesting PSUs and eventually these dividends and profits are going to go down. The other related thing is that the divestment money is being used to plug the gap between revenues and expenses, but divestment will not be a continual source of income like taxes.

Now, let’s move to the third source of income which is capital receipts.

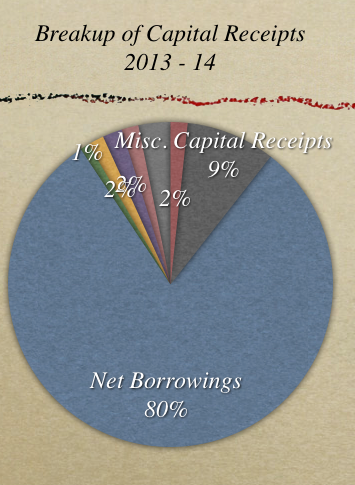

Capital Receipts

As you can see the government has to rely a lot on Capital Receipts, and Capital Receipts are mainly just borrowings. The other big number there is disinvestments which comes under miscellaneous capital receipts and is Rs. 40,000 crores for this fiscal.

Here is how they break out.

| Head | In Crore of Rupees |

|---|---|

| Recoveries of Loans & Advances | 10,654.00 |

| Misc. Capital Receipts | 55,814.00 |

| Net Borrowings | 503,844.46 |

| Net Securities against Small Savings | 5,797.52 |

| State PF Net | 10,000 |

| Other Receipts | 12,296.54 |

| External Debt | 10,560.10 |

| Net Market Stabilisation Scheme | 20,000.00 |

| Grand Total | 628,966.62 |

You will notice that this is Rs. 20,000 crores more than the capital receipts shown in the first table, and so far I haven’t been able to find out the reason for the difference. The number in the first table equals allows the total to add to the expenses and also the Reconciliation Statement on the budget website lists down the capital receipts as 608,966.62 crores so that number is the right Net Capital Receipts but I don’t know from which head the 20,000 crores has to be removed in the latter table.

Here is a pie chart of the above numbers.

Conclusion

We have been talking about deficit for some time here, and if you look at these numbers above – 36.6% of the total revenues are capital receipts, and 80% of those capital receipts are borrowings. So, effectively we borrow 29.3% of what we have to spend. That’s just too high, and has to be brought under control. When you look at it from this context, widening the tax base and better compliance is inevitable if you have to get this number under control.

Manshu.. is is possible to abolish personal income tax in India and bring a better direct tax regime as i heard only a small percent of the population actually pays taxes..??

Great compilation. Gives the details in a nutshell. Thank you. Look forward to such data for 2014-15. By when should one expect that.

Its good information to one and all.

Hello Manshu

Appreciate your efforts for this post. Could you provide a way for me to get a revenue breakup of India Post ? They do a lot of stuff including speed post, express post and financial services but they only post consolidated revenue. Is there any way to get the same ?

This is a most wonderful post I have ever read on Budget..! Simple to understand. Just as needed. Nice work..!

Hi Manshu

Simple, and comprehensive posts on budget I have ever found on the net.

Thanks a lot.

srinivas

hi I want to know that if VAT(value added tax) is apply to all items then what will be collection of VAT in the form of tax with respect to all other taxes.

Manshu, Hray Krishn: Today after seeing court’s decision on Lalu’s Chara Ghotala, I went into flash back, remembering other such great leaders of our nation who are bent upon plundering this country left right and center. 2G, CWG, Coal, Govt. land selling, MNREGA………etc..

I immediately thought of some source of information where I can get info on govt’s sources of income and expenditure areas. I opened Google to get the answer and reached you and your ‘One mint’ Wow, you are great bro !!. Your articles are very enlightening. I got answers to two of my today’s questions alright, along with many others which were in my mind before , e.g. falling rupee, govt’s source of foreign currency. Now I request you to please write an article on all the Gotalas/gates, the accused person, their respective amounts, their sources and relevant deptts and their total. It will be an eye opener.

The government collects revenue from every citizen of this country (that includes the poorest person who buys a packet of biscuits or beedi because he pays VAT printed on it to the shop keeper) in different forms which is supposed to be spent on this country & its citizen’s welfare schemes, their financial betterment, defense. housing, insurance, health, education, infrastructure etc. and these people claiming to be the leaders of Aam Admi loot their hard earned money from the treasury on different pretexts with the help of false documents. The Poor people vote for them because they fall for their (a) big fake talks about their welfare (b) emotional talks about their mutual caste relationship (c) the fictitious sacrifices they have made for them like going to jail (c) for making them laugh during their speeches with their sense of humor, utterance of particular funny and sarcastic words from their native language ridiculing other leaders or by cracking dirty jokes and (d) free bees they distribute to them during election.

Sir,

Please provide me the answers for below two questions-

What is the largest source of revenue for the Indian government?

Which tax generates the largest source of revenue for Indian Govt?

Thanks.

excellent work sir.

can i hv the same breakup of reciepts and expenditures for j&K BUDGET OR ATLEAST THE WEB LINK FOR SAME. I NEED IT FR INTERVIEW,

THNX

Sir,

Could you please provide the details/breakup for D&P of Rs. 50608 (2011-12 Actual)?

Sir,

Could you provide the details/breakup for Dividend and Profits of Rs. 73,866.36 Crore?

Well researched and well presented!

Thanks!

Hi Manshu,

Thanks for this and all other posts you are writing.

I subscribed OneMint a year ago and since then reading your every articles posted there.

It has really helped me understanding abc of finances. Thanks for all the efforts you are putting to educate me and others.

Hi Sandeep,

Thank you for your wonderful comment.These are the comments that keep me going! Please feel free to post any questions or suggestions that you may have for me or any of the other readers either here or in the Forum. Thanks!

Hi,Great article and thanks to insight ,only comment I have is on the conclusion ,the deficit .

1) Would there be a deficit or rather would we require that much money if the corruption is avoided ?

2) we dont give unnecessay sops to just get votes

3) the unnecessary expenses are avoided from goverment orgnasiation and all

4) reduce the import and promote the export

If there is no corruption, then the country’s finances would be in much better order, there is no doubt about that. There are some economic theories that state that corruption or more specifically bribes grease the wheel of the economy, but just look at the list of the richest and most developed countries and you will find that it has no place for corrupt countries.

Very good post Manshu. Ur posts make my eco/fin knowledge improve alot.

Glad to her that – thank you for your comment!

Manshu..!

This is a wonderful post I have ever read on Budget..! Nice one..!

Thanks Mihir! Glad to hear that!

The income from\post office,indian Railways will come under which category

It is the economic services or general services category.