This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

The Finance Ministry on March 31st announced the applicable interest rates for all the Post Office Small Savings Schemes, including PPF, Sukanya Samriddhi Yojana (SSY) and Senior Citizens Savings Scheme (SCSS). Except for SCSS and SSY, the government has kept all other interest rates unchanged, including 8.7% for its most popular scheme, PPF.

To encourage more and more people to get the Sukanya Samriddhi Account (SSA) opened, the Government has decided to ride against the tide and has increased its interest rate to 9.20% from 9.10% earlier, an increase of 0.10%.

As the interest rate on Sukanya Samriddhi Yojana is subject to a revision every financial year, this rate of 9.2% will remain applicable only for the current financial year, 2015-16 and will be further revised in March 2016 for the next financial year, 2016-17.

But, this move of keeping its interest rate higher makes me feel that the Modi Government will continue to keep its interest rate higher going forward as well. I think, like the current financial year, they will try to keep a differential of approximately 0.50% between PPF and Sukanya Samridhi Yojana.

I had posted an article last month in which maturity values were calculated with 9.1% rate of interest throughout its tenure of 21 years. But, as the interest rate has been updated to 9.2% and as most of the investors are yet to open this account, I thought there is a need to have a new post having maturity values calculated as per the new rate of 9.2%.

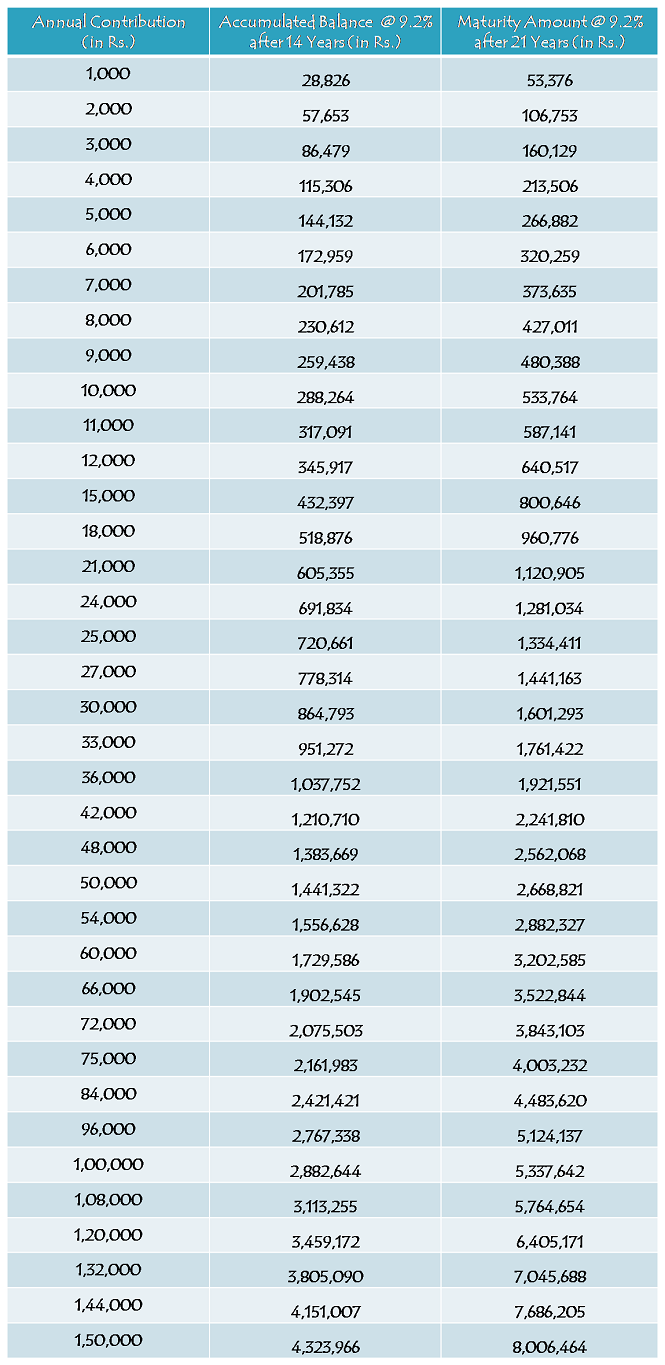

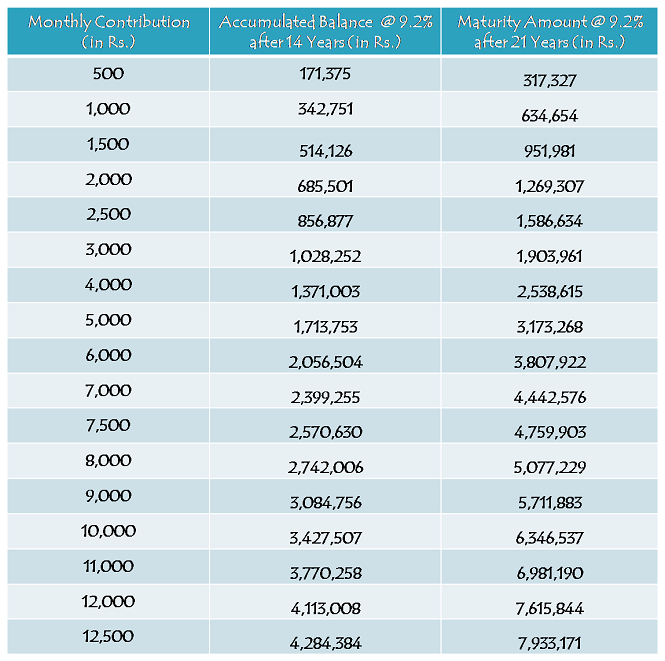

So, here you have the tables in which maturity values are given as per your annual contributions as well as monthly contributions:

Yearly Contribution Table

Monthly Contribution Table

As different investors will have have different amounts and different timings of their deposits, it is natural that their maturity values will also be different. So, these maturity values are only indicative based on certain assumptions and here you have those assumptions:

* Rate of Interest has been assumed to remain 9.2% for all these 21 years.

* Yearly contributions have been assumed to be made on April 1 every year i.e. the beginning of the financial year.

* Monthly contributions have been assumed to be made on 1st day of every month.

* Although it is not mandatory, a fixed amount of yearly/monthly contribution has been assumed.

* It is also assumed that no withdrawal is made throughout these 21 years.

As people are looking for more and more information about this scheme, I would like to again highlight the main features of this scheme here:

Who can open this account? – Parents or a legal guardian of a girl child up to the age of 10 years, can open this account in the name of the girl child. So, if your daughter is born on or after December 2, 2003, you can get this account opened for her in a post office or an authorised bank branch.

Which documents are required to open this account? – You need birth certificate of the girl child, along with the identity proof, residence proof and two photographs of the parents/legal guardian, to open an account under this scheme. You can approach any post office or a branch of any of the authorised banks to get this account opened.

9.2% Tax-Free Rate of Interest for FY 2015-16 – As mentioned above, this scheme will carry 9.2% rate of interest for the current financial year and it was 9.1% for the previous financial year. Similarly, interest rate will be revised every year in March and will be applicable for the applicable financial year afterwards.

Scheme Matures in 21 years or on Girl’s Marriage, whichever is earlier – The scheme gets matured on completion of 21 years from the date of opening of the account or as the girl child gets married, whichever is earlier. Please note that the girl attaining the age of 21 years has no relevance to maturity period of this scheme.

Deposit for 14 years only – You need to deposit a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000 only for the first 14 years, after which you are not required to deposit any amount. Your account will keep earning the applicable interest rate for the remaining 7 years or till it gets matured on your daughter’s marriage.

NRI/OCI Investment – It is still not clear whether Non-Resident Indians (NRIs) or Overseas Citizens of India (OCI) are allowed to open an account under this scheme or not. But, as it is not allowed with most of the post office small saving schemes, I think the government will not allow them to invest in this scheme either. I’ll update this post as soon as I get any information regarding the same.

Partial Withdrawal – It is allowed to withdraw 50% of the balance for higher education as the girl child attains the age of 18 years. Except for this period, it is not allowed to withdraw any amount during the whole tenure of this scheme.

Nomination Facility – Nomination facility is not there with this scheme. In an unfortunate event of the death of the girl child, the balance amount will be paid to the parents/ legal guardian of the girl child and the account will be closed immediately.

You can check all the features of this scheme from this post – Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

You can also check the updated list of banks and download the application form to open an account from this post – Sukanya Samriddhi Yojana – Updated list of Authorised Banks to Open an Account, Specimen Application Form & Passbook. If you have any query or something related to all these posts, please share it here.

sir, if monthly emi of sukanya scheme is Rs. 1500 & also 2000 then pl reply me on mail monthly EmI Calculator & Amount Rs. from year 18 & 21

Sir meri duhater ka dob 03/09/09 hi to 8year.agar hum per month 3000jama karte hai to kitne year jama karege Aur maturity Kiya hogi.

Mere father retired ho gaye hai.ab Wo post office mai fd karana chahate hai.koi profitable policy ho to mujhe inform kare .unki policy 5 years wali ho.mujhe apna contact no send kar de…..

Hello Mr Shiv,

Is there a difference in returns when you invest in monthly payments as compared to when you invest in yearly installment??

Sir different – different fy year me different amounts dal Santa hu.

6 Step Process to Transfer Sukanya Samriddhi Yojana Account from Post office to Bank.

More info@ https://www.moneydial.com/blogs/6-step-process-to-transfer-sukanya-samriddhi-yojana-account-from-post-office-to-bank/

If I start the scheme at the age of 10 for how many years I have to pay. If I am interested to pay 150000 per year .what will be the return either at 18 or at 21

Very nice skim for girl

hi sir plZ discrip ssy

sir,

if i start investing 1000/ month in this scheme initially.

after 2 years if i feel that i can invest 3000/ month in this scheme.

can i do this .is it possible ?

Please reply.

Dear sir

Maine apni Beti ka account post office me khola hai mai chahta hu is accaunt ko dusre post office me transfer krana to kya aesa possible hai. Please reply me Thank you.

Very nice skim for girls

Very nice

My Girls D.O B 16-4-2014 (1year 6months only )iam decided sukanya samrudhi yojana yearly deposit 1000 ofter 21 years how much amount return immediately replay sir

6042091

Sir Ji Maine Ye Yojna 19 Jul 2016 ko Start Ki thi Us Taime Maine iss Yojna Mai 5000/- Paid Kiye The But Meri Sukanya 10 Agust 2016 Ko Hai Hiting Medical Ex-pair Ho Gai .

Muje Ye Puchana Hai Ki Iss Yojna Chalu Hone Par Agar Aisi Ghatna ho Jay To GOV Of INDIA Alagse koi Ruls Hai Kya ???

SUBJECT – TIME DIFFRENCE OF DEPOSITE AMOUNT

1. I AK DUBEY opening SUKANYA SAMRIDDI ACCOUNT (A/c No. 8641803651) of my daughter AAKANSHA DUBEY on 23 may 2015 at holiday camp post office in mumbai after some time shifted at MAU UP with family.

2. On 23 may 2016 go to Mau post office and asked and show passbook to the concern person this account opening at Mumbai but shifted here so I want deposit 50,000 by checque he see passbook and give deposit form so I( 50,000 checque number 013275 of UBI BHITI MAU) deposited and get aknowlgement deposit recipitE from MAU POST OFFICE.

3. On 1 June 2016, debited 50,000 in my account after this ,so many time go to post office for passbook updating but always tells my printer or net are not working but I have no record. In this routine on 26 Aug 2016 I go to postoffice for passbook updating he see and tell I want ten digit account number .So I call HOLIDAY CAMP POST OFFICE and get ten digit account after this update my passbook but not showing 50,000 deposit amount, then I asked to post master he tells today my clerk on leave ,you come tomorrow then on 27 Aug 2016 I go to post office and concern clerk he deposited on 27 Aug 2016 after this update passbook showing 50,000 .

Sir tell me what can I do. For interest from 2 June 2016 to 26 Aug 2016.

Your faithfully

AK DUBEY father of AAKANSHA DUBEY

House no-324/5-A NAI BASTI

NIZAMUDDIN

-PURA BHITI MAU 275101

Mob No- 8181000764

DT-30/8/16

Pita pan bharat in the world economy system secular sashak Dharam bharat piess in god we trust 1956Bharat jayshriharimannarayanregs.swamijirtikiran.com

1-SS Yojna account is transferable to any other branches ?

2-If the child survive then what benefit to guardian ?

Sir mere beti ki d.o.b. 31-03-2010 ki hai agar main 2000 rupees per month invest karta hu to maturity kitne milege . Aur rupees kb tak zamma karna hoga.

Dear Sir,

please clear one ques.

New born Girl child parents how to apply,? Birth certificate – (is Sufficient for apply ?)

ID proof of Girl child not available right now.